[ad_1]

Key Points

- The risks of factor investing are usually understated (perhaps, severely so), and the diversification benefits tend to be overstated.

- Because factor returns substantially deviate from normality and because correlations between factors are not constant over time, a multi-factor portfolio may retain exposure to the risk drivers of the individual factors. Thus, portfolios invested in multiple factors may still experience severe drawdowns and decade-long periods of underperformance.

- Factor investing, for patient investors who understand the risks, has the potential to improve a portfolio’s long-term risk-adjusted return, especially when strategies used are transparent, use sufficiently researched factors, and have low management fees and good implementation characteristics.

Factor investing, an investment approach which targets specific stock characteristics such as value or momentum, is becoming a stronghold of investor portfolios.1 Many factor-investing strategies are popular for good reason: they are transparent, offer exposure to widely agreed-upon sources of expected return, have low management costs and, with proper design, reasonable transaction costs. Of course not all products in the category provide all of these features. When these features are present in a strategy, however, the strategy has the potential to generate a substantial positive impact on investor returns.

Product providers blithely advertise the benefits of factor investing, touting the strong long-run (usually backtested) value-add of individual factors, the manageable tracking error, and the low average correlations of most individual factors. The usual factor-investing sales presentation leaves an impression that investing in factors means almost guaranteed excess returns and that investing in a number of factors eliminates most of the risks of underperformance as a result of diversification. The standard disclaimer that follows the presentation cautions past performance is not indicative of future returns, the excess return is not guaranteed, and so forth, while offering little information about the specific dangers of factor investing. The combination of positive messaging in presentations with easily overlooked or disregarded disclosures means that investors too often ignore, and thus do not prepare for, the risks that come with factor investing.

Not fully understanding the myriad risks that lie ahead in the investment journey, investors are likely to make poor choices about when to begin and end their investment in a particular strategy. Entering at the wrong time, or missing a few market turning points, can mean the investor is ultimately a net loser in factor investing. Factor investing can be a very useful tool, however, to help investors enhance their return and make prudent investment choices if they do so with full knowledge of the strategy’s potential risks.

Risks Of Factor Investing

Factors definitely have risks, and ignoring these risks can leave investors hugely underprepared for the investment journey. Investors, for example, can have difficulty understanding how the average value-add and tracking error of a factor translate into underperformance, a very practical concern for many investors.2 Another wrinkle is that the return distributions of most factors substantially deviate from the normal distribution, so that large outlier returns appear far more frequently than investors might expect. Further, some factor returns may be serially correlated; that is, future returns are not independent of past returns.3 For factors, poor performance may likely be followed by further periods of poor performance, and such continuation can make periods of underperformance excruciatingly painful.

We can take a look at the momentum strategy, for example, to gain a better understanding of the risks involved. Figure 1 compares the realized performance of a long–short momentum portfolio with a counterfactual momentum strategy in which returns are calibrated to be normally distributed. The trend in both strategies from the beginning of 2005 through March 2009 was positive, but that changed in the following month. For the month of April 2009, the momentum trade returned −36%, the strategy’s worst month since January 1963. In the calibrated normal distribution, however, this percentile of realized performance would have equated to a return of −8%. An investor who had assumed returns are normally distributed would never have foreseen that the strategy’s return could be as extremely negative as it turned out to be.

Finally, and perhaps most dangerous of all, factor investing presents the risk of data mining. Only factors that show good backtest results are published, let alone used. The resulting upward bias in return estimates is known as selection bias. A factor may look good because it is good or because the historical record is randomly good. Because disentangling the two can be a difficult proposition, the historical results should be expected to exceed future efficacy. In some cases, historical data can even create an illusion of value added by a strategy which in reality has no structural efficacy (Harvey, Liu, and Zhu, 2016). Similarly, the backtest results that attract investors and their capital were mostly earned during a span when little money was being committed to these factor-tilt strategies. An influx of capital can easily arbitrage away the efficacy of a factor, and in some cases this may already have happened for certain factors (McLean and Pontiff, 2016).

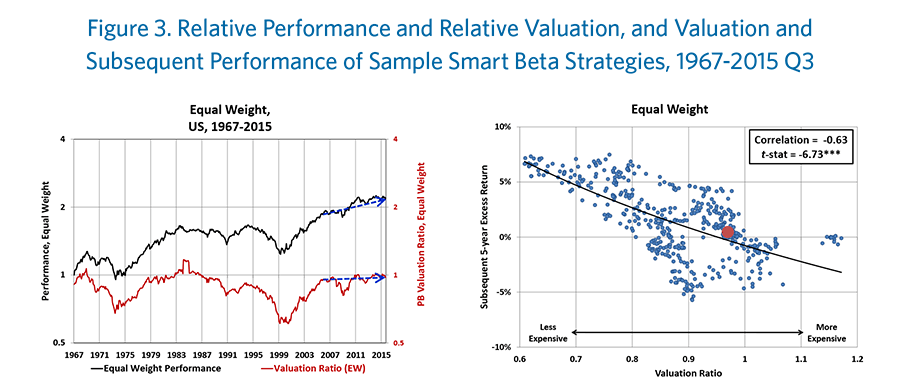

(For a larger view, click on the image above)

[ad_2]

Source link