[ad_1]

Jeffrey Saut is chief investment strategist for Raymond James & Associates, which has more than $750 billion in assets under management. He is well-known for his insightful commentary regarding the stock market, and makes regular appearances on major financial news networks. ETF.com recently spoke with Saut to discuss his outlook for the U.S. economy and stocks.

Jeffrey Saut is chief investment strategist for Raymond James & Associates, which has more than $750 billion in assets under management. He is well-known for his insightful commentary regarding the stock market, and makes regular appearances on major financial news networks. ETF.com recently spoke with Saut to discuss his outlook for the U.S. economy and stocks.

ETF.com: It’s been nearly seven months since the S&P 500 made new highs. Where does the market go from here?

Jeffrey Saut: We’re going to make new all-time highs. If you look at the history of the market, there have only been two years when the S&P 500 was up in April, May, June, July in a midterm election year—1954 and 1958.

In both of those instances, the market was substantially higher by year-end. I don’t think it’s going to be any different this year.

You’re looking at earnings growth of 20%-plus for the next three or four quarters. You’ve still got fear out there. I saw the bullish indicators drop down to 29%.

There’s been no pickup in selling pressure. It continues to plummet; now a 70-year low. Buying pressure continues to act pretty perky.

Stocks are not all that expensive. Before the tax cuts, the bottom-up operating earnings estimate for the S&P 500 this year was $141. It’s now $158 for this year and $174 for next year.

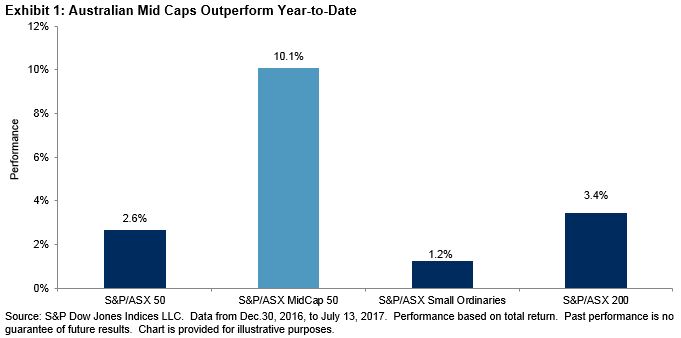

ETF.com: Small-caps and midcaps are doing even better than the S&P 500, presumably due to trade war concerns. Do you expect that outperformance to continue?

Saut: Yes, I do. You recently saw a hit to the small-caps and the FAANG stocks, but they seemed to stabilize since then. They could continue to consolidate, but longer term, the small-caps and the midcaps are the place to be.

ETF.com: How do you think the trade war situation is going to evolve? Is it going to have an impact on the economy and corporations?

Saut: If they go through, it will have an effect on certain companies. But the stock market is telling you they’re not going to go through. My politically based analyst in D.C. thinks it’s more serious, but Mr. Market is saying otherwise.

ETF.com: Second-quarter GDP growth was strong, and now most economists are talking about 3% growth for the year as a whole. Do you agree with that, and do you think that level is sustainable?

Saut: I have said for months now that the economy is stronger than a garlic milkshake, and I’ll continue to make that statement.

Rather than looking at GDP, the thing that is a truer reflection on the economy is real final sales, because it excludes net exports and inventories. It came in at a super strong [increase] of 5.1% in the last GDP report.

ETF.com: The current bull market is one of the longest in history. How many more years can it go on?

Saut: Secular bull markets tend to last 14-plus years. There was a secular bull market from 1949 to 1966, and then the markets went rangebound.

Then the markets broke out of that trading range in the summer of 1982, and you started the 1982-2000 secular bull market that lasted 18 years. I think we’ve got six to nine years left in this thing.

Now, if you’re talking about the business cycle, in about a year, this will turn into the longest business cycle expansion in recorded history. But I have argued, and continue to argue, that the downturn was so severe and the recovery—at least up until the past 15 or 16 months—was so lame or so muted that what you did was just elongate the midcycle. I don’t think we’re in late cycle yet. You’ve got a year or two of midcycle before we transition into late cycle. I’m not all that worried about the historic precedent that this is going to be the longest upturn in economic history.

ETF.com: Given your outlook, which sectors do you see outperforming, and which do you see underperforming?

Saut: I still like tech a lot. I like consumer discretionary, because I think the consumer is strong. I like the financials. In fact, I like just about all the sectors, except utilities and consumer staples.

ETF.com: What turns you off from them?

Saut: They’re expensive.

Email Sumit Roy at [email protected] or follow him on Twitter sumitroy2

[ad_2]

Source link