According to the latest report on exchange-traded fund (ETF) flow data from State Street Global Advisors, fixed income exchange-traded fund (ETF) inflows were out of this world in the month of June, garnering over $25 billion.

“Even with a 6% rally in global equities, investors allocated a record amount to fixed income ETFs,” wrote Matthew Bartolini, CFA Head of SPDR Americas Research State Street Global Advisors, in the report. “Equity ETFs did garner $20 billion of inflows. However, inflows to bonds were truly out of this world with over $25 billion –a more than 45% increase over the prior record from October of 2014.”

The record number of inflows into bond ETFs allowed for record capital allocations into the fixed income space.

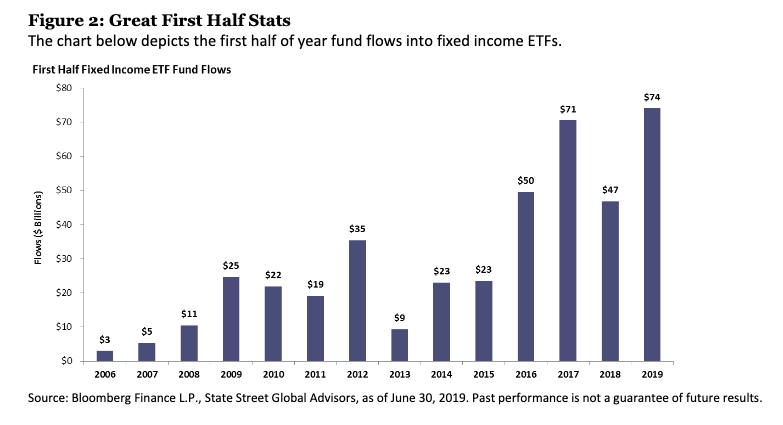

“Bonds’ record June haul pushed the first-half figure to $74 billion, which is also a record amount for a first half,” Bartolini noted. “This surpassed the $70 billion bond ETFs amassed in 2017, a time period that was aided by regulatory tailwinds emanating from the fiduciary rule that led to all ETFs having a record amount of fund flows once the year was over.”

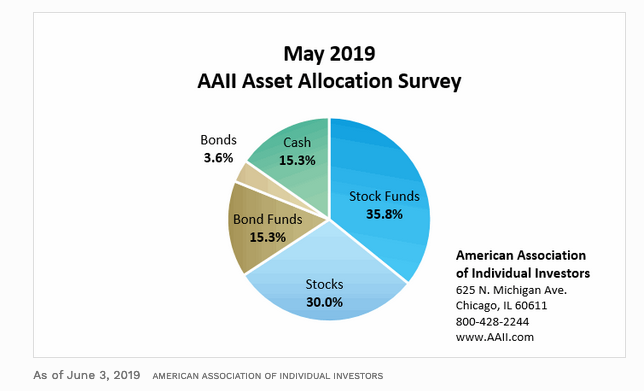

As the U.S.-China trade deal that was supposed to happen went south, investors increased their exposure to fixed income to a point where it reached a six-year high during the month of May as negotiations unraveled, according to the latest AAII Asset Allocation Survey.

As such, other notable trends included a decreased exposure to equities and an increase of investors sitting on the sidelines with cash.

Other highlights:

- Allocations to stocks and associated funds declined 2.0 percentage points to 65.8 percent

- Equity allocations remain above their historical average of 61.0 percent for the 74th consecutive month

- Bond and bond fund allocations rose 1.8 percentage points to 18.9 percent

- Fixed-income allocations were last higher in April 2013 (19.7 percent)

- May was the fourth time in five months with bond and bond fund allocations above their historical average of 16.0 percent

This latest data could provide insight on a repeat performance of fixed income’s first quarter. It’s no doubt that the volatility-laden fourth quarter of 2018 spurred an investor move to bonds, but that trend persisted in the first quarter of 2019 with $34.5 billion going into fixed income exchange-traded funds (ETFs), according to a US-Listed Flash Flows Report from State Street Global Advisors.

As opposed to simply adding a broad-based fund like the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), it will take more of a strategic bent, such as looking into actively-managed funds or other corners of the bond market like municipal debt. This is especially so since the Federal Reserve said during its fourth and final rate hike in December 2018 that it will do more reassessing–the central bank already lowered its forecast to no rate hikes in 2019 as opposed to the initial two forecasted.

For more market trends, visit ETF Trends and to access up-to-date data on ETFs, visit ETFdb.com.