Kevin Carmichael: Latest CPI won’t stop Bank of Canada from hiking rates further, but it might pave way for a pause in new year

Article content

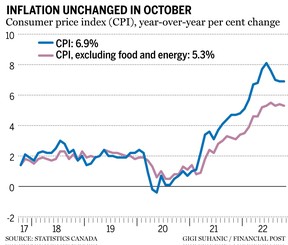

The consumer price index, which the Bank of Canada uses to guide its interest rate policy, increased 6.9 per cent in October from a year earlier, matching the previous month’s year-over-year gain, Statistics Canada reported on Nov. 16. Grocery prices and natural gas costs grew at a slower pace, offsetting higher gasoline prices.

Advertisement 2

Article content

On the surface, the numbers are a positive, as many on Bay Street had assumed that inflation accelerated in October. Here’s what you need to know:

Article content

Price plateau

It’s starting to look like Canadian inflation has peaked.

Annual price increases surged to 8.1 per cent in June, and have slowed ever since. That’s notable because some of Canada’s peer countries are fighting double-digit inflation. The United Kingdom’s Office for National Statistics on Nov. 16 reported its consumer price index rose 11.1 per cent in October from a year earlier, up from 10.1 per cent in September.

Article content

In Canada, it’s significant that a 17.8 per cent jump in the price of gasoline from October 2021 — compared with a 13.2 per cent increase in September — failed to push headline inflation back above seven per cent, as fuel prices have been the driving factor behind the surge in the cost of living over the past year. It suggests higher interest rates are beginning to take the heat off an economy that the central bank deemed was too hot for its own good.

Advertisement 3

Article content

To be sure, the cost of almost 80 per cent of the 700 goods and services that Statistics Canada tracks increased more than three per cent from a year earlier in October, and prices for more than 60 per cent of those items rose more than five per cent, according to Charles St-Arnaud, chief economist at Alberta Central. But those percentages appear to be peaking, too, suggesting the inflationary pressures that started with surging commodity prices and supply chain bottlenecks in 2021 are no longer spreading.

Month-to-month changes also are cooling, suggesting “inflationary pressures are losing momentum and weakening,” St-Arnaud said in a report to his clients.

Food focus

Food prices rose 10.1 per cent from a year earlier, compared with 10.3 per cent in September. That figure is still too high, considering year-over-year wage increases continue to trail inflation. However, the figure does offer hope that the effects of poor harvests in 2021 and the disruption to food supplies caused by Russia’s invasion of Ukraine are starting to fade. The price of meat, fresh fruit and fresh vegetables increased at a slower pace, Statistics Canada said.

Advertisement 4

Article content

Still, food has replaced fuel as the most politically sensitive piece of the inflation story. The price of food purchased at stores increased 11 per cent in October from the year-ago month, exceeding the headline number for the 11th consecutive month, Statistics Canada said.

-

Kevin Carmichael: Why the Bank of Canada’s mandate renewal a year ago is causing Macklem headaches today

-

Cooling labour market shows rate hikes are doing their job, says Bank of Canada chief

Core readings

Headline inflation tends to be dictated by fuel and food prices, and because both are subject to vagaries such as the political whims of major producers and weather conditions in important farming regions, the Bank of Canada and others attempt to track underlying price pressures by following a selection of “core” measures of inflation.

Advertisement 5

Article content

Two of the core measures the Bank of Canada created to smooth out inflation readings increased 4.8 per cent and 5.3 per cent, respectively, in October, slight increases from the previous month. With food and fuel prices removed from Statistics Canada’s price basket, the index rose 5.3 per cent from October 2021, compared with 5.2 per cent in September.

Veronica Clark, an economist at Citigroup Global Markets Inc., in a note to clients said the core readings “solidified” her view that the Bank of Canada will raise the benchmark rate another half-point next month, calling the core numbers the “most important part” of the latest inflation report.

Statistics Canada’s homeowners’ replacement cost index, a proxy for home prices, increased 6.9 per cent on the year, down from 7.7 per cent in September. Year-over-year gains have decelerated every month since May, when the annual gain in the index was 11.1 per cent.

Advertisement 6

Article content

Overall, however, shelter costs were slightly higher in October, as higher interest rates increased mortgage costs by the most since February 1991 (11.7 per cent). Rent prices rose 4.7 per cent, compared with 4.2 per cent in September, which Statistics Canada attributed to laxer health measures related to COVID-19, the return of post-secondary students to campuses and higher levels of immigration.

Bottom line

Inflation is running more than three times faster than the Bank of Canada’s two-per-cent target, so the central bank will almost certainly raise interest rates again when its leaders next gather in early December.

“Given elevated inflation and inflation expectations, as well as ongoing demand pressures in the economy, the Governing Council expects that the policy interest rate will need to rise further,” the central bank said last month, when it increased the benchmark rate a half point to 3.75 per cent.

The latest numbers won’t alter that plan, but they might allow the central bank to start thinking about pausing interest rate increases at some point early in 2023.

• Email: kcarmichael@postmedia.com | Twitter: CarmichaelKevin