By Rob Williams, Director of Research

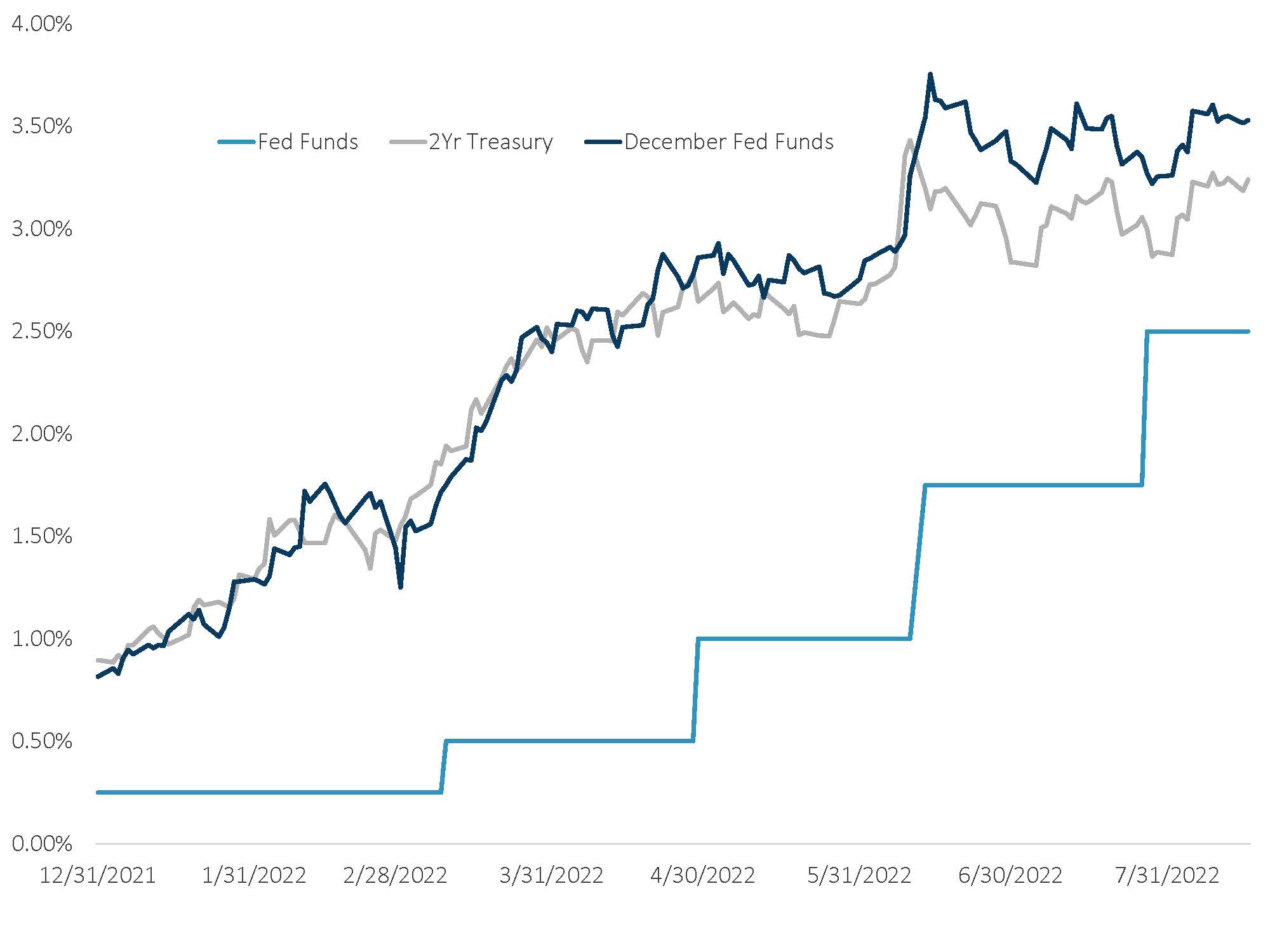

The Fed is likely to wrap up hiking rates by year-end, which is good news for fixed income investors. What the Fed has articulated and what futures markets indicate is that they will finish with the federal funds rate in the 3.0% to 3.50% range. This also jives with current yield levels. Outside the short-lived spike in early June, longer rates have been ranging around 2.75% to 3.0% since April. This is where markets see fair value and implies a hike of 50 basis points in September, with the possibility of two 25-basis-point hikes in the last two meeting of 2022. This suggests the rate damage from here will be contained and supports our base case of positive returns in the second half.

