[ad_1]

Main Thesis

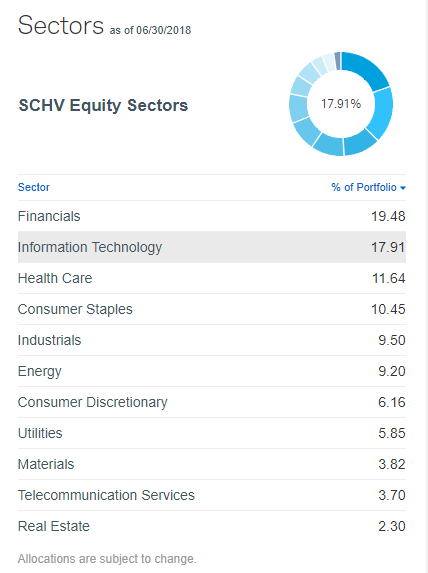

The purpose of this article is to articulate why I believe the Schwab Large Cap Value ETF (SCHV) is still an attractive investment option at its current market price. Recent volatility has me staying firm on my broad market funds, and convinced me to add to my dividend and value positions instead. SCHV fits both these objectives, as it trades at a very reasonable valuation and has seen significant dividend growth in the first half of 2018. Furthermore, SCHV is overweight three sectors I like: financials, information technology, and healthcare. Financials is one area I especially see continued value, as large U.S. banks are making record profits and hiking dividends aggressively. There is also a backdrop of rising interest rates which should ultimately benefit that sector, and therefore SCHV, in the long-run.

Background

First, a little about SCHV. The fund’s stated objective is to “track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Large-Cap Value Total Stock Market Index”. The fund attempts to hold the same proportions of its stocks as its weightings in the index and is managed by Schwab. SCHV is currently trading at $55.81/share and is yielding 2.48% annually, based on its four previous distributions. My most recent review of SCHV was back in early May, when I continued to recommend the fund. Since that time, SCHV has returned roughly 7%, after accounting for distributions. While this is a great short-term return, it is important to note that value is under-performing the broader market over the longer term, which makes sense because we remain in a growing economy. However, as trade disputes continue to increase market volatility, value is holding its own in the short-term, when compared to the broader market and growth strategies. This is illustrated by the graph below, comparing SCHV to Schwab’s US Broad Market ETF (SCHB), Schwab U.S. Large Cap Growth ETF (SCHG), and Schwab U.S. Dividend Equity ETF (SCHD):

Source: CNBC

Source: CNBC

Given that I expect volatility to continue in the second half of the year, and market valuations remain above historic averages, I see compelling reasons to add to long value positions, and I will explain why in greater detail below.

Dividend Growth Even Stronger in Q2

One important reason why I still like SCHV at its current valuation has to do with the fund’s dividend. While not “high”, it is right in line with many dividend strategies, as the fund’s focus on value stocks allows it to own many companies who have not seen their yields depress because of rapid stock appreciation. In fact, SCHV actually has a higher yield than many popular dividend-specific funds. To see how this yield stacks up, let’s consider how it compares to popular dividend ETFs right now. I have selected four popular dividend ETFs which focus on quality, growth, dividend aristocrats, and high yield: SCHD, iShares Core Dividend Growth (DGRO), SPDR S&P Dividend (SDY), and Vanguard High Dividend Yield (VYM). A comparison of SCHV’s yield againts these funds is illustrated in the chart below:

| Fund | Current Yield |

| SCHV | 2.48% |

| SCHD | 2.61% |

| DRGO | 2.03% |

| SDY | 2.39% |

| VYM | 2.86% |

Source: Seeking Alpha

As you can see, SCHV lands right in the middle of the pack, so dividend-oriented investors can use this fund as an option to buy value stocks, but also earn a comparable yield.

