By Richmond Quantitative Advisers

Although we at Richmond Quantitative Advisors (“RQA”) are not “gold bugs” by any stretch of the imagination, we now believe that long positions in gold are likely a good directional bet over the intermediate to longer-term, particularly given: i) a favorable macro fundamental risk/reward backdrop; ii) steady (and likely increasing) international tensions; and iii) a diverse set of momentum and trend-based signals indicating the potential for a major move higher.

Key Points & Considerations

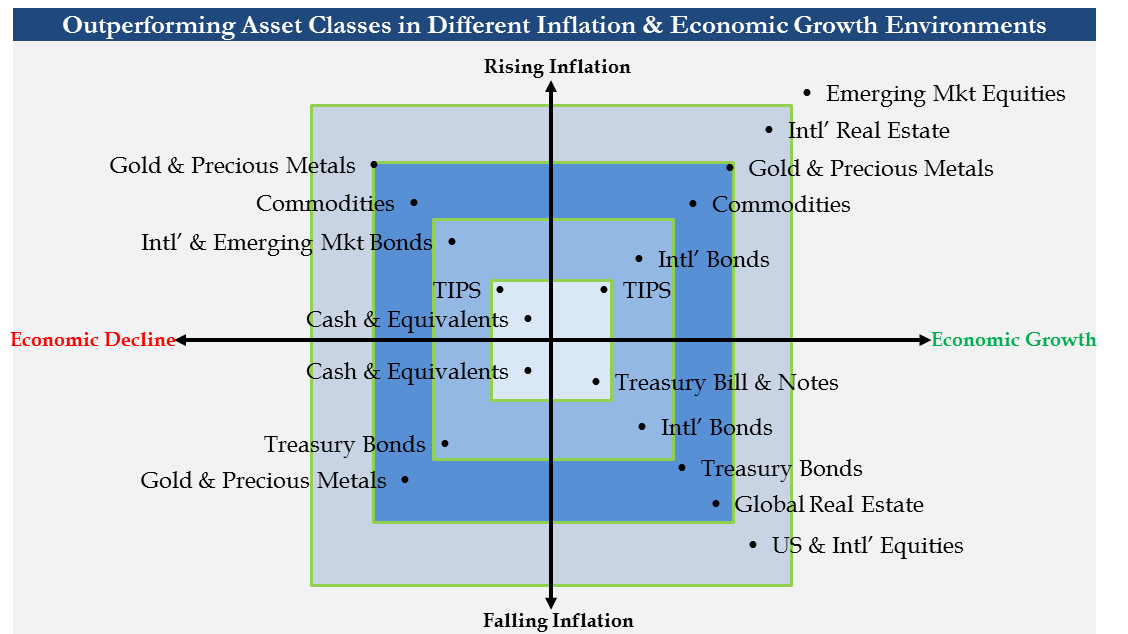

As a backdrop, we take a viewpoint of each asset class as it is structured to perform during the four macro-economic environments the U.S. can exhibit – inflationary economic growth, deflationary economic growth, inflationary economic recession, and deflationary economic recession. Accordingly, we view the asset allocation approach should start with this framework, and from there, we actively tilt based on economic and behavioral factors to capture full exposure to those assets that exhibit the highest probability of outperformance going forward. We join fundamental and economic data with current trends taking place across asset classes. More specifically we deploy an ensemble of momentum based metrics to assess capital flows and further improve our viewpoint and potential exposure to each asset class. As we continuously monitor these asset classes, gold has started to increase its attractiveness from a probability of outperformance standpoint. Key discussion points and consideration regarding a gold investment are set forth below.

- Gold remains a great risk/reward trade given several potential macro conditions:

Inflation Linked Conditions:

- If inflation stays low, rates will likely remain low or even fall globally, leading to further long-term currency depreciations, and in turn, incremental value tailwinds for gold. Moreover, if rates move lower, the opportunity costs of owning gold will also continue to decline. (Positive)

- On the flip-side, if inflation comes back in any meaningful way, gold is likely to be the hedge-of-choice for most investors. (Positive)

- To provide some additional color and a hint of directional indication from our perspective, there are a variety of major trends unfolding that could ultimately lead towards added inflationary pressures in coming years:

- Most of the primary U.S. Presidential contenders on both sides of the aisle have indicated their preferences for a weaker U.S. dollar. More specifically, Donald Trump has continually made direct tweets such as: “China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA. We should MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games – as they have for many years! On the other side, however, Elizabeth Warren and other Democrats are advocating for “active currency management”, which in our opinion likely has a strong tilt towards de-valuation, as well.

