[ad_1]

In a recent discussion about value funds, triggered by my July 2018 article about how to properly view expense ratios, an investor suggested the Invesco S&P SmallCap 600 Pure Value ETF (RZV) was a superior choice to the Bridgeway Omni Small-Cap Value Fund (BOSVX), the fund my firm recommends.

The investor’s rationale was that RZV not only has a lower expense ratio (0.35% versus 0.60%), but also that, using the regression tool available at Portfolio Visualizer and an analysis using the three Fama-French factors, it had somewhat higher loadings on the market beta factor (1.18 versus 1.04), the SMB (size) factor (1.08 versus 0.90) and the HML (value) factor (0.71 versus 0.68) over the period September 2011 (BOSVX’s inception) through May 2018. Before jumping to conclusions, however, we need to explore a few issues.

As discussed in my book, “Your Complete Guide to Factor-Based Investing,” co-authored with Andrew Berkin, Bridgeway’s director of research, one of my five criteria for allocating assets to a factor is that the factor should be robust to various definitions. The value factor met that criterion (as well as the other criteria that we established; namely, persistence, pervasiveness, implementability and intuitive explanations). A strong value premium existed regardless of whether one determined value by price-to-book, price-to-cash flow, price-to-earnings or a variety of other measures, like price-to-enterprise value, dividends and sales.

Multiple Value Metrics

One of the reasons my firm’s Investment Policy committee recommends BOSVX is that the fund does not rely solely on the HML factor to determine value stocks eligible for purchase. Instead, it uses multiple value metrics. Reasons to consider multiple metrics include:

- Different measures work better in some industries than others.

- While value metrics are highly correlated, they are not perfectly so, providing a diversification benefit.

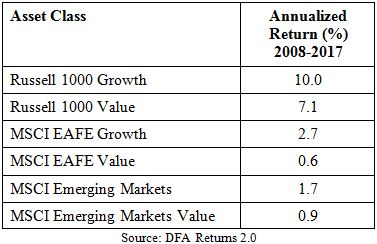

- There are long periods in which one metric works better than another. For example, in the U.S. from 2008 through 2017, while price-to-book (P/B) ratio produced a negative premium of 0.8% and price-to-cash flow (P/CF) ratio produced a negative premium of 1.0%, price-to-earnings (P/E) ratio produced a positive premium of 1.2%.

We can look at the long-term evidence on different value metrics. The following Fama-French data show the value premium over the period 1952 through 2017:

- P/B: 4.8%

- P/E: 6.4%

- P/CF: 4.7%

- P/D: 2.0%

Note how the price-to-dividend (P/D) metric provided the weakest value premium of these four measures.

For those interested, I recommend an interesting paper by O’Shaughnessy Asset Management, which suggest reasons that P/B has lost some explanatory power.

With these facts in mind, when we look at regression results showing various funds’ loadings on a value factor based solely on P/B, funds that use only P/B, or more heavily weight P/B, tend to have higher loadings on the value factor. On the other hand, funds that use multiple metrics may actually have more exposure to value stocks, but not when measured solely by the P/B metric.

Comparing Funds

We can see this at work when comparing the portfolios of RZV and BOSVX. Using data from Morningstar, the following table shows their value metrics as of March 2018:

As you can see, while RZV has a lower P/B ratio than BOSVX, their P/E ratios are virtually identical (although BOSVX’s is slightly lower). In addition, BOSVX has a much lower P/CF ratio. Looking at the total picture, it would be hard to draw the conclusion that RZV has more exposure to the value factor.

I would also add that, at least currently, Morningstar reports that even though RZV shows a higher loading on SMB, BOSVX’s average market cap is slightly lower than RZV’s ($835 million versus $854 million). Of course, these figures can change over time.

[ad_2]

Source link