Groups say they’re encouraged by the steps taken, but not everyone is sold on the measures

Article content

Real estate market watchers have increasingly been calling on governments to focus on building new housing to rein in runaway home prices, but were mixed as to whether supply-oriented measures introduced in the budget will have a major impact.

Advertisement 2

Article content

Among other housing-related measures, the Liberals said last week that they plan to set aside $4 billion over five years for a Housing Accelerator Fund in partnership with the Canada Mortgage and Housing Corp. to develop 100,000 net new housing units. The government also plans to spend $1.5 billion over two years to create 6,000 affordable units — 25 per cent of which will be for women-focused housing — and make another $1.5 billion in loans and funding available to develop 6,000 co-op housing units.

Article content

As housing supply is inelastic and takes time to build — particularly with time lags surrounding planning permissions and supply chain snarls — new units will not come online overnight but would be part of a longer-term strategy.

Advertisement 3

Article content

Some industry groups, like the Toronto Regional Real Estate Board, were encouraged to see these strides taken on the supply side from various levels of government, especially after years of pushing demand-side measures that did little to cure the problem.

“TRREB is pleased to see measures that the federal budget includes funds to help municipalities modernize their zoning, planning and building approval processes, so that new ownership homes can be brought to the market quicker,” said TRREB president Kevin Crigger in a press release following the budget.

Phil Soper, president at Royal LePage, told the Financial Post he thought the government was right to spread the funding to some different housing types, such as entry-level, co-op housing and northern territory housing.

Advertisement 4

Article content

“The money they’re applying in various different buckets will help,” Soper said. “It is an ecosystem, it’s like a coral reef: you need entry-level housing to have healthy mid-level and entry-luxury, luxury (housing). People circulate through the housing market through their lives as their wealth builds, as their careers develop — and part of that puzzle is rental accommodation, part of that puzzle is affordable housing. If it’s broken at the entry-level, the entire housing economy suffers.”

But not everyone was sold on the supply measures. John Pasalis, president at the Toronto-based housing analytics firm Realosophy Realty Inc., said in a Thursday Twitter thread that anyone hoping that the government was getting serious about rapidly rising house prices would find that the budget “did not deliver.”

Advertisement 5

Article content

Pasalis warned that the new supply-side policies would need more cross-government cohesion in order to be effective.

“I’m not optimistic that the supply side policies (for market housing) are going to have much of an impact if we don’t have provincial governments who are motivated to make the changes they need to make,” he wrote.

One consensus across the real estate space is that the supply issue will not be fixed overnight.

By the Royal Bank of Canada’s count, Finance Minister Chrystia Freeland announced at least 29 new housing measures worth $10 billion over five years.

RBC economist Robert Hogue, who authored a post-budget report for the bank, did not expect the measures would move the needle on their own and deliver quick relief to Canadians struggling with housing costs.

Advertisement 6

Article content

But he did suggest that the breadth of the effort would send positive signals, suggesting the government is working to bring the market back to a more sustainable, affordable path.

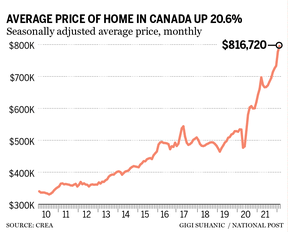

Canada’s national average home price is now north of $800,000, according to figures.

-

Canada plans to double homebuilding in a decade, but it’s going to need luck finding enough workers

-

Trudeau takes aim at foreign homebuyers, promises support for first-time buyers in budget 2022

-

Faster rate hikes, cooling home prices could put the squeeze on HELOC holders

-

The real problem behind Canada’s out-of-control housing market

Canada already stands behind the rest of the G7 countries when it comes to population-adjusted housing stock, according to a May 2021 report from Scotiabank. Chief economist Jean-Francois Perrault estimated that Canada would need an additional 1.8 million homes in order to just catch up with the G7 average. More recently in January, Scotiabank’s economics team pointed to Ontario as a particular pressure point, requiring 650,000 homes to reach the national average of housing stock per capita. Scotiabank pointed to this supply-demand imbalance as the underlying cause for affordability challenges.

• Email: shughes@postmedia.com | Twitter: StephHughes95

https://t.co/yBs40l33PN

https://t.co/yBs40l33PN