[ad_1]

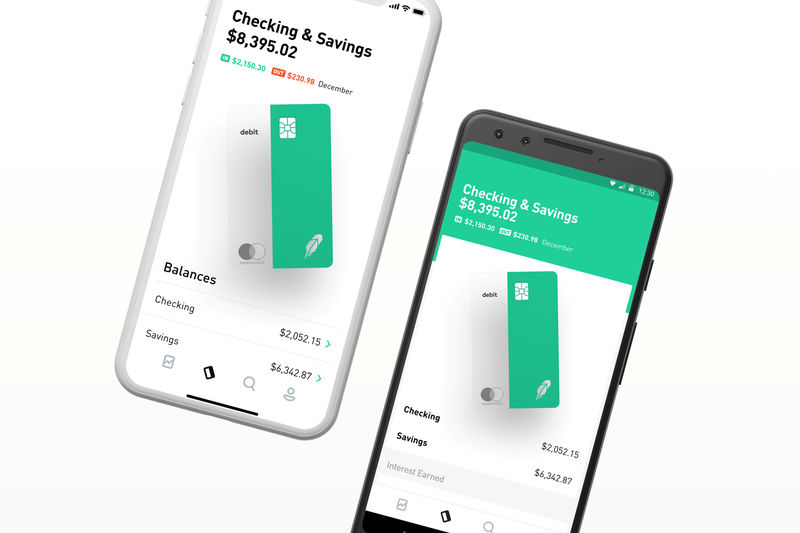

© Reuters. Photo illustration of Robinhood’s checking and savings accounts

© Reuters. Photo illustration of Robinhood’s checking and savings accountsBy Pete Schroeder and Anna Irrera

WASHINGTON (Reuters) – Financial technology startup Robinhood could face scrutiny by U.S. regulators over statements that its new checking and savings accounts are insured by an industry-backed protection fund.

The uncertainty over the new services underscores the regulatory gray area many new fintech companies operate in, as they look to use new technology to gain footholds in traditional financial services.

Robinhood, which is valued at $5.6 billion and has gained popularity with young consumers through its commission-free stock trading app, announced on Thursday it would soon be offering checking and savings services.

The firm said that up to $250,000 in the accounts would be insured by the Securities Investor Protection Corp (SIPC), an industry nonprofit created by Congress to help recover customer assets when brokerages go under.

The chief executive of SIPC told Reuters on Friday he does not believe the fund would actually insure Robinhood’s accounts and said he had raised the matter with the Securities and Exchange Commission.

“I spoke to my colleagues at the trading and markets division at the SEC, and I’m sure they’ll be consulting with the firm today,” SIPC CEO Stephen Harbeck said in an interview. “I believe that, as stated by the firm, there’s some significant legal problems that they have.”

Late Friday, Robinhood changed the nomenclature on its website to identify the product as a “Cash Management” tool rather than a “Checking & Savings” one, and released a statement from Co-Founders and Co-CEOs Baiju Bhatt and Vlad Tenev.

“As a licensed broker-dealer, we’re highly regulated and take clear communication very seriously,” the statement said.

“We plan to work closely with regulators as we prepare to launch our cash management program, and we’re revamping our marketing materials, including the name.”

The statement did not say whether the cash-management product would be insured in any way.

The SEC did not respond to a request for comment.

Robinhood says on its website that SIPC insurance protects up to $250,000 in cash per account should the company fail. But Harbeck said SIPC was not consulted by Robinhood before announcing the services, and he believes SIPC insurance would not apply.

He pointed to Robinhood’s website that states a customer does not need to invest to obtain checking and savings services. SIPC’s insurance is specifically meant to protect investors, he said.

“If that is true, then the money is not deposited for a protected purpose,” he said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

[ad_2]

Source link