The word “Metaverse” has been around for years, originating in the 1992 novel Snow Crash.(1) Since then, we’ve seen versions of virtual worlds that have become almost as immersive as real life to many of its players—for example, World of Warcraft and Second Life. After Facebook rebranded itself as Meta Platforms the Metaverse became a more mainstream concept. And like with other emerging technology concepts like crypto, blockchain, and NFTs, investors have shown interest in finding ways to invest in the Metaverse. This note addresses some of the most common questions regarding the Metaverse relating to indexes and index-linked ETFs using the Alerian Galaxy Immersive Digital Worlds Index (DWRLD) as a reference.

First of all, what is the Metaverse?

In a broader sense, the Metaverse refers to the “next evolution in social connection and the successor to the internet.”(2) Just like the internet, there will be a single Metaverse with no single owner and users will be able to access the Metaverse through their computers and mobile devices. Right now, the Metaverse exists through a mix of the social media and gaming world where immersive role-playing games collide with customizable avatars and currencies.

If it’s in its early stages, why do we already have Metaverse indexes and passive ETFs?

While most investors may know of companies like Meta Platforms (META) and Roblox (RBLX), an index of metaverse-related stocks may help investors access a basket of similarly themed stocks through an index-linked ETF. If the Metaverse is the next iteration of the internet (which has grown significantly since its inception), there is value to track this sector in its early stages and capitalize on growth opportunities. Estimates predict that the Metaverse economy could go from $500 billion in 2020 to $800 billion in 2024.(3) Much like the streaming and gaming sector, which shares some overlap, there are long-term shifts supporting the way consumers digest entertainment and information (read more here).

Content continues below advertisement

What is in a Metaverse Index?

The Alerian Galaxy Immersive Digital Worlds Index (DWRLD) is an index of stocks engaged in the development of immersive digital ecosystems. The index splits the Metaverse into three main business segments, which are described in more detail below.

What does the Metaverse have to do with crypto?

Platforms like Decentraland run on Ethereum blockchain. Decentraland is made up of parcels of virtual space called LAND which are NFTs maintained by Ethereum smart contracts and purchased by cryptocurrency tokens called MANA.(4) Other virtual worlds, however, may not run on blockchain. For example, Roblox, Minecraft, and other mainstream video games run on their own platform. Avatars and currency are unique to the individual game and not decentralized. While users can build their own land, they do not own full rights to their assets like they do on blockchain-based platforms.

What overlaps does the Metaverse have with other subsectors?

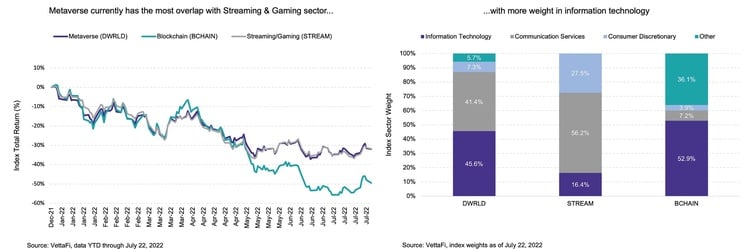

The Metaverse as it stands today relates most closely to the gaming sector with some overlap with blockchain and broader tech sectors. But DWRLD is a distinct index compared to both the S-Network Streaming & Gaming Index (STREAM) and the Alerian Galaxy Global Blockchain Equity, Trusts and ETPs Index (BCHAIN). As of July 22, DWRLD has performed more similarly to STREAM, but holds a heavier weighting to the information technology sector and less weight in the consumer discretionary sector. Compared to BCHAIN, DWRLD has less broad sector diversification and more focus on internet-related sectors. DWRLD includes large-cap stocks like Meta Platforms (META), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL), popular gaming stocks like Roblox (RBLX), Activision Blizzard (ATVI), and Electronic Arts (EA), and social media stocks like Twitter (TWTR) and Snapchat (SNAP).

What index-linked ETFs currently exist?

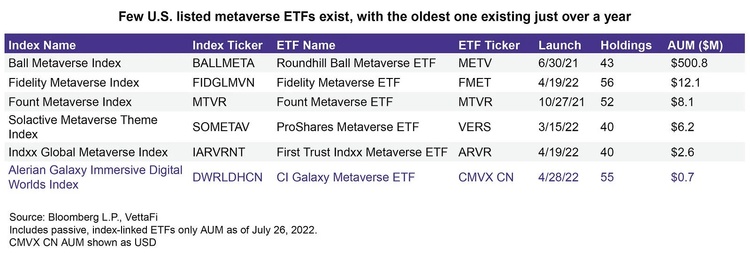

While DWRLD is currently linked to a Canadian-listed ETF—the CI Galaxy Metaverse ETF (CMVX CN)—there are only a few passive U.S. listed metaverse-themed ETFs. Most of these have a small amount of total assets and are all recent launches, with the oldest ETF launching just over a year ago.

Bottom Line:

The Metaverse is still relatively new and shares many overlaps with the gaming industry. As blockchain technology evolves, the Metaverse could grow closer to a decentralized space creating opportunities for new companies to emerge. Metaverse indexes and their associated ETFs can help investors track the changing industry, while accessing what could possibly be the next iteration of the internet in its early stages.

The Alerian Galaxy Immersive Digital Worlds Index is the underlying index for the CI Galaxy Metaverse ETF (CMVX CN).

The Alerian Galaxy Global Blockchain Equity, Trusts and ETPs Index (BCHAIN) is the underlying index for the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC).

The S-Network Streaming & Gaming Index (STREAM) is the underlying index for the First Trust S-Network Streaming & Gaming ETF (BNGE).