Food retail prices rose by 8.7 per cent in March compared to the previous year

Article content

Grocery bills are rising at the fastest rate in 13 years, driven by major swings in the price of dairy, meat and pasta, according to Statistics Canada’s latest consumer price index.

Advertisement 2

Article content

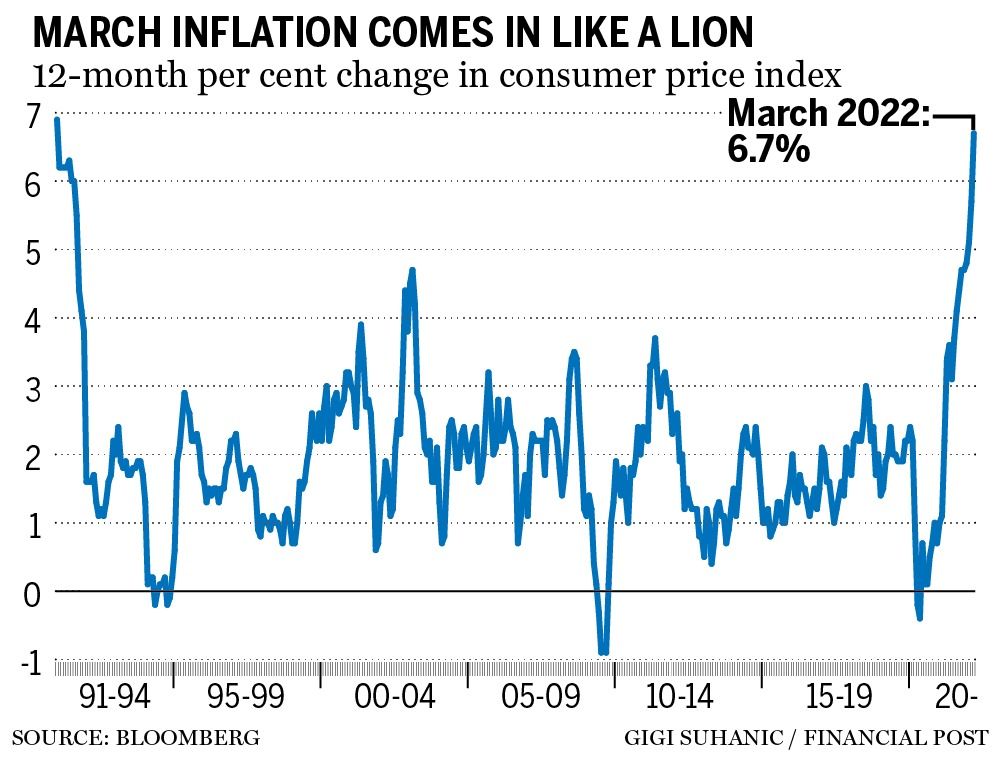

Food prices rose by 8.7 per cent in March compared with the previous year, the biggest year-over-year increase since 2009. The jump in food outpaced the overall consumer price inflation of 6.7 per cent for March, Statistics Canada reported on Wednesday.

Gasoline and various costs related to housing carry bigger weights in the consumer price index, but food is an important actor in the inflation story because households are confronted with the cost of nutrition on a weekly basis. One of Bank of Canada Governor Tiff Macklem’s biggest challenges is keeping inflation expectations in check, a job that will be harder if consumers face sticker shock every time they visit the grocery store.

“These are unprecedented food price increases,” said Simon Somogyi, a professor at the University of Guelph who specializes in the business of food. “This is not good news for families.”

Advertisement 3

Article content

Dairy and egg prices rose faster than they have since 1983, with milk prices up 7.7 per cent, cheese up 10.4 per cent, and butter up 16 per cent. Fresh and frozen beef prices surged 14.1 per cent in the last year, while ham and bacon was up 15 per cent.

“I’m staggered by the increase in butter prices,” Somogyi said, adding that rising feed costs help explain why some of the largest increases in latest inflation report are for animal products. Higher grain costs also pushed up pasta prices in March by 17.8 per cent, while breakfast cereal rose more than 12 per cent year over year, the biggest increase since 1990.

Extreme drought last year dramatically cut crop yields across Western Canada, tightening the supply of domestic grain and driving up feed costs. On top of that, wheat futures have spiked anew, as the Russian invasion of Ukraine destabilized one of the world’s most important bread baskets.

Advertisement 4

Article content

In February, the Dairy Commission of Canada (CDC), the federal body that controls farm-gate milk prices under Canada’s supply management regime, announced an 8.4-per-cent increase in the price that dairy companies must pay farmers for milk. The historic increase was meant to account for higher fuel, feed and fertilizer costs, the CDC said.

-

Kevin Carmichael: Roaring inflation leaves Bank of Canada little choice but to come on strong

-

Canada’s inflation rate comes in much hotter than expected

-

Half of businesses surveyed by the Canadian Chamber of Commerce say rising costs are biggest challenge

-

‘We had a deal’: U.S. dairy farmers accuse Canada of playing games in cheese dispute

Processors responded with price increases of their own. Lactalis Canada Inc., the local arm of the French dairy giant that owns Beatrice milk, Astro yogurt and Black Diamond cheese, upped its prices on grocers by as much as 15 per cent to account for the CDC’s increase, as well as higher labour, transportion, and packaging costs.

Advertisement 5

Article content

Canada’s big grocery chains say they’re under pressure from suppliers to pay more for shipments of products, but some have been pushing back, resulting in public disputes that have stripped products from shelves. Late last year, the global confectioner Mondelēz International Inc. stopped shipping Oreo and other biscuit brands to Loblaw Companies Ltd., after the supermarket chain refused to pay more for the products. That situation played out again, much more publicly, when PepsiCo Inc. stopped shipping its Frito-Lay snack products to Loblaw stores across the country in a price standoff that dragged on for two months this spring.

The top three grocers in Canada — Loblaw, Sobeys’ parent Empire Co. Ltd., and Metro Inc. — have reported profit growth in their latest earnings updates, which they have attributed to a range of factors beyond just food revenues. But Somogyi said the increasing profits at a time of high inflation is “somewhat troubling.”

Food inflation could start to slow down, at least in some categories, as the upcoming growing season starts to produce a domestic supply of fruit and vegetables, he said. Global supply chain disruptions, higher fuel prices and labour shortages have dramatically increased in the time and money it takes to import products from southern growing regions into Canada. Statistics Canada said fresh fruit prices increased 9 per cent from March 2020, including a 23-per-cent rise in the price of oranges.

• Email: jedmiston@postmedia.com | Twitter: jakeedmiston