Check here to find out how the crisis is impacting markets, Canadian businesses and the financial world

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic retaliation as western nations pile on sanctions in what France has called “all-out economic and financial war.”

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

To get the latest news on the conflict and how it is affecting markets, businesses and the economy, watch here.

11:22 a.m.

Companies leaving Russia grow by the hour

International companies are exiting Russia en masse in wake of its invasion of Ukraine, reversing three decades of investment following the collapse of the Soviet Union in 1991, Bloomberg reports.

As sanctions from Western countries pile up, many companies have concluded that it’s become too risky on both a reputational and financial level to do business there. The number of companies leaving is growing by the hour.

BP Plc started the exodus on Sunday, announcing it would exit its 20 per cent stake in state-controlled oil company Rosneft. Next came Shell Plc. on Monday, followed by Norway’s biggest energy company Equinor ASA, France’s TotalEnergies SE and Exxon Mobil Corp.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

Still other companies are pausing business interests in the country. Daimler Truck Holding AG said it’s stopping business activities there until further notice. Volvo Car AB and Volvo AB are also halting sales and production in Russia. General Motors Co. said it would halt shipments to the country as well.

Meanwhile, MasterCard Inc. and Visa Inc. said they are blocking some Russian activity from payment networks to comply with sanctions.

Foreign companies who can’t easily exit the country, such as consumer goods companies, could face retaliation from Russia for the moves, experts say. They could be subject to boycotts and, in extreme situations, some firms could even have their assets seized.

— Bloomberg

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

11:02 a.m.

IEA members open their oil reserves

Ministers from the International Energy Agency (IEA) member states have agreed to the release of 60 million barrels of oil from their emergency stockpiles, following a special meeting on the impact of Russia’s invasion of Ukraine on oil supply.

Sixty million barrels is roughly equivalent to 12 days of Russian crude oil exports, commodities analyst Rory Johnston said on Twitter Tuesday.

The move is intended to provide stability to global oil markets where prices have been spiking over fears of disruptions to exports of crude and refined products from Russia.

But some analysts speculated Tuesday that the move would not be sufficient to ease soaring prices.

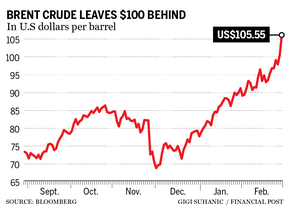

Brent futures prices for May delivery climbed to more than US$105 a barrel and West Texas Intermediate (WTI) crude for April rose to above US$103 a barrel during the session Tuesday.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

Tuesday’s announcement represents the fourth drawdown of emergency oil stockpiles in the history of the IEA. Previous releases occurred in 2011, 2005 and 1991.

In a press release, the IEA said energy supply should not be used as a means of political coercion or as a threat to national and international security.

“The IEA Secretariat will continue to closely monitor global oil and gas markets and to provide recommendations to the Governing Board, including possible additional emergency oil stock draws, as needed,” the organization said.

“Ministers also discussed Europe’s significant reliance on Russian natural gas and the need to reduce this by looking to other suppliers, including via LNG, and to continue to pursue a well-managed acceleration of clean energy transition.”

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

The IEA said on Thursday it will release a 10-point plan for how European countries can reduce their reliance on Russian gas supplies.

— Meghan Potkins

10:57 a.m.

Not everybody is pleased with the pace of Canada’s actions against Russia. This from the former foreign affairs and trade adviser to Stephen Harper.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

10:44 a.m.

Canada has just announced another $100 million in humanitarian aid to Ukraine.

“The lives of the children of Ukraine have been thrown into chaos. Their classrooms have been replaced by bomb shelters. Their playgrounds have become battlefields. Their beds have become the hard ground,” Minister of international development Harjit S. Sajjan said in a press release today. “We will continue to be there for our Ukrainian friends and partners during this difficult time.”

The money will help provide emergency health services (including trauma care), protection, support to displaced populations and life-saving services such as shelter, water and sanitation, and food.

10:05 a.m.

No quick fix to Europe’s energy crisis — not even from Canada

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

There appears to be no easy solution to Europe’s skyrocketing energy costs.

Right now, there’s geopolitical risk to the oil market but it’s not yet reached a point where production has slowed and barrels have come offline, said an energy director at RBC Capital Markets. Still, tensions in Ukraine have caused oil prices to surge, recently pushing past US$100 a barrel.

“Let me be clear here: I think the oil market fundamental backdrop is perhaps the most bullish that I have seen in my career,” Michael Tran, managing director of global energy strategy at RBC Capital Markets, said in an interview with Larysa Harapyn.

Tran also noted that Europe, which is one of Russia’s biggest customers for oil, could struggle in trying to find alternative supplies of energy and natural gas. Getting help from Canada could prove difficult because “we just don’t have large-scale export capacity pointed in the right direction.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

Europe has been bolstering its green supply of energy, but the recent conflict on the heels of supply-chain strain from late last year show that there’s still too much friction to be fully self-reliant on green energy.

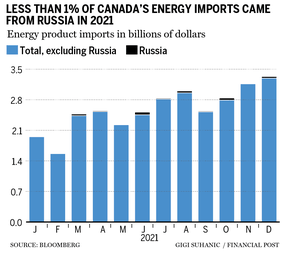

As the chart below shows the Russian conflict is not likely to impact Canada’s energy supply as less than one per cent of our energy imports come from the country.

— Bianca Bharti

9:41 a.m.

‘We will cause the collapse of the Russian economy’

France declared an “all-out economic and financial war” against Russia today as punishment for its invasion of Ukraine.

Canada, the United States and allies have imposed sanctions on Russia’s central bank, oligarchs and officials, including President Vladimir Putin himself, and barred some Russian banks from the SWIFT international payments system.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

French Finance Minister Bruno Le Maire described the sanctions packages as proving “extremely effective.”

“We’re waging an all-out economic and financial war on Russia,” Le Maire told France Info radio. “We will cause the collapse of the Russian economy.”

In a matter of weeks, Russia has turned from a lucrative bet on surging oil prices to an uninvestable market with a central bank hamstrung by sanctions, major banks shut out of the international payments system and capital controls choking off money flows.

Today Russia said it was placing temporary curbs on foreigners seeking to exit Russian assets, putting the brakes on an accelerating investor exodus driven by the sanctions.

Le Maire’s remarks drew an angry riposte from Russia’s former president and prime minister, Dmitry Medvedev, who is now the deputy Chair of the Security Council of the Russian Federation.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

9:38 a.m.

North American stocks opened lower today with bank stocks declining further as the Russia-Ukraine crisis deepened, while a surge in oil prices boosted shares of energy companies.

The Dow Jones Industrial Average fell 79.12 points, or 0.23 per cent, at the open to 33,813.48.

The S&P 500 opened lower by 10.80 points, or 0.25 per cent, at 4,363.14, while the Nasdaq Composite dropped 34.70 points, or 0.25 per cent, to 13,716.70 at the opening bell.

The TSX was up 64.60 points or 0.31 per cent to 21,190.96

Additional reporting by Reuters and Bloomberg

Advertisement

This advertisement has not loaded yet, but your article continues below.