Content continues below advertisement

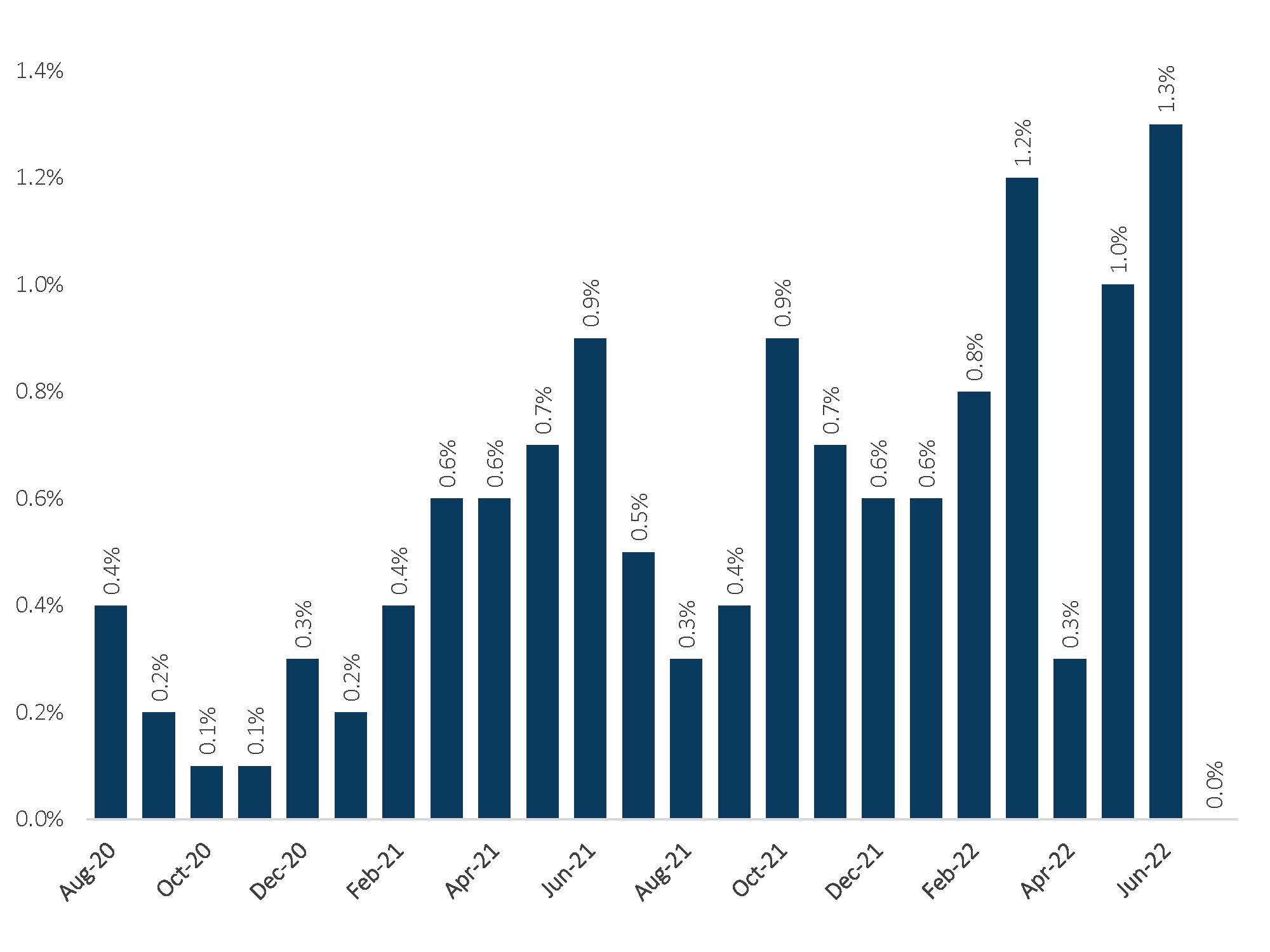

1. There has been some inflation relief, but the jury’s still out on the deceleration. The most recent inflation data has shown pricing pressures receding, driven by falling energy prices. While one month does not make a trend, evidence has been mounting that we may have seen peak inflation.

