By David Schassler, Portfolio Manager from VanEck

The VanEck Vectors® Municipal Allocation ETF (MAAX) tactically allocates among VanEck municipal bond ETFs based on interest rate and credit opportunities to seek capital appreciation plus tax-exempt income. It uses a data-driven, rules-based process that leverages technical and macroeconomic indicators to guide credit and duration exposure, seeking to avoid market risks when appropriate. The expanded PDF version of this commentary can be downloaded here.

Overview

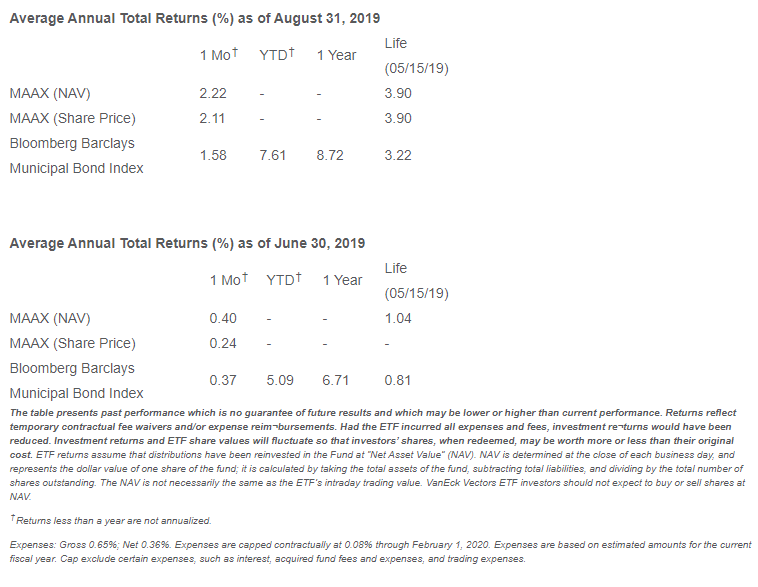

The VanEck Vectors Municipal Allocation ETF (MAAX) is currently yielding 2.73% vs. 1.65% for the Bloomberg Barclays Municipal Bond Index, as of August 30, 2019. August was a big month for MAAX. It returned 2.11% vs. 1.58% for the Bloomberg Barclays Municipal Bond Index. The outperformance largely came from fears of a recession that sent long-term yields down and, concurrently, prices up. The top-performing position was in long-term bonds. The VanEck Vectors AMT-Free Long Municipal Index ETF (MLN) returned 2.93%. MAAX’s exposure to shorter-duration investments, such as its holding in the VanEck Vectors Short High-Yield Municipal Index ETF (SHYD), lagged its other investments with a return of 1.36%.

Muni Risk Factors

Risks have been modestly rising in the municipal market, but they are not yet at a level which would cause MAAX to reduce its credit and/or duration exposure. Heightened levels of risk is being measured in the volatility of the 10-year U.S. Treasury Note and the ratio of muni yields to Treasury yields. For now, MAAX remains overweight both credit and duration, and it will maintain those exposures until additional risks arise.

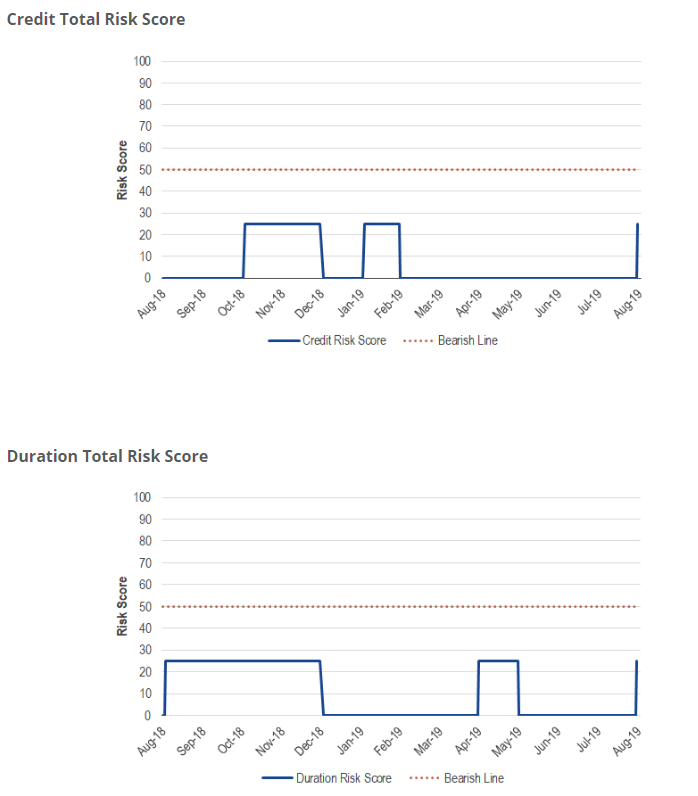

In aggregate, the model is measuring elevated levels of credit and duration risk. The risk is scored from 0 to 100. A score below 50 implies that risk is low and a score of 50 or higher implies that risk is high. The current credit risk score is 25 and the current duration risk score is 25. Since both of these scores are below our systemic risk threshold of 50, MAAX will maintain its overweight credit and duration risk positioning.

