[ad_1]

For years now the unrelenting message in the financial press has convinced the investing public that for the everyman, the cheapest way to invest on your own is to buy index funds that mirror one index or another. The drumbeat tells you to avoid ”single stock risk” in favor of going instead with an average of your choosing.

In what is being called the race to zero fees, the huge fund giants like Vanguard, Black Rock’s iShares, or others will charge you very small fees to replicate the S&P500 or the Dow Industrials for as little as 0.10 percent. Since all they are doing is matching an average, they don’t need to employ analysts or portfolio managers to make the investment selections. All that work is done by the firms that control the indices.

However, that tiny fee guarantees you “average” performance because that is what you have bought. In a good year that might be just fine. In 2017 stocks soared in anticipation of a big gain in corporate earnings resulting from the 14 percent cut in the corporate tax rate. That rally continued into 2018, but as tariff wars unfolded and the Federal Reserve was raising interest rates, the outlook for 2019 became far less rosy. As the indices plummeted in the grim 4th quarter and if you owned that type of fund, you were destined to lose money in your low-priced fund unless you headed for the showers and liquidated your holdings with everybody else at the bottom on Christmas Eve.

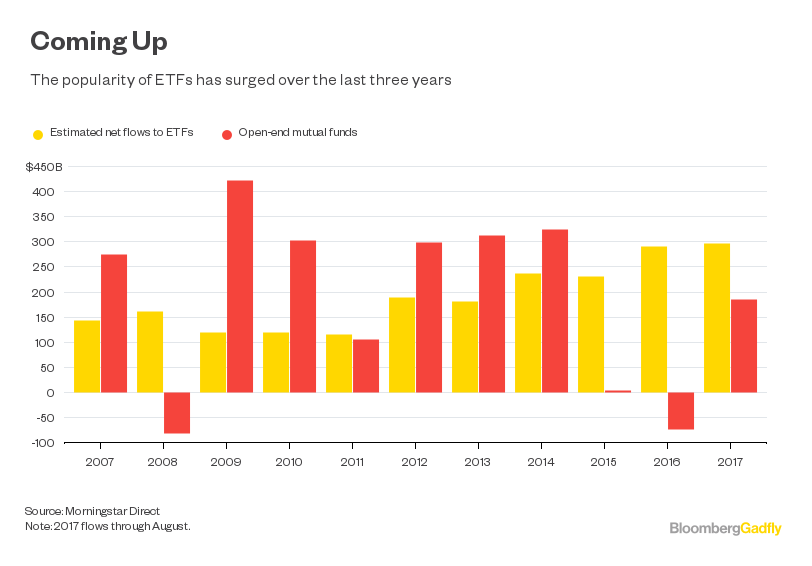

As investing has moved away from ferreting out interesting new companies or old ones with improving stories, the ETF (electronic funds transfer) companies are trying to invent new baskets of stocks that might attract your attention in the future based around a theme or gimmick: robots, cash flow, an industry, or a characteristic-like momentum.

I’m writing this from Hollywood, Florida, where I am attending the Inside ETFs conference. The exhibit hall is jammed with companies large (JP Morgan Chase and Goldman Sachs), medium and small, all offering new products. What I am learning is that you must look under the hood to see what these various funds own to make an informed decision as to whether the fund will fill your needs.

Also, the brand new niche products might be tiny, with as little as $3 million in them, and never trade from one week to the next. That lack of liquidity may be a problem when you want to sell. The stock selection might be by a smart highly trained investment committee or by a computer-derived algorithm looking for businesses with a common set of characteristics. The fees more typically run from 0.70 percent to 0.95 percent, not the tiny 0.1 percent for the big indexes because humans are involved in the stock selection process. Some of these new ETFs have very short records of operation so we don’t yet know how they will perform in the future in good times and bad.

Amidst this disruption, I would still argue for my ilk: active managers with a proven record of stock selection. If you pick the winners in an index and not the dogs, you have a chance to better the averages and enjoy higher returns. As growth slows in an aging economy, that skill set may be the better option to protect you in a tougher environment.

Joan Lappin, CFA, has been called an “investment guru” by Business Week and a “top manager” by the Wall Street Journal. The Sarasota resident founded Gramercy Capital Management, a registered investment advisor, in 1986. Email her at jlappinCFA@gmail.com. Follow her on twitter: @joanlappin. Her past columns appear at heraldtribune.com/topics/joan-lappin. Neither she, Gramercy Capital, nor its clients own any security mentioned in this column.

[ad_2]

Source link