[ad_1]

[Editor’s Note: The following originally appeared on FactSet.com. Elisabeth Kashner is director of ETF research and analytics for FactSet.]

Asset managers looking to keep up with the ETF revolution are looking for ways to break into the ETF space. These days, the path to success seems ever narrower. Not only are the major market segments well-covered, and the potential fee revenue compressed, but market acceptance of new ideas is disappearing.

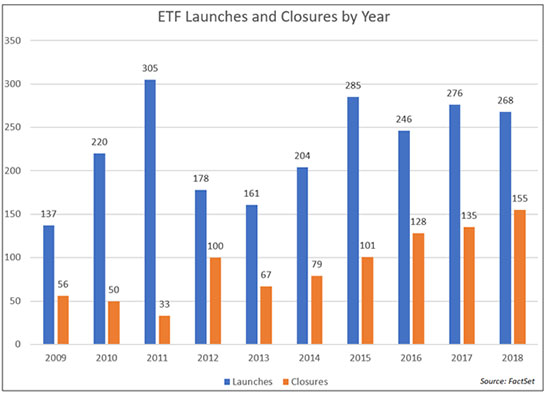

Launching new funds keeps getting harder. This trend manifests in the flat pace of new launches, the increase of closures, and, in the past few years, the dominance of bespoke and in-house funded products.

ETF launches are where innovation happens. Closures generally are a sign of health, as the market cleans up the flops and moves on. Closures can also signal a lack of opportunity, as they can indicate the limits of investor interest in a segment or strategy.

Over the past five years, the pace of ETF launches has flattened out, but the closure rate has increased. The joint launch/closure ratio, as shown in the chart below, indicates that asset managers’ sense of opportunity has diminished, while the willingness to throw in the towel has increased.

(For a larger view, click on the image above)

Sticking With Established ETFs

The decline in the pace of launches is not the only factor limiting success of new entrants in the ETF marketplace. New launches face increasing constraints on growth, as investors largely ignore them in favor of established funds.

More and more, newly launched funds gather only minimal assets in their first year. Worse, a large majority of new launches close or get trapped by their low AUM.

The mountain chart below shows fund asset levels on their first birthday, sorted into bands, by year. The number of funds that accumulate less than $50 million or close up shop in their first year has been growing steadily since 2003.

For example, 81% of funds that launched in 2018 had less than $50 million in assets by the close of the year, while only 2% cracked the billion-dollar mark. The market has been getting tougher for years.

(For a larger view, click on the image above)

While many asset managers expect inflows after a fund achieves a certain level of seasoning, perhaps three or five years, the data shows that such expectations are largely unmet. It turns out that fund assets at the 12-month mark are strongly predictive of current asset levels, as a study of all funds launched between 2007 and 2016 reveals.

This next series of charts answers the question “where are they now?” by comparing asset levels at each fund’s first birthday with December 2018 levels.

Of the ETFs that had less than $50 million in assets at one year, 44% have since closed, with another 30% stuck in the under $50 million range.

Funds That Had Accumulated Less Than $50 Million After Their First Year

(For a larger view, click on the image above)

This next chart shows the opposite case: the present-day fate of funds that had $1 billion or more in assets under management at the 12-month mark. Just a handful closed while over three-quarters stayed in the billion-dollar-plus zone.

Funds That Had Accumulated More Than $1 Billion After Their First Year

(For a larger view, click on the image above)

[ad_2]

Source link