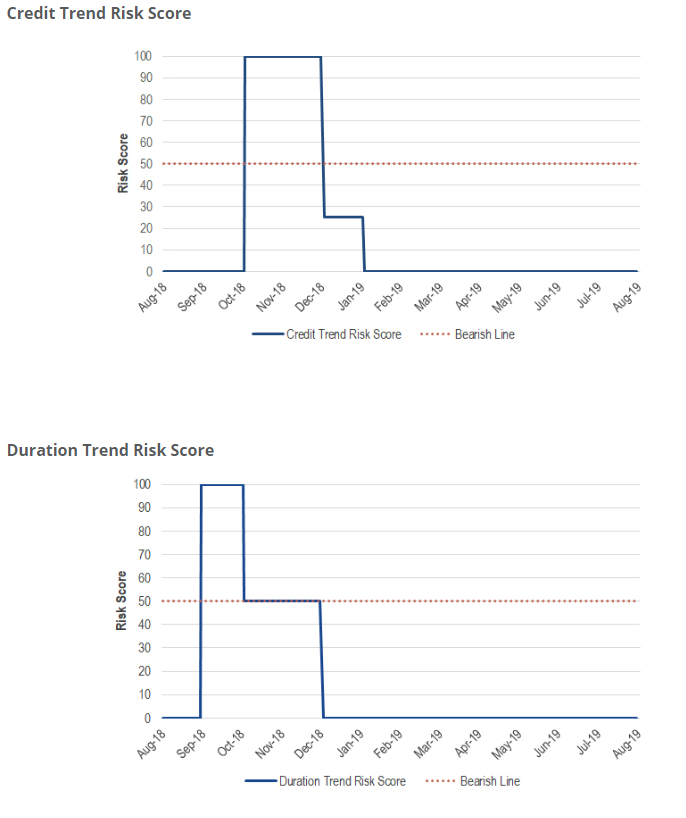

The factors that determine the total level of both credit and duration risk are momentum, volatility and mean reversion. The scoring methodology works the same here. Scores below 50 are bullish and scores 50 or higher are bearish. The trend risk score is bullish for both credit and duration risk given the recent strength in bond prices.

The volatility risk factor is signaling caution for both credit and duration. Specifically, the model is measuring extreme realized and implied volatility in the 10-year U.S. Treasury Note. The 10-year note is an important measure of fixed income risk because it is a sign of investor sentiment about the economy. The current volatility risk score is 50 for both credit and duration, which indicates that we are in a higher risk regime.

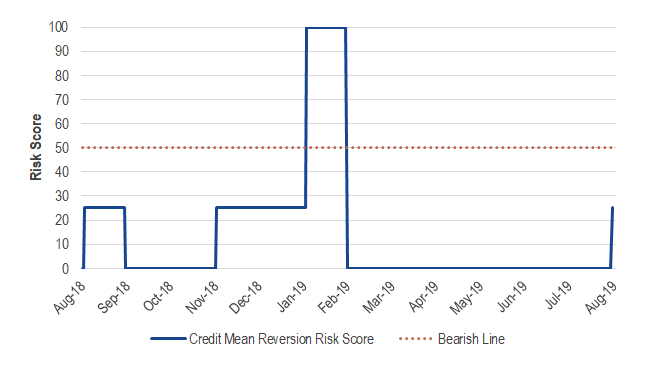

Credit mean reversion risk, at a score of 25, is elevated, but still below the high risk threshold of 50. These indicators seek to identify divergences in typical fixed income relationships. Right now, the ratio of municipal yields to Treasury yields is at an extreme due to the recent volatility in the U.S. 10-year note. This has potentially created a near-term overbought market condition for municipal debt.

Credit Mean Reversion Risk Score

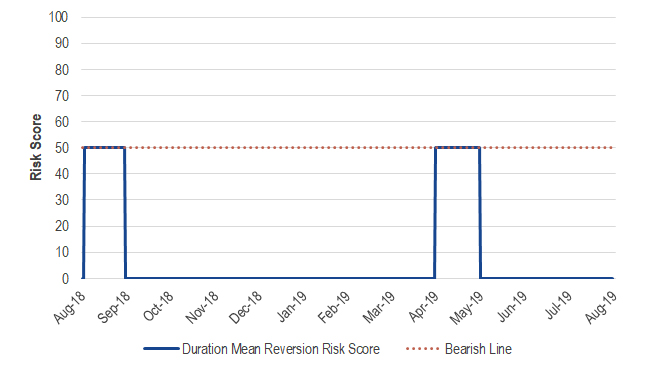

The duration mean-reversion risk remains low with a score of 0.

Duration Mean Reversion Risk Score

To conclude, risks are elevated within the municipal fixed income market. However, the risk is not yet high enough to be considered systemic. Therefore, MAAX will continue to take both credit and duration risk in the pursuit of yield. These risks will be monitored closely, and MAAX’s exposures will be adjusted if the risk environment changes materially.

Click here for performance as of the most recent month-end.

1 30-day SEC yield for MAAX was 3.19% (unsubsidized 0.26%) as of 8/30/19.