The iShares North American Tech-Software ETF (NYSEArca: IGV) soared 1.5% higher on Wednesday after one of its largest holdings, cloud software company Salesforce, reported better-than-expected earnings for its first quarter of the 2020 fiscal year.

Here’s how Salesforce did:

- Earnings: 93 cents per share, excluding certain items, vs. 61 cents per share as expected by analysts, according to Refinitiv.

- Revenue: $3.74 billion, vs. $3.68 billion as expected by analysts, according to Refinitiv.

“I am thrilled with our results this quarter, and I am especially excited to have delivered record revenue in Q1 and operating cash flow of almost $2 billion, up 34% year-over-year,” said Marc Benioff, chairman and co-CEO, Salesforce. “We have a massive opportunity in front of us and are well-positioned for long-term growth as the world’s #1 CRM.”

“Our strong revenue growth in the quarter reflects the strength of our business and the tremendous demand we’re seeing from customers worldwide,” said Keith Block, co-CEO, Salesforce. “Companies of every size and industry are undergoing a digital transformation to better serve their customers and they are choosing Salesforce as their partner.”

IGV seeks to track the investment results of an index composed of North American equities in the software industry and select North American equities from interactive home entertainment and interactive media and services industries. The fund generally invests at least 90 percent of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index.

The index measures the performance of U.S.-traded stocks from the software industry and select companies from the interactive home entertainment and interactive media and services industries in the U.S. and Canada. The fund is up 19 percent thus far YTD.

An Emerging Markets Tech ETF to Consider

The U.S.-China trade impasse heavily discounted a lot of U.S. equities the past week, but it also put the red tag sale on emerging markets (EM). Combine the tariff battles with a cautious U.S. Federal Reserve, and it puts the EM space at an attractive valuation relative to its peers.

While most investors might have been driven away by the losses in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue in 2019.

Can’t make up your mind whether to invest in the plethora of emerging markets available in the ETF space or the Invesco QQQ Trust (NASDAQ: QQQ). The Emerging Markets Internet & Ecommerce ETF (NYSEArca: EMQQ) marries the idea of technology and EM in one ETF.

EMQQ invests in companies with exposure to the ecommerce and Internet sectors in emerging markets. Purchasing EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increases their utilization of the Internet and ECommerce.

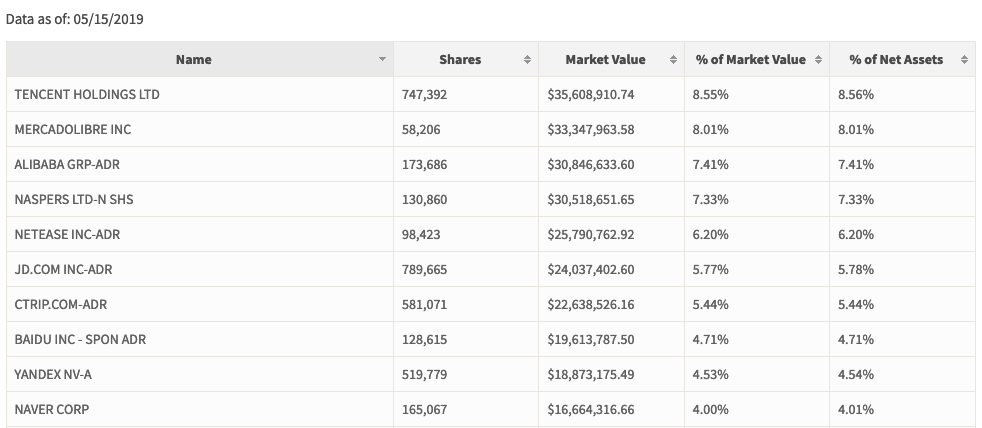

The fund provides broad-based exposure to the big names in tech overseas like Tenecent Holdings. Just take a look at its top 10 holdings:

For more market trends, visit the Innovative ETFs Channel.