Fixed income funds have seen a resurgence in recent months as advisors and investors look to pivot their portfolios in a time of rising interest rates by the Federal Reserve. With the next interest rate hike set to be announced tomorrow and anticipated to be 0.75%, all eyes are on the central bank to set the tone for the second half of 2022.

Concern about a potential 100 basis point rate hike has been floated since the release of June’s CPI, a surprising 9.1% on expectations of 8.7%, driven high by energy, food, and housing costs but with all individual measurements reflecting inflation. On the opposite end is a resilient job market that added 372,000 jobs in June, while in between are signs of a slowing economy.

For now, the focus remains on inflation with the central bank committed to its fight to bring inflation under control, even at the cost of economic recession. Although, the Fed still hopes to be able to navigate a soft landing. There are concerns, however, that several inflationary pressures remain outside the purview of the Fed, such as energy and food prices driven ever higher by the ongoing Russian war in Ukraine, as well as continued COVID-19 impacts on the global supply chain.

“Until there’s very clear evidence of the labor market beginning to meaningfully deteriorate, the No. 1 focus for the Fed must be inflation,” Matthew Luzzetti, chief U.S. economist at Deutsche Bank, told PBS News.

USFR Takes the Guesswork Out of Rate Hikes

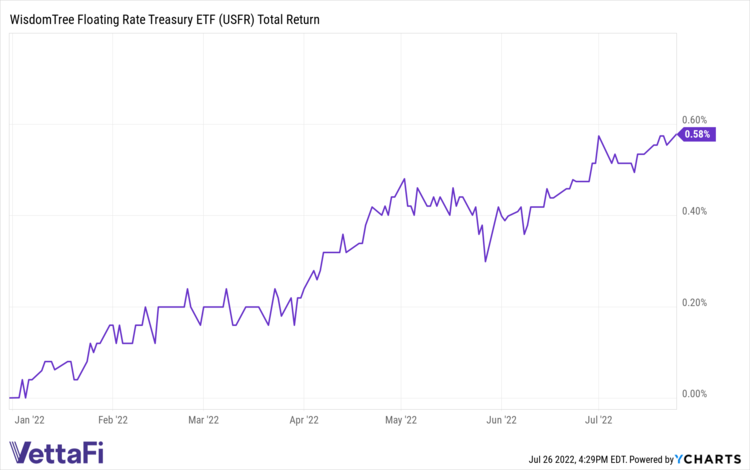

One fund that is riding high within fixed income this year is the WisdomTree Floating Rate Treasury Fund (USFR ), an ETF that can make hedging portfolios for interest rate increases much easier for advisors and investors. Year-to-date USFR has net flows of $4.18 billion.

Content continues below advertisement

The fund capitalizes on the use of floating-rate notes by the U.S. Treasury and can be an excellent option for investors looking to limit their amount of credit risk but still capture higher yield potentials in rising rate environments.

WisdomTree believes that floating rate debt is an important bridge between long-maturity, fixed-rate Treasury Bonds, and short-maturity Treasury bills. By investing in floating rate Treasuries, holders are paid out quarterly and the amount paid is based on a rate that resets daily in reference to a weekly rate. It can be a good option if Treasury bill yields are rising because it provides the opportunity for greater compensation over a fixed rate bond.

Another benefit to a floating rate is that price volatility can be somewhat lessened by the weekly resets when compared to fixed income bonds. Treasury floating rate notes are a good option when the yield curve is flat or inverted.

USFR seeks to track the Bloomberg U.S. Treasury Floating Rate Bond Index, which measures the performance of floating-rate notes of the U.S. Treasury and contains floating rate notes with two-year maturities and a minimum outstanding amount of $1 billion. The index uses a rules-based strategy and is weighted by market cap. The index excludes fixed-rate securities, Treasury inflation-protected securities, convertible bonds, and bonds with survivor put options.

USFR carries an expense ratio of 0.15%.

For more news, information, and strategy, visit the Modern Alpha Channel.