[ad_1]

Unusual market events have a way of sticking in our memories, especially when they produce drawdowns that leave even the savviest advisor wondering how to explain to their clients what happened.

Unusual market events have a way of sticking in our memories, especially when they produce drawdowns that leave even the savviest advisor wondering how to explain to their clients what happened.

The volatility spike of early 2018 might not have decimated most accounts, but it did provide an unpleasant jolt for many ETF investors and their account managers.

At some point, we’ll get another one of these dispiriting moments. As the years go by, maybe we’ll get a lot of them. Although that’s not to suggest one needs to be in a constant state of panic, it could be worthwhile to contemplate the possible ways of mitigating any unexpected roughness.

Exchange-Listed Options To The Rescue

One method of preparing for the unknowns is exchange-listed options. When option strategies are done right, they can be useful as a defensive investing component, as well as for a client seeking income opportunities, in ETFs.

But advisors who want to offer either alpha or tail-risk protection ideas may struggle with presenting options as a genuinely viable asset class, especially since options on occasion are dismissed as introducing new risk, rather than serving as a tool to manage it.

Randy Swan, the founder, CEO and lead portfolio manager of Swan Global Investments, says that mindset has to change. Swan recalls that before the 2008 financial crisis, many advisors were reluctant to consider options.

The crisis made the world dramatically rethink how to manage and mitigate risk, while putting a sizable dent in modern portfolio theory. But a decade later, the advisor set remains hesitant about options.

“You’ve got to spend a lot of time educating advisors,” Swan said. “People tend to stick with what they know, even if it’s not the best solution.”

Growth & Liquid Markets

It isn’t overly difficult for an advisor to have a conversation with a client when a down week or month can be attributed to the whims of the market. What can be more challenging is to formulate a real-world option strategy for an ETF portfolio.

However, ETF clients who are concerned about diving in to a new arena may take some comfort in knowing that volume in exchange-listed options has been growing.

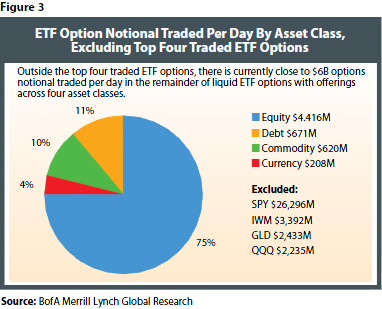

Based on data from The Options Clearing Corporation (“OCC”), a regulated central counterparty that clears options for 15 U.S. exchanges, average cleared ETF option volume through Sept. 30 was more than 7 million contracts a day. That was up 16% from the same period in the prior year. Total cleared ETF option volume through September was above 1 billion contracts.

In other words, an advisor who overlays options on ETFs is not, in general, going to be introducing clients to an illiquid market, though it’s true that not all ETFs themselves have significant volume, and the possibility always exists that they can close.

It also needs to be noted that options aren’t available on every ETF, although hedging opportunities may exist, even if the client’s ETF holdings don’t have direct option equivalents.

Benefits Of Pairing ETFS & Options

Pairing ETFs and option strategies may warrant particular consideration today given the extraordinary growth of the ETF industry.

According to the survey, Reshaping Around the Investor: Global ETF Research 2017, from Ernst & Young, assets in the global ETF universe soared from $417 billion in 2005 to $4.4 trillion in September 2017.

[ad_2]

Source link Google News