Who knows why the 17.7 million Canadians who cast ballots in the last federal election voted the way they did? Many of them were tired of Stephen Harper, obviously. I’ve wondered if the outcome also shows that some voters knew their John Maynard Keynes better than Harper and former New Democratic leader Thomas Mulcair realized.

In 2015, the economy still was limping from the Great Recession and oil prices had collapsed. It was no time to prioritize a balanced budget and only the third-place party was offering to run deficits. Contrary to Conservative messaging, Justin Trudeau alone looked ready to fight a slowdown.

Context matters when it comes to talking about debt and deficits. And that’s why four years later, Trudeau is on shaky ground with those Keynesians who backed him four years ago.

As the governing party is fond of pointing out, the economy is doing great overall. And yet the deficit still is expanding, according to the Parliamentary Budget Officer’s latest projection. That wasn’t the deal.

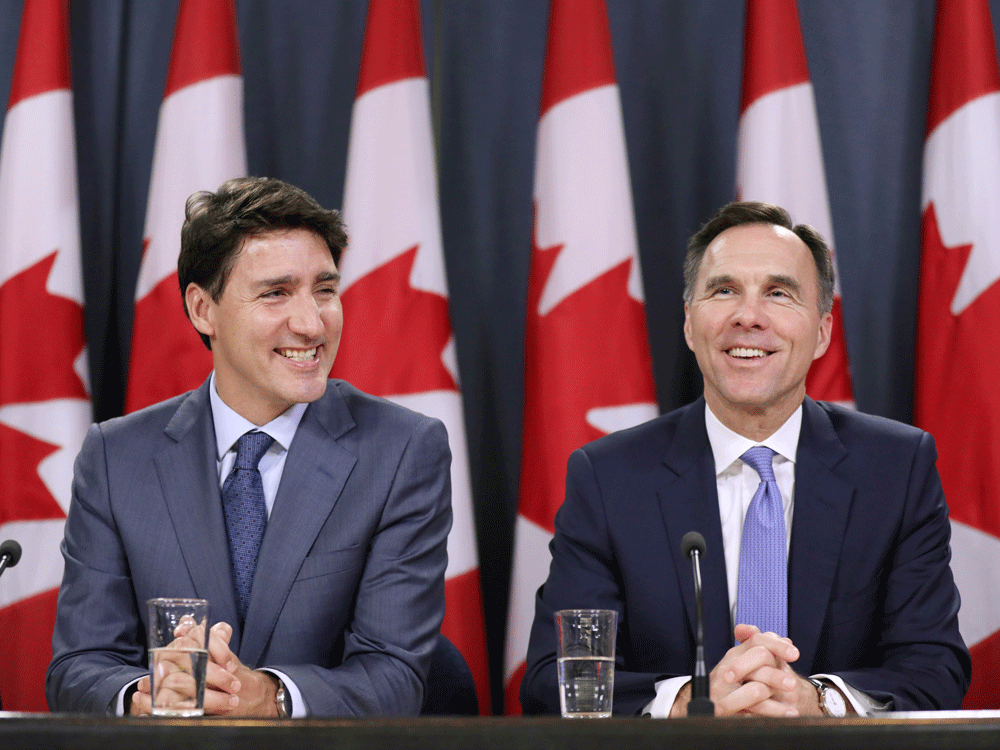

But is it a firing offence? Only if you think Trudeau and his Finance Minister, Bill Morneau, should have been more straightforward about their approach to fiscal policy.

The deficit is on track to max out at around one per cent of gross domestic product, which is no big deal. The comparable number for the United States is five per cent. “Relative to others, it’s not a high deficit,” Charles Seville, co-head of Americas Sovereigns at Fitch Ratings, the credit-rating agency, said by phone from New York.

Earlier this month, Fitch re-upped Canada’s `AAA’ rating, one of only 11 sovereigns that have earned the agency’s highest score. The Government of Canada borrows at rates in the very low single digits and that’s not about to change. Under those conditions, and given all of the other things that Canada should be worried about, a balanced budget is a luxury, not a necessity.

The Conservatives have figured that out. As a leadership candidate in 2017, Andrew Scheer said he would balance the budget two years after he became prime minister.

We’re a mid-level recession away from losing our status as risk-free borrower

In May, with polls saying the Tories could win the election, Scheer officially changed his mind. In a speech in Vancouver, he said it could take up to five years to erase the deficit, which would require a second term.

In Scheer’s fifth year, the revenue shortfall will be $9 billion, or 0.3 per cent of GDP, according to the PBO. That barely counts as a deficit.

The government sacrifices revenue of about $6 billion a year by taxing the income of smaller businesses at a much lower rate than companies that employ more than 500 people, and it gives up a similar amount by exempting the sale of principal residences from the capital gains tax. Curb those two sops, and the budget would be balanced in no time.

If you think those are too precious to touch, then comb through the Finance Department’s latest report on tax expenditures, where you will find dozens of measures that are “used to achieve a policy objective that deviates from the core function of the tax system, at the cost of lower revenues.” They are worth a combined $150 billion, or almost as much as Ottawa collected in personal income taxes in the fiscal year that ended in March 2018.

The political class has all the fiscal room it needs to balance the budget whenever it wants. Bottom line: It no longer wants.

And that’s why its time for the rest of us to resume paying attention.

Canada needs a new fiscal consensus before it’s too late

Fitch gave Canada another gold star, but the report made clear there is room for improvement. The combined gross public debt of the federal government and the provinces is about 90 per cent, according to the way Fitch measures it, and that’s high for a top-rated sovereign.

Interest payments on that debt amount to 7.5 per cent of revenue, compared with the `AAA’ median of four per cent. Canada’s economic growth also has been slower than its peer group over the past five years.

We’re a mid-level recession away from losing our status as risk-free borrower. “The provincial finances collectively look less sustainable,” Seville said. “The scenario that concerns us most is the fallout from a downturn that is worsened by a severe correction in the housing market that would lead to a prolonged recession.”

Such a scenario is unlikely, but possible. The International Monetary Fund this week cut its outlook for global economic growth and central banks are panicky. Canada needs a new fiscal consensus before it’s too late.

Balanced budgets tied to calendar dates don’t work because the target is rigid, not mention arbitrary. Morneau’s preferred anchor, a downward tracking debt-to-GDP ratio, is fine in theory, but leaves politicians with too much room to manoeuvre. Legal restraints don’t work; with the U.S. in danger of violating its statutory debt limit, law makers opted to change the law rather than reduce the deficit. Trudeau disappeared Harper’s balanced-budget law in a similar manner.

A party that wants to win the Keynesian vote this autumn could do worse than take the advice of Scott Clark and Peter Devries, retired department of finance officials who now work as consultants and write blog posts in their spare time. They advise setting aside a contingency reserve in each budget and using the money to pay off debt if it isn’t required to offset a change in economic circumstances.

A nice, simple policy that would be perfect for the current context.

•Email: kcarmichael@postmedia.com | CarmichaelKevin