[ad_1]

This past February, based on a review of some investing wisdom from John C. Bogle and Peter L. Bernstein, I offered Seeking Alpha readers my take on the perfect portfolio for the next 10 years.

In combination, the two linked articles, one on my personal blog and one right here on Seeking Alpha, offer a thorough grounding in the argumentation offered by Mr. Bernstein in favor of a portfolio comprised of 60% stocks and 40% bonds, followed by a slight modification of such in line with a more recent recommendation by no less than John C. Bogle that, given the present environment, a 50/50 allocation may be even more prudent.

One reader wrote the following in the comments section of my ‘perfect portfolio’ article:

You are a very talented and gifted writer who makes complex ideas very understandable to those of us who do not have formal training in the financial area. . . . The knowledge and perspective shared in (the article on investing wisdom) at your blog should be required reading in all basic financial planning classes.

What, though, did I recommend as the ‘perfect portfolio?’ Here is how I summarized it in my Seeking Alpha article:

Without further ado, then, here is my “base” allocation for the next 10 years.

- 30% U.S. Stocks

- 20% Global ex-US Stocks

- 50% Long-Term U.S. Treasuries

In summary, we are talking about a 50/50 allocation in stocks vs. bonds, with the stock allocation being broken down 60/40 between U.S. stocks and foreign stocks.

In very short order, several readers replied to the effect: “OK, Mr. ETF Monkey. How about actually recommending some ETFs to go about doing this with?”

Not to worry, that was my plan all along. In this article, I will start with the bond component of the portfolio. Then, in either one or two future articles, depending on how lengthy and detailed the analysis gets, I will consider the allocation to stocks in the portfolio.

OK, so let’s get right to it.

TLT-ing The Portfolio in the Right Direction

At 50%, the largest allocation in my ‘perfect portfolio’ is to long-term U.S. Treasuries.

My recommended ETF for this portion of the portfolio is the iShares 20+ Year Treasury Bond ETF (TLT).

Simply put, TLT is the class of its field. With an inception date of July 22, 2002, it goes back to the very early days of ETFs. As a point of reference, only 98 of the 2,249 ETFs tracked on ETFdb.com were in existence on that date. In terms of size, with AUM of $11.215 billion, TLT is roughly 6x the size of its nearest competitor and, as of this writing, the 73rd-largest ETF in the entire marketplace. It carries an expense ratio of .15% and, due to its solid $9.5 million daily trading volume, has a rock-bottom trading spread of .01%.

According to its website:

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

The index referred to in that quote is the ICE U.S. Treasury 20+ Year Bond Index. According to its website, this index contains 40 securities. As of this writing, TLT holds exactly 34 securities in its portfolio, all long-term U.S. Treasury bonds, along with a tiny component of cash and/or derivatives.

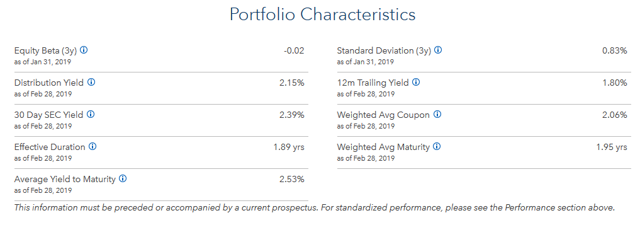

Here’s a quick look at TLT’s portfolio characteristics.

Source: iShares TLT Website

Source: iShares TLT Website

In summary, TLT offers a wonderful vehicle for including long-term U.S. Treasury bonds, a core component of my ‘perfect portfolio’ for the next 10 years.

Two Similar ETFs Worthy Of Your Consideration

To round out the picture, I would like to briefly feature two other ETFs worthy of your consideration for this asset class.

