[ad_1]

Even so, there are some very interesting technical indicators in play at this time.

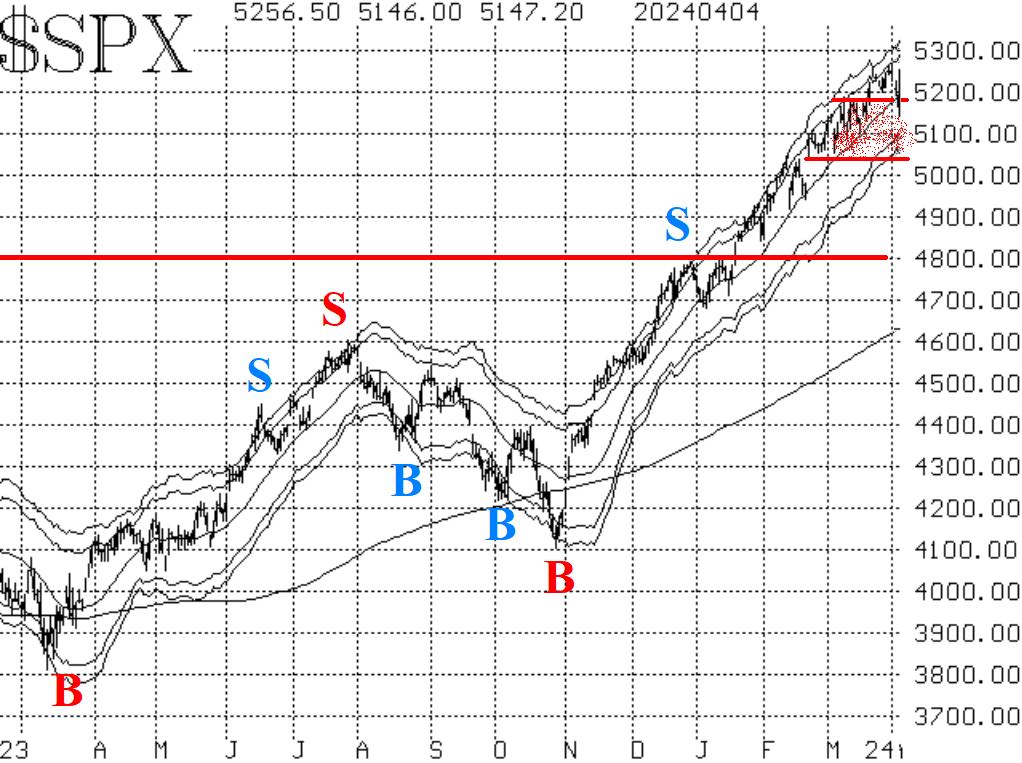

Let’s start with the $SPX chart (Figure 1). It is still within the wider rising channel (thick blue lines on the chart), but it has violated the narrower, higher channel (marked with the thinner blue line on the chart). That keeps the $SPX chart in the “bullish” column. A violation of support at 2860 would be a big problem, though.

Equity-only put-call ratios continue to be at odds with one another. The weighted ratio is on a sell signal, and the standard ratio is technically still on a buy signal.

Breadth is a very interesting indicator, however. The breadth oscillators have been on sell signals for about a month. Obviously, $SPX was probing higher for a good portion of that month, but breadth was not following suit. This created a negative divergence. These oscillators are already getting oversold.

Volatility has remained low. This has been the one indicator that has protected the bullish case over the last few months. We continue to feel that a close above 15 by $VIX would be negative for stocks. That Index did rise above 15 on Thursday, but it did not close there. So, $VIX has not given a sell signal.

Furthermore, there is a negative divergence between the Russell 2000 (IWM) and $SPX.

In summary, the market is finally showing some signs of wear and tear, but the bulls have not capitulated yet. Did a “stealth correction” just take place, and $SPX is finally joining in at the end of it, or are the bulls losing control and we’re destined to see a full-blown correction in $SPX as well? At the current time, we do not have confirmed bearish signals, but a break of support and an upside breakout by $VIX would generate those confirmed sell signals.

The SPDR S&P 500 ETF Trust (SPY) closed at $287.82 on Friday, down $1.62 (-0.56%). Year-to-date, SPY has gained 8.29%.

SPY currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 152 ETFs in the Large Cap Blend ETFs category.

This article is brought to you courtesy of McMillan Analysis Corp..

[ad_2]

Source link Google News