While this is well and good, what is especially compelling about SCHV has less to do with its current yield and more to do with dividend growth. With interest rates rising consistently over the past year, I have been advocating dividend growth strategies over high yield or aristocrats since 2018 began. Fortunately, SCHV is improving on this metric as well. During my May review, SCHV hit my goal of double digit percent dividend growth (year over year) with its Q1 distribution coming in 10.35% higher than its Q1 2017 distribution. As I mentioned this figure improved in Q2, registering an increase above 18% what was paid last year. I don’t see any reason why this strong dividend growth will not continue in the second half of 2018, so I expect this yield to continue to push higher as we head in to 2019 (all other things being equal). Therefore, SCHV offers not only value, but a growing dividend as well, two key metrics for more conservative investors.

Financials – True Value Play

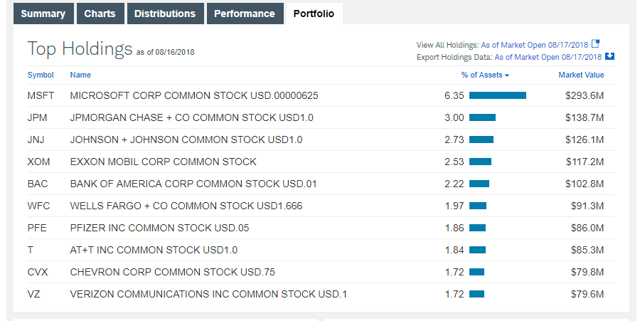

When considering SCHV as an investment, it is important to factor in the performance and outlook for the Financials sector, as this sector makes up about 20% of the fund. In fact, three of the fund’s top ten holdings are large U.S. banks, JP Morgan Chase (JPM), Bank of America (BAC), and Wells Fargo Co. (WFC), as illustrated by the chart below:

Source: Charles Schwab

Source: Charles Schwab

I continue to believe financials remain an area investors want to be overweight right now, with a primary reason for their attractive valuations. While the sector had been beaten down (rightfully so) during, and after, the recession, major U.S. banks are truly doing better than ever. Aside from raking in billions in profits, banks such as JPM, BAC, and WFC are hiking their dividends aggressively, well in to the double digits. This is contributing to SCHV’s impressive dividend growth I mentioned above, and will continue to do so.

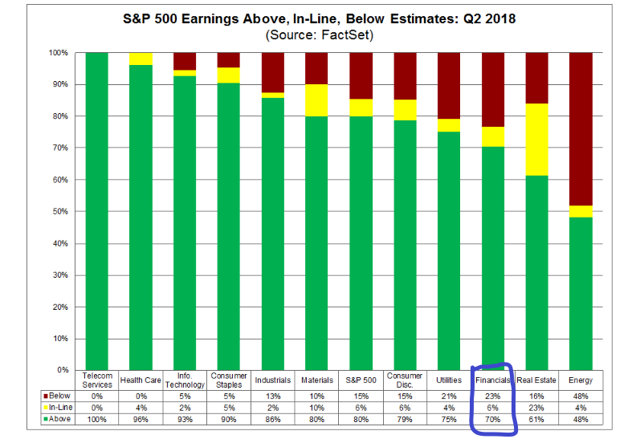

Furthermore, as I mentioned, this is a sector that is performing quite strongly. In fact, Q2 earnings showed that 70% of financial companies beat analyst expectations when they reported, as illustrated by the chart below:

Source: FactSet

Source: FactSet

Of course, you could be saying “wait a minute, the Financials sector is at the bottom of the pack”, begging the question of why that is an area to buy. While it is true the majority of sectors (in fact, all but energy) beat expectations this time around, it really comes down to valuation. For example, the iShares Core S&P 500 ETF (SPY), has a current price to earnings ((P/E)) ratio above 24. Contrast these with SCHV’s top bank holdings, as well as the broader Financial sector, as measured by the Financial Select Sector SPDR ETF (XLF), illustrated in the chart below:

| Fund/Company | P/E |

| JPM | 15 |

| BAC | 16 |

| WFC | 15 |

| XLF | 13 |

Source: Seeking Alpha

As you can see, this is an area that is drastically cheaper than the broader market. And, in fairness, having 70% of the companies in your sector beat analyst expectations is really quite strong. While it may be at the bottom of the pack on a comparative basis, it is a solid figure. Coupling this with dividend growth and an average valuation about 37% cheaper than the broader market, and this sector looks like a value play indeed.