These are:

- SPDR Portfolio Long Term Treasury ETF (SPTL)

- Vanguard Long-Term Treasury ETF (VGLT)

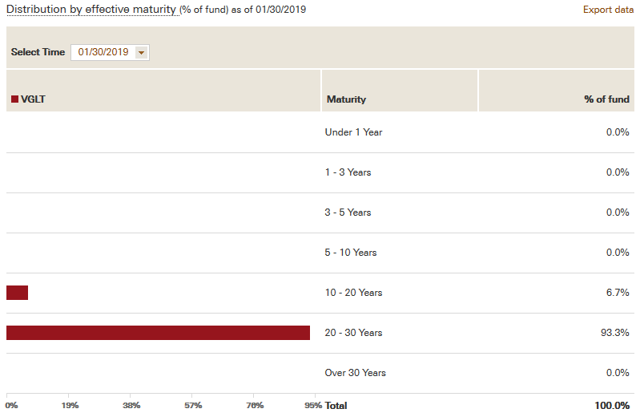

Both of these ETFs are very similar in that they track the Bloomberg Barclays Long U.S. Treasury Index. With 50 holdings in the index, it is slightly broader than the index TLT tracks. Additionally, as shown below, while the index used by TLT is exclusively comprised of securities with a maturity of over 20 years, this index contains a modest sampling of bonds with maturities in the 10-20 year range.

Source: Vanguard VGLT Website

Source: Vanguard VGLT Website

As you might suspect, if you ran a comparison of TLT, SPTL, and VGLT on Portfolio Visualizer, you would find that SPTL and VGLT are very slightly less volatile, while TLT tends to produce, again, a very slightly higher overall return. At .06% and .07%, respectively, SPTL and VGTL beat TLT’s .15% expense ratio.

Long story short, you could easily select any of these 3 ETFs and obtain extremely similar results. In my case, one small consideration is that, as a Fidelity brokerage client, I am able to trade TLT commission-free. So, for example, if your brokerage offers commission-free trading in either SPTL or VGLT, that might make one of these more attractive to you.

Suggested ETFs To Buffer Interest-Rate Risk

Despite the demonstrated power of long-term U.S. Treasury bonds to provide a nice offset for stocks in a long-term portfolio, there is certainly a valid question that arises in the current environment.

Here’s how one reader put it in the comments section:

The elephant in the room of course is what happens when rates increase? This is highly unlikely for political reasons, but that is one scenario where a 60% long bond portfolio would underperform.

As it happens, I was also pondering that very question even as I wrote that original article. I am all too well aware that we are currently in an environment in which the yield curve has flirted with inverting, with short-term rates gradually rising but long-term rates remaining stubbornly low. Careful readers might have noticed two little tidbits. After featuring the strong results of long-term bonds in a 50/50 portfolio, I said:

My conclusion? As we look to build our perfect portfolio for the next 10 years, we will use long-term treasuries as our core bond holding, and use short-term bonds (you could also substitute cash) to the extent we wish to lower our volatility even further.

A little later, in discussing the question of rising rates, I said:

If an investor is really concerned about the precise interest rate environment today, one could dollar-cost average (or similar) into this asset class over time, gradually moving from the shorter end of the duration spectrum.

As it happens, some version of this is exactly what I plan to do in my personal portfolio. I plan to continue to offer readers occasional glimpses into my personal portfolio as I implement these changes.

For now, however, let me offer 3 additional ETFs that you may wish to consider if you would like to implement this idea.

These are:

- Vanguard Short-Term Bond ETF (BSV)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- iShares Short Treasury Bond ETF (SHV)

I wrote an article specifically on BSV not too long ago so I won’t bother rehashing what I wrote there.

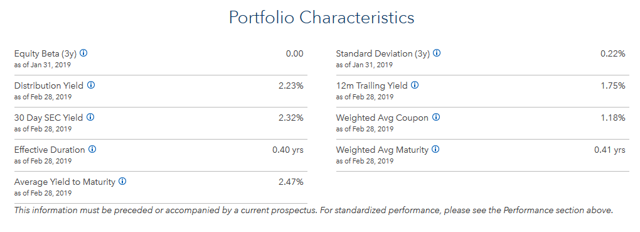

I’ve never written about either SHY or SHV before, so let’s spend just a couple of minutes on these two ETFs.

