Flat jobs reading points to more action from the Bank of Canada, economists predict

Article content

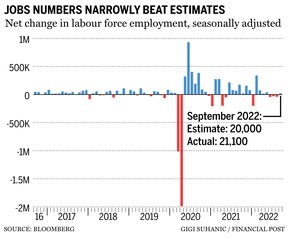

Employment numbers for September made few waves among economists on Friday, with Statistics Canada reporting the labour market remained essentially flat for the month.

Advertisement 2

Article content

Canada added 21,100 positions from August — just slightly above estimates for 20,000, the agency said. However, economists described the net gain as not statistically relevant, attributing it mostly to a 46,000 jump in education jobs.

Article content

The unemployment rate fell from 5.4 per cent in August to 5.2 per cent, still above the record low of 4.9 per cent in June. But the jobless rate declined because fewer people were looking for work, Statistics Canada said.

Meanwhile, the average hourly wage rose above the five per cent mark for the fourth month in a row, to 5.2 per cent in September from September 2021, down slightly from August’s increase to 5.4 per cent.

“Average hourly wages were up in nearly all industries on a year-over-year basis in September, including in accommodation and food services,” the labour force survey said.

Advertisement 3

Article content

Overall, conditions in the labour market remain tight. “Job openings have been edging lower but were running almost 60 per cent above February 2020 levels as of mid-September. And those job openings are competing for seven per cent fewer unemployed workers than pre-pandemic,” said RBC Economics in its analysis of the numbers.

However, some economists believe the numbers, which mark the end of the third quarter, hint at a weakening in the labour sector as total employment fell 49,000 over the three-month period. Economist David Rosenberg called it “the worst quarter since 2020Q2” in a note.

National Bank economists Matthieu Arseneau and Alexandra Ducharme said that excluding the jump in education positions, “employment was down 25,000 in September, a third decline in four months for a cumulative loss of 57,000 jobs.”

Advertisement 4

Article content

They also point to slow growth in the average hourly wages of permanent workers, which only rose 0.2 per cent on a month-over-month basis.

Still, most economists agree the Bank of Canada won’t veer off its stated course of more rate hikes to address inflation and tamp down demand and wage pressures.

Here is a rundown of what economists have to say about September’s jobs reading and what the numbers mean for interest rates:

Douglas Porter, chief economist, BMO Capital Markets

“For a change, this is a Canadian jobs report without the drama, and fully consistent with a slowing economy. Job conditions are certainly not cool enough to prompt the Bank of Canada to fully back off from its aggressive tightening campaign. But at the same time, the underlying calming suggests that the bank may at least consider slowing the pace of hikes. At this point, we are still leaning to a 50 basis-point hike at this month’s meeting, with the Business Outlook Survey (Oct. 17) and the CPI (Oct. 19) having the final say.”

Advertisement 5

Article content

Stephen Brown, senior Canada economist, Capital Economics

“While the rise in employment and fall in unemployment rate seem to be good news, the 0.6 per cent month-over-month fall in hours worked last month nevertheless points to downside risks to our assumption that GDP was unchanged in September, and suggests third-quarter growth could be even weaker than the 0.6 per cent annualized gain we have pencilled in.

“Meanwhile, there are signs of increasing wage pressures everywhere except the wage data, with the surprising fall in average earnings growth to 5.2 per cent year over year, from 5.4 per cent, implying that earnings fell on the month in seasonally adjusted terms. That was partly due to the compositional shift in workers into lower paying sectors, however, and so it is unlikely to materially change the bank’s assessment of the inflation outlook. Following the hawkish speech from governor Tiff Macklem yesterday, it is unlikely that the bank will drop all the way down to a 25 basis-pint hike, so we assume it will raise interest rates by 50 basis points this month, to 3.75 per cent.”

Advertisement 6

Article content

Nathan Janzen, assistant chief economist, RBC Economics

“Loss of labour market momentum is unlikely to dissuade the Bank of Canada from further interest rate hikes. Labour markets are still very tight. The unemployment rate is still low, and demand for workers is still very high. Job openings have been edging lower but were running almost 60 per cent above February 2020 levels as of mid-September. And those job openings are competing for seven per cent fewer unemployed workers than pre-pandemic. That excess of labour demand versus available supply will limit the pace of further increases in the unemployment rate near-term, even as the number of job postings continues to slow, and will continue to add to wage pressures.

