[ad_1]

Today, revisions to the Global Industry Classification Standard (GICS), an industrywide sector classification upon which dozens of ETFs are based, will finally take effect.

These changes, which we’ve reported on extensively, are the largest such change to the classification standard ever made. As such, dozens of GICS-based ETFs will require significant rebalancing to accurately reflect their benchmarks’ new compositions.

Substantial ETF rebalances sometimes can result in hefty capital gains tax events for investors. Fortunately for investors, that isn’t likely to happen to here.

The reason is tied to an unusual “heartbeat” pattern that has begun to appear in the daily flows of several of the largest, most popular GICS-linked ETFs—tell-tale evidence of trades made specifically to boost ETF tax efficiency in situations just like this.

Flows Pulse Felt Earlier This Year

In August, we reported an unusual “heartbeat” pattern had emerged in the flows data for two Vanguard ETFs impacted by the GICS changes, including the Vanguard Information Technology ETF (VGT) and the Vanguard Consumer Discretionary ETF (VCR) (read: “Behind Vanguard’s “Heartbeat” Flows”).

Roughly equal amounts of money had flowed in and out of these two funds each week for several consecutive weeks, with the flows often separated by a single day. The quantity of money changing hands had been sizable, ranging from $250 million to $400 million at a time:

Sources: ETF.com, FactSet; Data from Sept. 1 to Sept. 25, 2018

This wasn’t the first time such a “heartbeat” had been spotted in an ETF’s daily flows data. Elisabeth Kashner, FactSet director of research and analytics, had first uncovered the pattern earlier this year, noting that these large, equal-but-opposite flows in and out of an ETF typically fell around a fund’s rebalance date (read: “The Heartbeat Of ETF Tax Efficiency”).

As she theorized, the trade allows ETF managers to reduce the capital gains that would otherwise result from large rebalances. By using the in-kind redemption process unique to ETFs, wherein fund shares can be swapped for underlying securities instead of sold (like in a mutual fund), portfolio managers can wash out appreciated, high-tax stock positions and minimize the ETF’s overall capital gains.

The process works like this: An anonymous donor (usually a market maker) injects short-term capital in advance of rebalance dates, funding share creations. That capital is then returned days later, as those ETF shares are then redeemed (read: “The Players Behind ETF Tax Efficiency”).

That was what Vanguard was doing with VGT and VCR back in June and July, after switching those two ETFs to new transition indexes designed to incorporate the GICS changes gradually. Now it appears that history is repeating itself, as the heartbeat pattern has appeared in several Select Sector SPDR funds right now.

Heartbeat Across Select Sector SPDRs

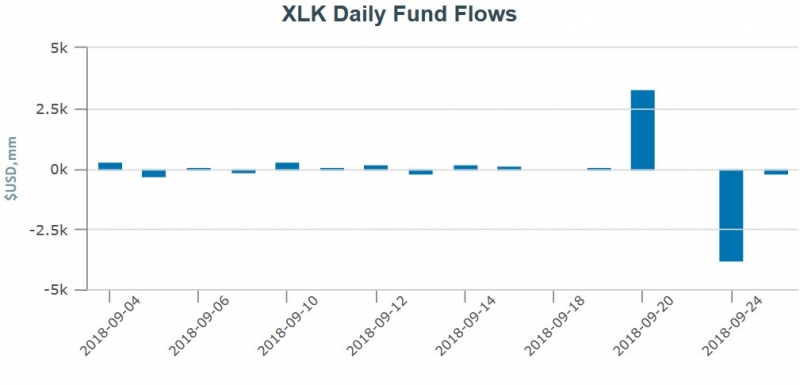

For example, the pattern is obvious in the Technology Select Sector SPDR Fund (XLK), where $3.3 billion entered the ETF on Sept. 20, only for $3.8 billion to exit on Sept. 24:

Sources: ETF.com, FactSet. Data from Sept. 1 to Sept. 25, 2018

The pattern also emerged in the Consumer Discretionary Select Sector SPDR Fund (XLY), where $2.5 billion entered on Sept. 20, and $2.2 billion exited on Sept. 24:

Sources: ETF.com, FactSet. Data from Sept. 1 to Sept. 25, 2018

[ad_2]

Source link