SHY has the same inception date as TLT: July 22, 2002. SHV came along about 4-1/2 years later, on January 5, 2007. Both of them have roughly the same AUM, in the $19 billion range. And, like TLT, they both carry an expense ratio of .15%.

Also like TLT, both of these ETFs are comprised exclusively of U.S. Treasuries. The only difference is term. SHY, as the name implies, holds U.S. Treasuries with maturities of 1-3 years, whereas SHV holds those with a maturity of less than one year.

Here is a quick look at the portfolio characteristics of SHY.

Source: iShares SHY Website

Source: iShares SHY Website

Next, the portfolio characteristics of SHV.

Source: iShares SHV Website

Source: iShares SHV Website

Playing It Out in the Portfolio

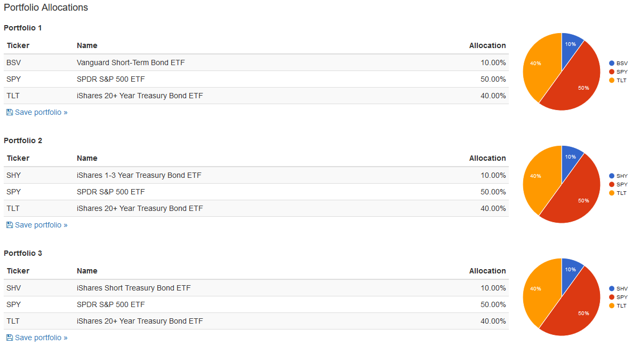

In the section above, I offered 3 ETFs that might at some level be considered variants of the same basic theme: an ETF featuring bonds at the shorter end of the duration spectrum which could serve to provide a measure of buffer against rising interest rates.

Below, I present the results of another backtest on Portfolio Visualizer. To try to get some idea of how each of these ETFs might play out when paired with stocks and long-term U.S. Treasuries, I built 3 iterations starting with 50% SPDR S&P 500 ETF (SPY) and 40% TLT, with the remaining 10% covered by BSV, SHY, and SHV, respectively. The portfolio covers the period from January, 2008 to the present (the starting point was limited by the inception date of BSV).

Source: Portfolio Visualizer Comparison

Source: Portfolio Visualizer Comparison

Below are the results.

Source: Portfolio Visualizer Comparison

Source: Portfolio Visualizer Comparison

My conclusion? For this piece of the puzzle, it would appear you might benefit slightly by going with BSV (Portfolio 1), and getting the slight benefit of the higher yields of at least some allocation to corporate bonds. Over this roughly 11-year period, this portfolio offered (very slightly) higher returns with an extremely negligible increase in risk.

So, if you find yourself troubled by allocating 50% of your portfolio to long-term bonds at this very point in time, you could split your 50% allocation in some fashion between BSV and TLT, and then perhaps consider a disciplined plan for ultimately moving the funds into TLT. You could do this either on a time basis (e.g. start with 25% BSV and 25% TLT and then move 2% per quarter into TLT), or based on the movement of interest rates (e.g. if long rates go up a half-percent, move 5% into TLT).

I think you get where I am going with all of this. You could play around with your bond allocation to the point where you felt comfortable.

As an outlier, you could even allocate some percentage of your bond holdings to international bonds. At the present time, yields from such are not particularly great, but they offer one more vehicle that can serve to smooth out the volatility from possible future interest rate changes.

Some Final Thoughts

Building on my work in search of the ‘perfect portfolio,’ I have offered 3 ETFs with which to build the portion devoted to long-term U.S. Treasuries. For those concerned about where we are with respect to interest rates at this precise point in time, I have made clear that I share your concern. Hopefully I have shared some helpful options that could be useful in mitigating potential risk from rising long-term interest rates.

I might offer just one caveat. One could get so conservative in doing all of the above that one would greatly diminish the potential for long-term returns. Only you can pick the balance of risk/reward that works for you.

As always, until next time, I wish you . . .

Happy investing!

Disclosure: I am/we are long BSV, TLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

[ad_2]

Source link