Advertisement 7

Article content

“Against that labour market backdrop, the Bank of Canada remains firmly focused on hiking interest rates enough to put a cap on inflation pressures. Key inflation data will be released in coming weeks as well, but at this point we continue to expect at least another 50 basis-points hike to the overnight rate later this month.”

David Rosenberg, economist, Rosenberg Research

“Overall, this report isn’t exactly supportive of the Bank of Canada’s view of a strong labour market. In addition to the tilt towards government jobs and part-time positions in September, it’s worth noting that the more reliable three-month and six-month trends are painting a rather bleak picture. Q3 was the worst quarter for employment since the COVID-19 recession. Worse, private sector employment is down 66,000 over the last six months. Again, you have to go back to 2020 to see such ugly numbers. And the private sector purge isn’t done, given the likely moderation in real GDP growth stemming from lagged impacts of earlier interest rate hikes by the central bank. In all likelihood, the jobless rate will start climbing again, which will then have the BoC reconsider its uber-hawkish stance. But for now, given the above-target inflation rate, look for the Bank of Canada to maintain its hawkish tone as it delivers another outsized interest rate hike on Oct. 26.”

Advertisement 8

Article content

Matthieu Arseneau and Alexandra Ducharme, economists, National Bank of Canada financial markets

“The Bank of Canada has committed for other rate hikes, but this morning’s data reinforces our view that a pause will be necessary soon to assess the delayed impact of its actions. With a weakening of domestic demand, companies are realizing fast that their labour needs may not be as high as they believed earlier this year and are perhaps stopping the bidding war to attract employees that has generated high wage inflation. Even if mass layoffs are avoided, hiring freezes in the face of strong population growth are likely to increase the unemployment rate in the coming months.”

Andrew Grantham, economist, CIBC Capital Markets

Advertisement 9

Article content

“The low unemployment rate and still strong wage growth support the continued hawkish tone from the Bank of Canada governor yesterday and a 50 basis-points rate hike at the next meeting. However, signs that a growing number of sectors are slowing down should bring a more cautious approach from policymakers after that. The moderate decline in hours worked suggests that monthly GDP will fail to break out of its recent sideways trend, and that September will once again post little to no growth.”

-

Canada’s unemployment rate drops to 5.2%: What you need to know

-

Not enough workers to build homes needed to address housing affordability: CMHC

-

Employers are missing out on this pool of potential employees eager to work

Stephen Tapp, chief economist, Canadian Chamber of Commerce

Advertisement 10

Article content

“At first glance, it looked like we finally received good news from Canada’s Labour Force Survey for September: after three months of declines, employment was up by 21,000 jobs, while the unemployment rate dropped back to 5.2 per cent after unexpectedly spiking to 5.4 per cent last month. Digging beneath the headlines, however, shows emerging signs of an underlying “cooling off” period. First, hours worked are down over one per cent cent since June. Second, labour force participation has sagged over the course of this year, and third, it’s the public-sector, not the private-sector, that continues to push up employment. That said, Canada’s labour market remains historically tight. It’s still very hard for businesses to fill the nearly one million vacant positions they’re seeking, and wage growth exceeded five per cent for the fourth month in a row — although this still isn’t enough to boost workers’ purchasing power, as it’s below the highest rates of inflation seen in a generation. Today’s labour market numbers will not deter the Bank of Canada from raising its policy interest rate by 50 basis points at its next meeting.”

Advertisement 11

Article content

Charles St-Arnaud, chief economist, Alberta Central

“Today’s Labour Force Survey data suggest the labour market in Canada continues to move sideways. The decline in the unemployment rate continues to signal that the labour market remains very tight despite some easing in recent months, something the Bank of Canada is monitoring closely.

“Comments from Governor (Tiff) Macklem this week made it clear that the BoC believes further increases in the policy rates are needed and a stalled labour market is unlikely to change that. As we have explained on numerous occasions, the Bank of Canada needs to slow growth and create some excess capacity in the economy to fight inflation. This will likely lead to a rise in the unemployment rate and to job losses. With that in mind, a weakening of the labour market should be expected in the coming months.”

“We believe the anemic labour market is unlikely to sway the Bank of Canada, as the central bank remains focused on inflation. As such, the outlook for the policy rate remains dependent on incoming inflation numbers. We continue to believe that the BoC will hike its policy rate by 50 basis points in October.”