By

Here is a very quick summary of the last 3 years of my writing:

- Since that time, signal after signal has appeared that risk was rising for investors. Despite apparently strong economic numbers, it was late in the game.

- The stock market has been on borrowed time since early 2016. That was when the Federal Reserve propped up the economy. They could have let it follow its normal cycle. They didn’t. The market rejoiced.

- The only thing that had not happened to tip the market over was the only thing that ultimately matters. In other words, the actual price of the S&P 500 and the broad stock market had not fallen significantly.

- Late last year, the S&P 500 had a “crash test.” It fell 20% from its peak. That included a 15.6% decline in just 3 weeks in December.

- The rally that followed, starting on Christmas Eve, 2018, served to return investors to their complacent state. That is, they believed that the “crash test” was “the crash.”

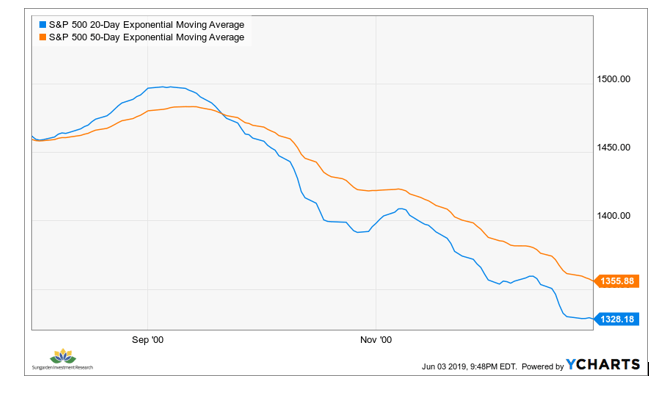

Last week, a market price signal that has been associated with every major S&P 500 decline since the year 2000 occurred. Specifically, the 20-day moving average fell below the 50-day moving average. That is technical talk for “prices are weakening.”

I normally plug 1 or 2 charts into a story. This one is all about the visuals, so I am providing 4 charts. Here is that “20/50 Bearish Crossover” in the S&P 500.

Here it is from back in the year 2000. This was early in the life of a 3-year bear market.

Click here to read the full article on Iris.