Data out Wednesday will likely pile more pressure on Bank of Canada

Article content

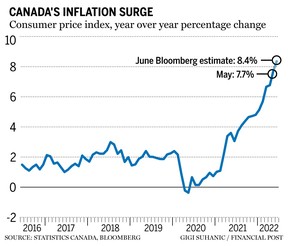

Canada’s main gauge of inflation likely topped eight per cent in June, complicating Bank of Canada Governor Tiff Macklem’s efforts to convince businesses and households that price pressures will eventually ease.

Advertisement 2

Article content

Statistics Canada is scheduled to update its consumer price index on Wednesday morning. The monthly reports have become sources of alarm, as the year-over-year change has exceeded three per cent — the upper limit of the Bank of Canada’s comfort zone — for more than a year.

The May consumer price index increased 7.7 per cent from a year ago, and most economists anticipate that the gain breached eight per cent last month. Such a reading would be consistent with the Bank of Canada’s prediction for inflation to hover around eight per cent for the next few months, before declining to three per cent in the latter half of the year.

However, inflation that fast would put additional pressure on the central bank to deliver another supersized rate hike at its next interest-rate decision in September. The Bank of Canada surprised many observers last week with a full-point increase, the biggest since 1998.

Advertisement 3

Article content

During a webinar last week with the Canadian Federation of Independent Business, Macklem reaffirmed the central bank’s commitment to get inflation back to its two-per-cent target, the midpoint of a target zone of one per cent to three per cent.

“By front-loading interest-rate increases, we’re trying to avoid the need for even higher interest rates down the road,” Macklem told an audience on July 14. “Front-loaded tightening cycles tend to be followed by softer landings.”

Macklem added that the central bank expects the economy to grow 3.5 per cent this year before slowing to 1.75 per cent next year. Despite an expected economic slowdown and decades-high inflation, Macklem said he believes Canada can avoid a 1970s-style stagflation environment because back then, the economy had already been overheated in the years leading up to a decade of high inflation and disappointing economic growth.

Advertisement 4

Article content

The high inflation that we have today is not normal, it’s not here to stay

Bank of Canada Governor Tiff Macklem

Another difference between then and now is that countries during the 1970s abandoned the Bretton Woods system that provided a currency peg to the United States dollar, which was pegged to gold prices.

“That was the monetary anchor, but it wasn’t replaced with a new anchor,” he said. “Monetary policy was adrift. It responded slowly. Inflation expectations ratcheted up. There was a wage-price spiral and the result is we had very high inflation for a decade. It took, unfortunately, a very sharp recession in the early ’80s to bring it back down.”

The Bank of Canada’s monetary policy report in July pointed to global supply challenges such as the Russian invasion of Ukraine and China’s pursuit of a zero-COVID policy as recent disruptions that are expected to unwind over the next year. The report projects inflation to peak in the third quarter before fizzling out as these supply challenges ease and demand slows.

Advertisement 5

Article content

However, the central bank acknowledged it did not get its forecast right in the past, pointing to these same global factors, which caused supply shortages and soaring commodity prices and shipping costs, as the reason for two-thirds of its inflation target miss.

-

Exclusive: Tiff Macklem on the Bank of Canada’s surprise rate hike, wrestling inflation and its forecast miss

-

Bank of Canada issues shock rate hike in effort to crush inflation

-

Canadian food suppliers signal more price hikes coming to grocery stores this fall

Economists at Bank of Nova Scotia revised their inflation outlook and now expect the consumer price index to average 7.1 per cent this year, after peaking in July, before slowing to 3.6 per cent in 2023.

Advertisement 6

Article content

“A broad range of supply chain indicators and input prices suggest inflation will cool in coming months,” chief economist Jean-François Perrault said in a July 18 report. “Yet, despite that and a marked downward revision to the growth outlook (to 3.5-per-cent growth in 2022), incoming inflation has been hotter than anticipated and wage pressures suggest that inflation will be stronger than earlier anticipated in 2023.”

Perrault and his team expect the Bank of Canada’s policy rate will peak at 3.5 per cent later this year and stay at that level through 2023. He added they do not expect the central bank to crank rates above this level only to cut them back next year.

Macklem has been signalling throughout the year that the Bank of Canada is getting tougher on inflation and that Canadians should not expect these levels to persist indefinitely.

“The high inflation that we have today is not normal, it’s not here to stay,” he said to the CFIB. “We are resolute in our commitment to bring inflation down.”

• Email: shughes@postmedia.com | Twitter: StephHughes95