IT – Slowing Down, But Long-Term Play Remains

Another important area to discuss is the Information Technology sector, which represents almost 18% of SCHV, as illustrated by the chart below:

Source: Charles Schwab

Source: Charles Schwab

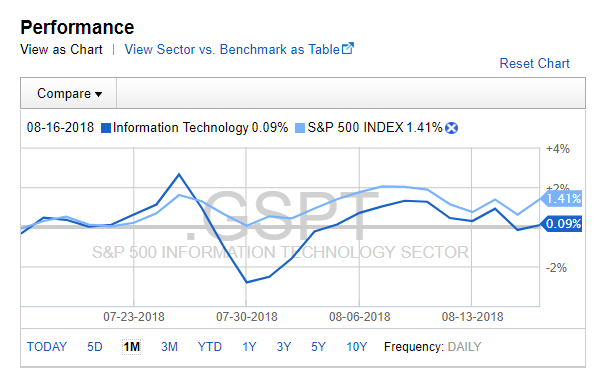

It is no secret this has been a sector on fire over the past few years, as we have seen it handily beat the broader market over multi year periods. However, recent regulatory investigations and other negative news headlines have pressured some of the biggest names in the sector, such as Facebook (FB) and Google (GOOG). This has pressured the entire sector, which has actually under-performed the broader market over the past month, as illustrated by the graph below:

Source: Fidelity

Source: Fidelity

However, I don’t see many reasons for the alarm bells to go off just yet, and continue to believe investors want to be overweight this sector. For starters, some of the high-flyers, such as GOOG, are not in funds like SCHV to begin with. SCHV is made up of tech firms like Microsoft (MSFT), which is a steady, established performer, but lacks the high multiples of some of its newer peers. Furthermore, consumer spending on technology continues to increase, even as our bull market matures. In fact, according to market research by NPD Group, “online consumer technology sales were up 16% in the 12 months ending May 2018” in a year over year comparison. This shows strong, healthy consumer demand for the products and services delivered by this sector.

And it is not just consumers who are on an IT spending binge. Global spending on information security products and services is forecasted to grow by double digits in both 2018 and 2019, with estimates by consultancy Gartner Inc. reaching as high as $124 billion by the end of next year. Highly publicized data security hacks and other breaches have been a sore point for many major companies over the past decade, and firms small and large are keen on staying out of the headlines in this regard. With criminal tactics constantly evolving, global spending in this area is sure to remain high for the foreseeable future. This points to strong demand in another key service category within the information technology sector, and should continue to help push revenue higher for the firms that provide it.

Bottom-line

SCHV is a fund for more conservative investors, offering strong, established companies that trade at valuations below the broader market. This is a strategy that makes sense to me in good times and bad. While it is true that in a growing economy value will under-perform, it still gives investors equity exposure and often offers above-average dividend income, which I never complain about. While the economy continues to grow, many investors may be tempted to shun value funds for more lucrative opportunities. But consider that SCHV’s top sector weighting is financials, which is a sector that should continue to prosper if the economy continues to grow, and also acts as a relative hedge against rising interest rates. Therefore, investors can capitalize on value but also a potential growth play at the same time. Finally, with increased levels of volatility over the past few weeks, looking for stocks and funds that trade at valuations below the market average might help more cautious investors ride out any coming storm. As someone who is comfortable with the amount of broad market exposure I currently have, I am looking to add to more value and dividend funds on any down days, and I continue to recommend initiating positions in SCHV at this time.

Disclosure: I am/we are long SCHV, SCHD, SCHG, JPM, DGRO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News