Consumer Price Index (MoM% Change)

Source: Sage, Bloomberg

2. Yields are fairly priced given the expectations for the terminal federal funds rate. The slowdown in growth activity combined with some relief in inflation has caused future hiking expectations to stabilize. While the Fed has some work left to do, market expectations, fed funds, and yields seem to be on a path to 3.0% to 3.5%. This suggests less pain for fixed income investors.

Futures Pricing of the Federal Funds Rate & Current Rates

Source: Sage, Bloomberg

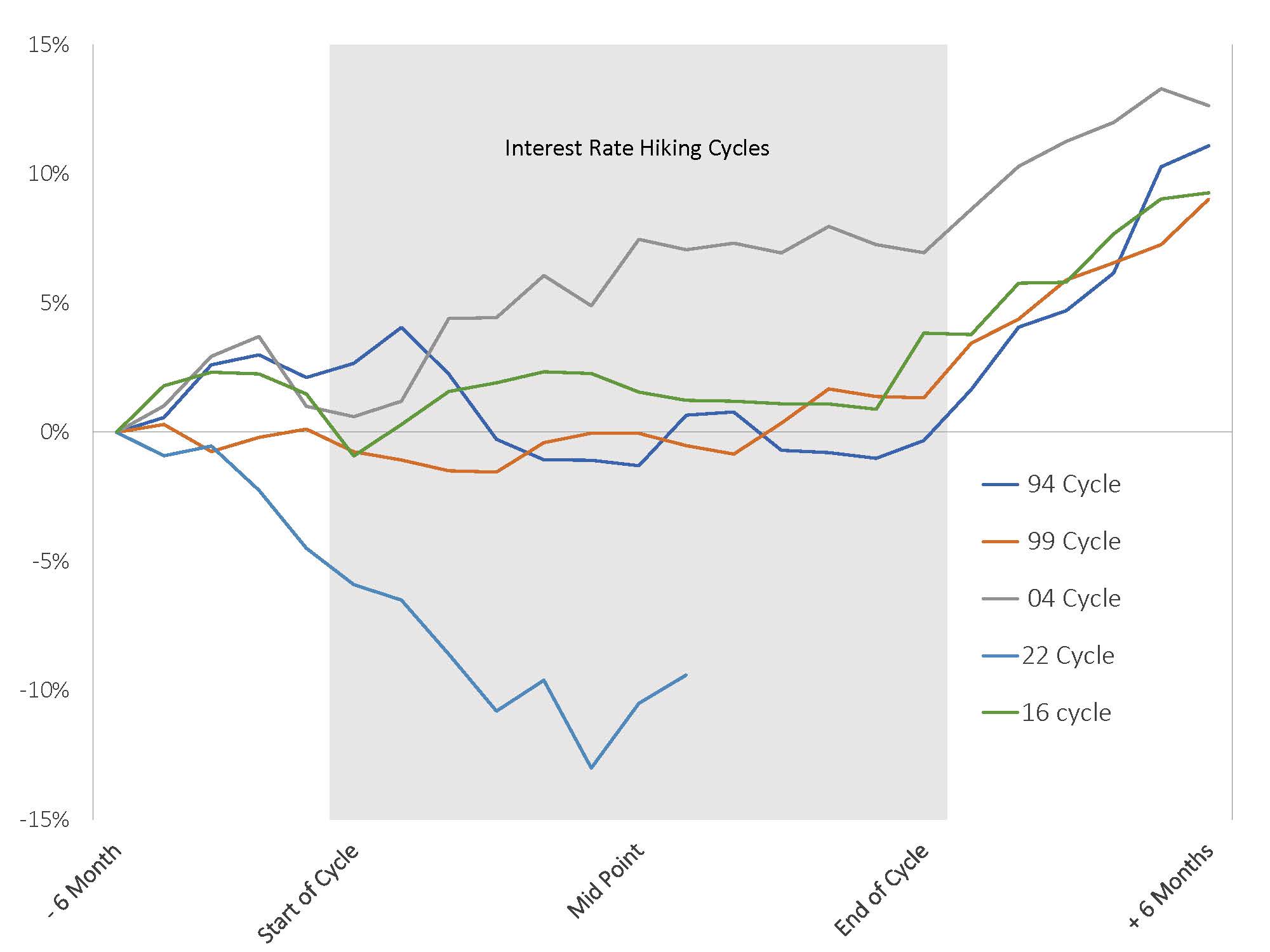

3. Fixed income has reached a turning point. Although this cycle has been an outlier in terms of the scale of negative returns, the pattern should be like previous tightening cycles. If the Fed finishes hiking by year-end, we are historically in a much better part of the cycle for returns.

