The king currency has finally hit the first long-term target of $114 that was set in the summer of a distant 2019 when it traded around $96.

That aim wasn’t clear then as the dollar index (DX) looked weak in the chart. The short-term structure was similar to a pullback after a heavy drop.

The majority of readers did not believe the DX would ever raise its head as you can see in the 2019 ballot results below.

However, I had found a bullish hint in a very big map, and I warned you “Don’t Get Trapped By Recent Dollar Weakness”.

Back in August, you had already been more bullish on the dollar as you voted the most for the target of $121.3 in the earlier post. This confidence is due to the certain position of the Fed, which resolutely fights the inflation, lifting the rate aggressively round by round.

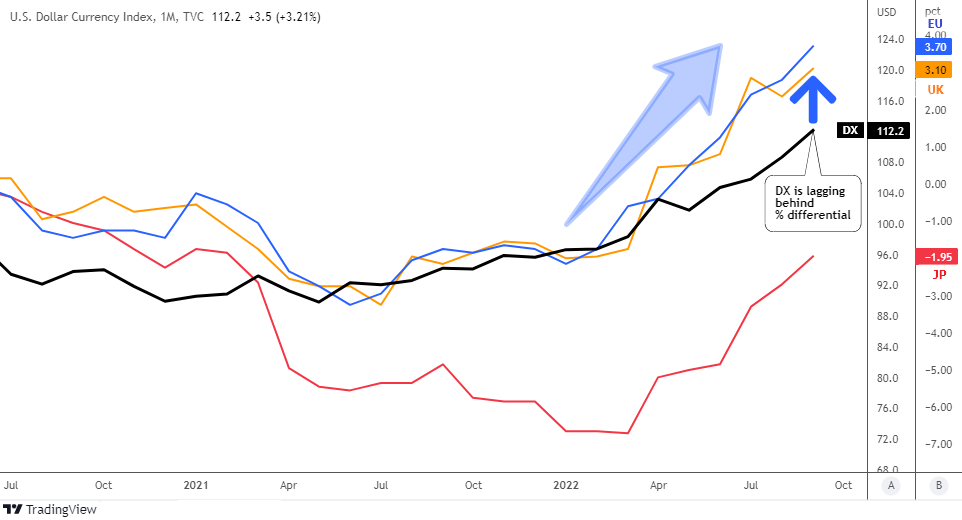

Let me update the visualization of the real interest rate comparison below to see if the dollar still has fuel to keep unstoppable.

The real interest rate differentials are shown on the scale B: blue line for U.S. – Eurozone, orange line for U.S. – U.K. and the red line for U.S. – Japan.

As you can see in the chart above the dollar’s buffer only grows over time as the trend gets even sharper. In August, the blue line was at +2.4%, the orange line was at +2.35% and the red line was at -3.3%. The change is huge in favor of the U.S. compared to its rivals.

Currently, the DX is lagging behind two differentials: U.S. – Eurozone (the largest component of the DX) and U.S. – U.K. (3rd largest component of DX). We can clearly observe the potential of the dollar to close that gap, rallying at least in the area of $120-$123, where the next target of the distant 2001-year top is located.

Let me refresh the technical chart below…

Continue reading at INO.com