[ad_1]

In the middle of holiday shopping season, Global X Funds joins the segment of retail ETFs with the launch of the Global X E-commerce ETF (EBIZ).

The company is taking on the online retail growth theme with a passive strategy linked to the Solactive E-commerce Index. EBIZ is a global-in-scope portfolio focused on companies that benefit from e-commerce specifically, either as a platform or service provider, or as an online retailer itself.

The ETF is listed on the Nasdaq and costs 0.68% in expense ratio, or $68 per $10,000 invested.

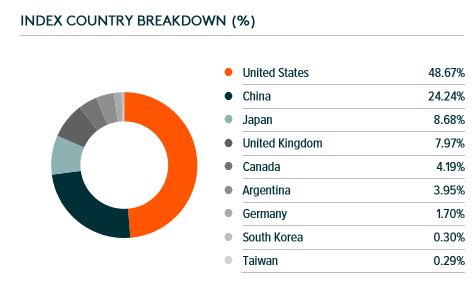

At launch, the 37-holding portfolio is 70% allocated to online retail, and about half of it is tied to U.S. companies.

Online retail shopping may seem like the norm in the U.S., but according to Global X, there is plenty of room for growth both here—in segments such as grocery shopping—and globally, where e-commerce is picking up steam.

“As a percentage of total retail sales, e-commerce constitutes only 9.8% of the total available retail market, with over 90% of the sales available for further disruption,” Global X said in a release.

Taking On ‘IBUY’

EBIZ will face the Amplify Online Retail ETF (IBUY), which tracks global companies where revenues are dominated by online retail sales.

IBUY has enjoyed first-to-market status since 2016, with a specific focus on e-commerce, and it too tilts heavily toward the U.S., with an 80% allocation in a portfolio comprising 39 stocks. Pricewise, IBUY and EBIZ are on similar terms; IBUY costs slightly less, at 0.65% in expense ratio. Both funds own names such as Etsy and Amazon.

At launch, EBIZ’s top-holdings lineup is as follows:

Charts data: Global X Funds

EBIZ joins Global X’s lineup of thematic growth ETFs that include funds like the Robotics & Artificial Intelligence ETF (BOTZ), the Social Media ETF (SOCL) and the Millennials Thematic ETF (MILN), among others.

Contact Cinthia Murphy at [email protected]

[ad_2]

Source link