Aggregate Bond Index Returns During Tightening Cycles

Source: Sage, Bloomberg

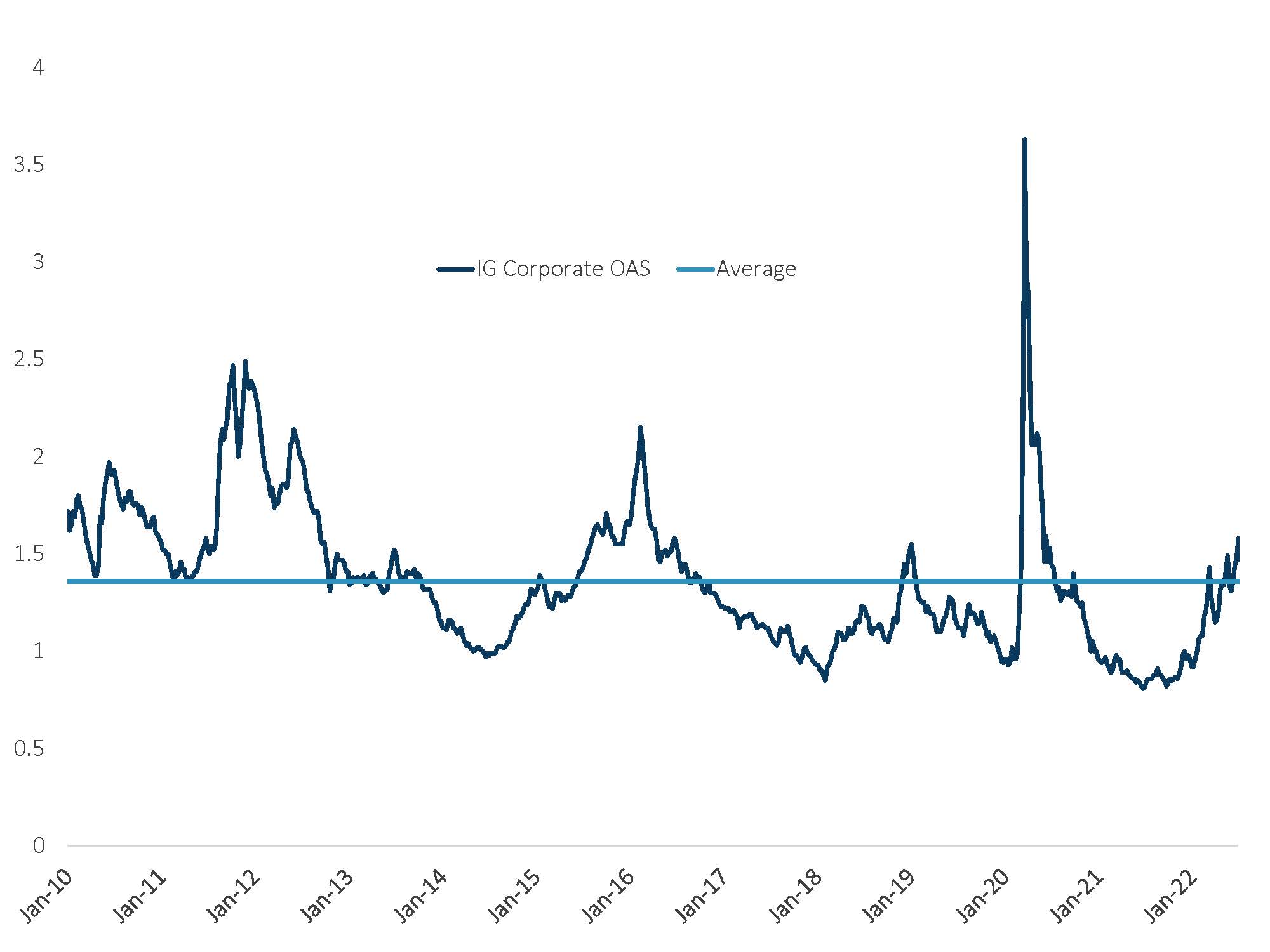

4. Corporate credit spreads have widened to account for Fed tightening. While investment grade (IG) corporate spreads have widened, they aren’t glaringly undervalued versus past widening episodes, so security selection is key.