- Governments globally, including the U.S., are seemly becoming more agnostic to ballooning deficits, whether in favor “trickle-down economics”, Modern Monetary Theory (MMT), or other similar derivations. Moreover, a large amount of government liabilities are coming due over the next several decades (e.g. government debt, pension liabilities, social security, Medicare, etc.). As global debt and liability burdens rise, particularly in the face of somewhat stagnant and/or slowing economic growth, governments will likely continue printing money to pay their debts (i.e. debt monetization), and as a result, devalue their currencies and create ever growing demand for other forms of investment that can protect their purchasing power in the likely reflationary environment – and gold has proven over thousands of years to be one of the most effective assets in providing this kind of protection.

Economic Growth Conditions:

- If the economy continues to see headwinds, particularly globally, gold will likely remain a safe-haven asset class as history indicates, leading to additional return tailwinds. (Positive)

- If the economy comes roaring back, gold will likely underperform, unless the economic boom is coupled with rising inflation, which could still make gold a good relative performer in any portfolio. (Positive)

- If the economy roars back and inflation remains low or lower than expected (i.e. a return to the “goldilocks” environment), then gold will likely underperform. (Negative) (Note: We view this to be fairly unlikely at this juncture, however, given recent trends in economic leading indicators.)

From a geopolitical-risk perspective:

- S. trade war tensions along with additional tensions with Iran (and others in the Gulf) seem to have dissipated in the near term; however, lasting relief and resolutions to these issues are likely far from being reached, leading us to believe the probabilities for addition spikes in global tensions and market volatility remain fairly high.

- The U.S. continues to “weaponize” the U.S. dollar market through sanctions, causing other nations and large sovereign investors to seek out other alternatives – namely precious metals, crypto assets, and alternative banking systems outside the SWIFT system.

- As a result, many countries like Russia, China, and several in the E.U. continue to increase their gold reserves given uncertainty around U.S. trade and political agendas paired with a more hard-nosed White House administration.

From a timing perspective, gold is showing positive momentum and breakout signals from multiple quantitative measures, after taking a long hiatus from positive returns since 2011/2012.

- 58% of the spectrum of RQA’s 440 momentum measures (spanning several weeks to several years) are turning bullish for the yellow metal.

- Based on a more discretionary technical view as illustrated below, it appears the weekly trend for gold has been steadily creeping higher since 2016, and most recently a strong upward breakout above long-dated resistance levels could be signaling the beginning of a more prolonged, significant move. Monthly price data suggests resistance upon breakout in the $150-$155 range, implying a ~15% move in the ETF.

GLD Weekly Price Series

GLD Monthly Price Series

Conclusions & Positioning

- RQA is suggesting increasing long-oriented exposure to the gold. An efficient vehicle for the gold trade is to purchase shares in the GLD SPDR Gold Shares ETF. More aggressive investors can look to the liquid ETF’s options as a leveraged play.

- Initiate long position in GLD within the current breakout range – $132-134.

- Based on the depth and size of the gold market and daily volume within the GLD ETF vehicle, we believe that accumulation with regards to liquidity of the ETF does not pose a significant risk.

- Initial upside target will be for a move of 15% to $152 over the next 6-8 months.

- Other assets that could be considered to exploit this trade thesis include silver (SLV), other precious metals, and a number of the more established cryptocurrencies like Bitcoin. We would note, however, that crypto-assets do not have a very long history of performance and have not been traded in reflationary environments, at least not in the U.S. or other developed markets. As such, we feel that core positions around this thesis should be oriented towards more established asset classes, while crypto-asset positions would likely make for a good alpha overlay, given their higher volatility.

Richmond Quantitative Advisers (“RQA”) is a Richmond, Virginia based registered investment advisor with a focus on evidence-based quantitative investment strategies. The firm, founded in 2017, offers access to its proprietary strategies through separately manages accounts and a private fund. RQA makes capital allocation decisions across strategies, time horizons, and asset classes in an effort to increase overall portfolio diversification – a method we reference as multi-dimensional diversification. Strategy offerings within separately managed accounts include both alternative and beta options. RQA was founded by two individuals with significant experience across financial markets and technology verticals. The firms founders formulate experience in each of the following areas – asset management, investment banking, equity research, and quantitative research. The founders each have more than a decade of developing and researching unique, evidence-based investing applications.

To receive RQA Research and Updates, sign up with your email.

Disclaimer: These materials have been prepared solely for informational purposes and do not constitute a recommendation to make or dispose of any investment or engage in any particular investment strategy. These materials include general information and have not been tailored for any specific recipient or recipients. Information or data shown or used in these materials were obtained from sources believed to be reliable, but accuracy is not guaranteed. Furthermore, past results are not necessarily indicative of future results. The analyses presented are based on simulated or hypothetical performance that has certain inherent limitations. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight.