Investors, including those seeking income, tend to naturally favor that which is more familiar and better understood, resulting in a home country and familiarity bias. For US investors, performance trends have likely reinforced those biases, as domestic benchmarks have handily outperformed international developed markets over the last decade thanks in part to their significant exposure to the technology sector. With the volatility in equities this year and weakness in technology amid rising interest rates and supply chain issues – not to mention US consumer confidence plumbing decade-lows in May – it could be an opportune time for income investors to reconsider their international exposure.

Developed market equities can provide both diversification benefits and yield enhancement to an income portfolio. Beyond adding exposure to stocks that would otherwise not be included in a US-focused income portfolio, international equities may also be attractive due to lower correlations with other common income investments. For example, five-year correlations between international equities and REITs and utilities are around 0.6. International companies also tend to provide more generous income. The five-year average yield for the MSCI EAFE Index (MXEA) is 140 basis points higher than that of the S&P 500 (SPX). To be clear, international equities come with additional risks, such as geopolitical risk and foreign currency risk, that should not be dismissed but are likely manageable in a well-diversified portfolio.

For income investors, a simple, yield-focused strategy could be an interesting way to gain international exposure and boost portfolio income. The S-Network International Sector Dividend Dogs Index (IDOGX), which is the underlying index for the ALPS International Sector Dividend Dogs ETF (IDOG ), selects the five stocks with the highest dividend yields in ten sectors (excludes real estate) from a starting universe of mostly large-cap stocks, which are domiciled in developed markets outside of the Americas. The 50 stocks are weighted equally, providing diversified sector exposure.

The equal-weighting scheme has contributed to IDOGX’s strong performance in a challenging year. For example, relative to benchmarks, IDOGX is overweight energy, which has done extremely well this year amid rising oil and natural gas prices. Year-to-date through May 31, IDOGX is up 2.8% on a total-return basis compared to declines for the MXEA and SPX of -11.0% and -12.8%, respectively. IDOGX was yielding 5.4% at the end of May – 200 basis points above the MXEA as shown in the chart below.

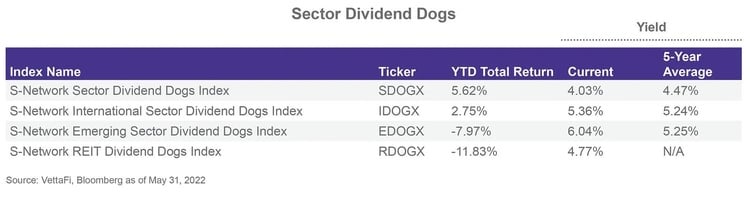

For those that would be interested in a domestic strategy with enhanced yield and an equal-weighting scheme, the S-Network Sector Dividend Dogs Index (SDOGX) deploys the same approach as IDOGX but has the S&P 500 as its starting universe. At the end of May, SDOGX was yielding 4.0% and was up 5.6% on a total-return basis year-to-date. Notably, of the income indexes profiled below, SDOGX and IDOGX are the only indexes outside of energy infrastructure to have positive year-to-date performance.

The S-Network International Sector Dividend Dogs Index is the underlying index for the ALPS International Sector Dividend Dogs ETF (IDOG). The S-Network Sector Dividend Dogs Index is the underlying index for the ALPS Sector Dividend Dogs ETF (SDOG).

Content continues below advertisement

Current Yields vs. History

Even with a strong start to the year, midstream/MLPs continue to offer attractive yields, although current yields are below historical averages.

SDOGX and IDOGX stand out from the other dividend dog indexes for positive performance YTD. The current yield for SDOGX is below its historical average, but IDOGX and EDOGX are yielding above their five-year average.

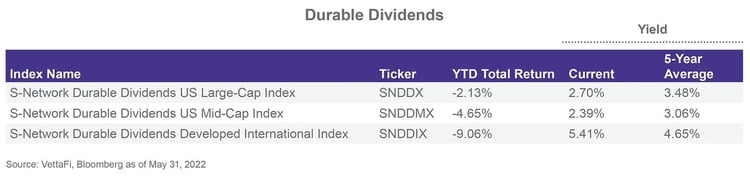

Multiple screens for dividend durability, including evaluating cash flows, EBITDA, and debt-to-equity ratios, help ensure reliable income from the durable dividend indexes.

Closed-end funds have been pressured by the rising interest rate environment, and the current yields for CEFX and CEFMX are above their historical averages.

Related research:

IDOGX: An International Breed with Higher Yield

Income Investments Outperforming Broad Equities as Rates Rise

SDOGX Fetches Higher Yields and YTD Outperformance

Income Opportunities: MLPs, CEFs, and Return of Capital

Income Opportunities: Examining Price and Total Return in 2021

Income Opportunities: Finding Income in an Inflationary Environment

Download PDF

For more news, information, and strategy, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi, which also owns the index provider for IDOG and SDOG. VettaFi is not the sponsor of IDOG and SDOG, but VettaFi’s affiliate receives an index licensing fee from the ETF sponsor.