By Kevin Nicholson, CFA, Global Fixed Income CIO, Co-Head of Investment Comittee

SUMMARY

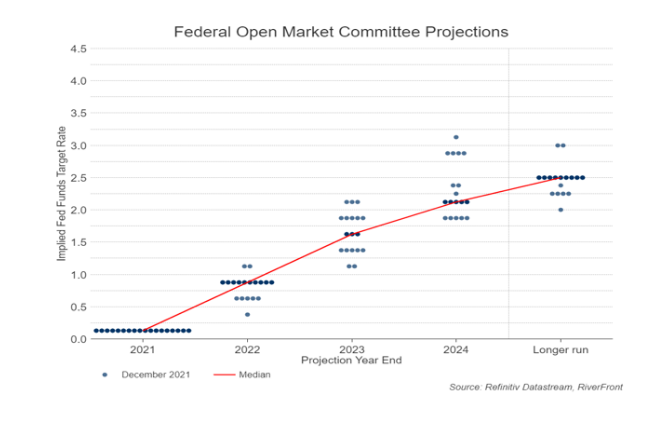

- We believe the median forecast for interest rates for the Federal Open Market Committee in 2024 is 2.125%.

- In this event, US Public debt would ultimately increase by 0.8% of Gross Domestic Product by our estimates.

- This increased interest cost should have limited repercussions on the economy and market, in our view.

Content continues below advertisement

Rising Rates Will Increase Government Debt Payments, But the Likely Amount Is Manageable.

Over the last couple of months, the mindset of the Federal Open Market Committee (FOMC) has shifted from thinking that inflation was transitory to it becoming a persistent problem. This shift in mindset has unnerved markets. To combat the rapid rise of inflation, the Federal Reserve (Fed) moved to end bond purchases by the end of March. Furthermore, FOMC members have voiced their preference to start hiking the fed funds rate sooner rather than later. The median FOMC member’s projection for the Fed Funds rate for 2024 was 2.125%, as of December 15, 2021, as shown in the chart below. The median projection would imply that the Fed will raise rates eight times over the next 2 years in its quest to fight rising inflation.

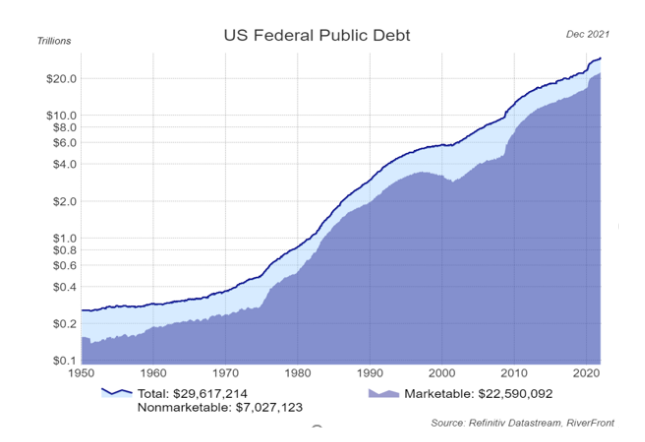

Many Americans wonder if a Fed funds rate of 2.125% is manageable given the US Treasury had $29.6 trillion of public debt outstanding as of December 31st. While the amount is astonishingly high, it is best understood in the context of the US’s $23 trillion economy. We have concluded that the Fed could take interest rates up to its median projection without dramatically upsetting the Treasury’s finances. We will illustrate this by explaining the composition of the $29.6 trillion of public debt outstanding.

Source: Refinitiv DataStream, RiverFront Chart shown for illustrative purposes only.

Marketable Debt

The marketable public debt consists of Treasury-bills (T-bills), notes, bonds, Treasury Inflation-Protected Securities (TIPS), and Floating Rate Notes (FRN). Currently, marketable securities (those issued and sold through the bond market) make up $22.6 trillion of the outstanding public debt (see chart, below) and carries an average interest rate of 1.43%. According to Bloomberg, $6.9 trillion of this debt will be maturing by the end of 2024, accounting for 30% of all marketable public debt. If we were to assume that the average interest rate moved in lockstep with the Fed funds rate, the rate would jump by 2% if the median projection is achieved. This would mean if all the debt maturing between now and the end of 2024 were to be reissued at an average interest rate of 3.43%, it would add approximately an additional $138 billion to the annual interest expense.

Source: Refinitiv DataStream, RiverFront Chart shown for illustrative purposes only.

Nonmarketable Debt

Nonmarketable debt consists of Treasury securities that are issued directly to government investment accounts, state and local governments tax exempt debt issuers, and other entities within the government for investment and regulatory purposes. Nonmarketable securities make up approximately $7 trillion of the public debt and carry an average interest rate of 2.03%. We could not find the same transparency regarding the maturities of the nonmarketable debt that we found on the marketable debt, so we must make some adjustments to finish the analysis. However, if we were to use the same assumptions that we used for marketable debt, where the average interest rate rose by 2%, in line with the Fed funds rate, and 30% of the debt were refinanced by the end of 2024, there would be an additional $42 billion of annual interest expense.

Public Debt Conclusion

While it is not ideal to add an additional $180 billion to the outstanding public debt due to the Fed attempting to normalize interest rates and fight inflation, we think the additional expense remains manageable when viewed through the lens of Gross Domestic Product (GDP). As mentioned above, US GDP is currently around $23 trillion according to the St. Louis Fed. In this context a $180 billion increase would amount to 0.8% of GDP – a large sum, but manageable in our opinion. One of the Fed’s jobs is to create price stability through managing inflation. With headline inflation at a 39-year high, the Fed is attempting to curtail inflation; and if successful, rates should come down and the US Treasury will have another opportunity to refinance the debt. RiverFront has prepared for rising interest rates by holding an underweight to fixed income relative to our composite benchmarks. We will likely look for more opportunistic levels to re-enter the asset class given that the Fed has plenty of room to raise rates before it becomes punitive for economic growth and financial stability.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Treasury Inflation Protected Securities (TIPS) are Treasury securities that are indexed to inflation in an effort to protect investors from the negative effects of inflation. The principal value of TIPS is periodically adjusted according to the rate of inflation as measured by the Consumer Price Index (CPI), while the interest rate remains fixed. TIPS will decline in value when real interest rates rise. Portfolios that invest in TIPS are not guaranteed and will fluctuate in value.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

A floating-rate note (FRN) is a debt instrument with a variable interest rate. The interest rate for an FRN is tide to a benchmark rate.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2003958