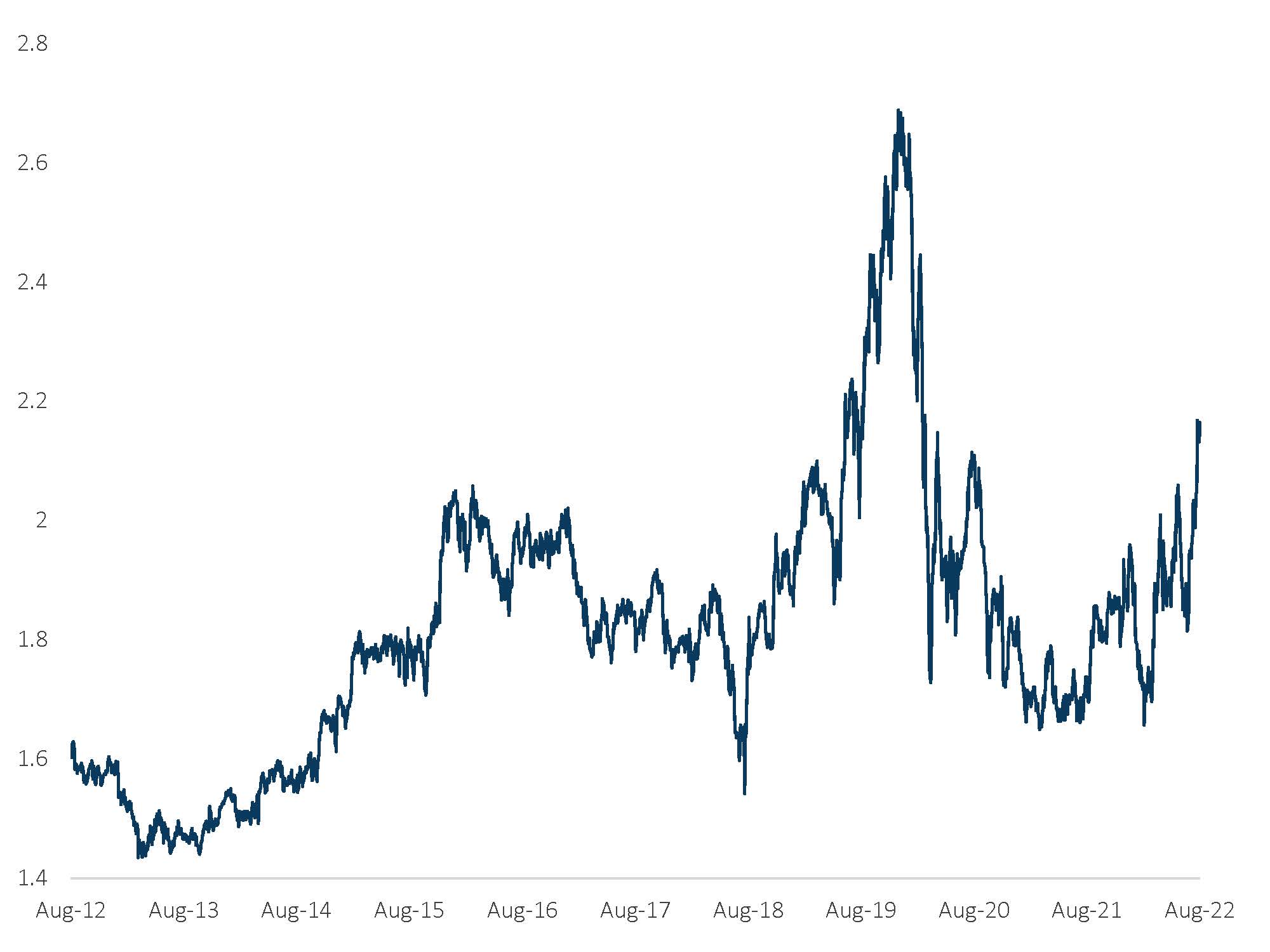

IG Corporate Spread Over Treasuries

Source: Sage, Bloomberg

5. High yield has outperformed recently, but we remain cautious. High yield corporates have recently outperformed investment grade credit with the recent “Fed Pivot” risk rally. However, the lowest-quality segment of the high yield market continues to underperform.

CCC Spread vs. High Yield

Source: Sage, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.