If monetary policy hawks were hoping to get a reprieve from the rising sentiment of an upcoming rate cut, Jerome Powell’s testimony in front of Congress earlier this month was probably not what they had in mind.

Indeed, the Fed Chair’s statements all but assured that the FOMC will cut interest rates when they next meet on July 31—the only question is whether it will be by 0.25% or 0.50%.

As a result, traders have been positioning themselves appropriately. In other words, they’re playing defense.

We can see this in the fund flow data for the Direxion Daily Gold Miners Bull 3X Shares (NUGT) and Direxion Daily Gold Miners Bear 3X Shares (DUST). Over the four weeks ending July 12, DUST has far and away the most inflows of any Direxion product (approximately $212 million). On the other side, NUGT has far and away the most outflows of any Direxion product (approximately $377 million).

In this same four-week period, NUGT and Direxion Daily Junior Gold Miners Index Bull 3X Shares (JNUG) are the two best-performing Direxion ETFs, up 44% and 49% respectively.

While it’s impossible to know for sure how these flows are being used tactically, the massive flows indicate that active traders are taking an interest in the safe haven asset, and the companies that mine it, ahead of the next Fed meeting.

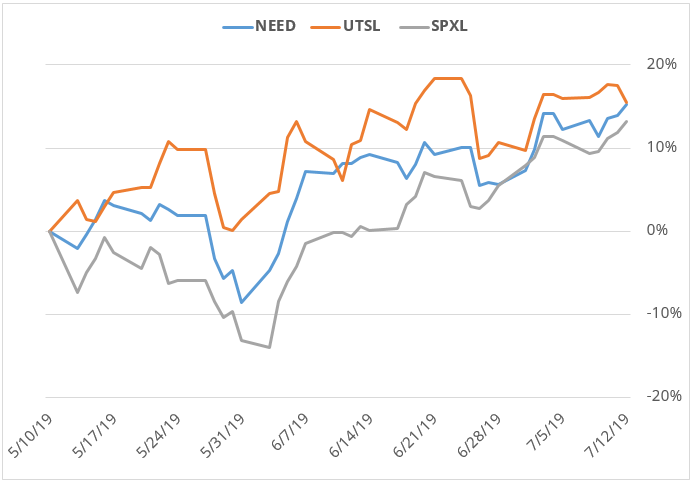

On that same defensive note, below is a chart showing the three-month performance of the Direxion Daily Consumer Staples Bull 3X Shares (NEED) and Direxion Daily Utilities Bull 3X Shares (UTSL) against the Direxion Daily S&P 500 Bull 3X Shares (SPXL).

Source: Bloomberg. Date: 5/10/2019 – 7/12/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Contrary to what the market’s new all-time highs would indicate, the outperformance of consumer staples and utilities, two of the most defensive sectors, paints a picture of even further investor appetite for defense.

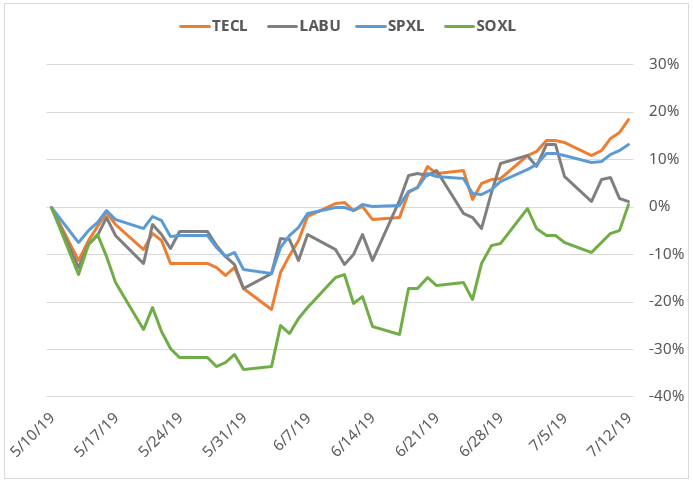

Comparatively, the Direxion Daily Technology Bull 3X Shares (TECL), Direxion Daily Semiconductor Bull 3X Shares (SOXL), and Direxion Daily S&P Biotech Bull 3X Shares (LABU) have all underperformed SPXL, and all three are among the leveraged equity ETFs with the most outflows over the last four weeks.

Source: Bloomberg. Date: 5/10/2019 – 7/12/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

So as trade talks, geopolitical tensions, and interest rate trends continue to build a wall of worry, those who keep a trading eye out for opportunities ─ and get the direction right ─ may continue to find them.

Stay nimble, traders.

Related Leveraged ETFs

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. The ETFs should not be expected to provide returns which are three times the return of their benchmarks’ cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

NEED/LACK Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Consumer Staples Sector. Consumer staples companies are subject to government regulation affecting their products which may negatively impact such companies’ performance. The consumer staples sector may also be adversely affected by changes or trends in commodity prices, which may be influenced or characterized by unpredictable factors. Additional risks include, for the Direxion Daily Consumer Staples Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily Consumer Staples Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

UTSL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Utilities Sector. Utility companies are affected by supply and demand, operating costs, government regulation, environmental factors, liabilities for environmental damage and general liabilities, and rate caps or rate changes. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

SPXL Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the securities that comprise the S&P 500® Index. Additional risks include, for the Direxion Daily S&P 500® Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily S&P 500® Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

TECL/TECS Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to the Technology Sector. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Additional risks include, for the Direxion Daily Technology Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily Technology Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

SOXL/SOXS Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Semiconductor Industry. Companies that are in the semiconductor industry may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in the semiconductor sector of the market to decrease. Additional risk include, for the Direxion Daily Semiconductor Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily Semiconductor Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

LABU/LABD Risks – An investment in each Fund involves risk, including the possible loss of principal. The Funds are non-diversified and include risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to investment in the securities of the Biotechnology Industry and Healthcare Sector. Companies within the biotech industry invest heavily in research and development, which may not lead to commercially successful products. Additional risks include, for the Direxion Daily S&P Biotech Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily S&P Biotech Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.