[ad_1]

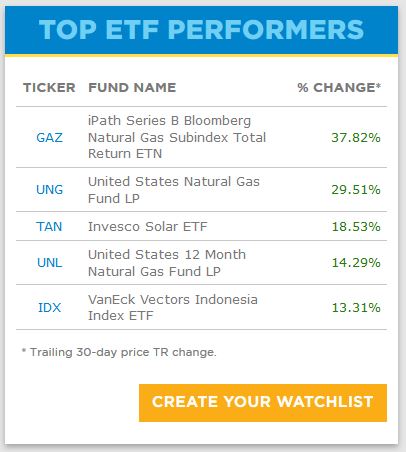

This week, we spotted a curious name among our top one-month performing ETFs: the Invesco Solar ETF (TAN), which has risen 19%.

Sources: ETF.com, FactSet; data as of Nov. 29, 2018

It should be no surprise that natural gas ETPs are going gangbusters; my colleague Sumit Roy covered the reasons for this last week in “Why Natural Gas ETFs Are Soaring.” But the solar ETF? Really?

Short Interest Makes ‘TAN’ Shine

TAN’s recent performance is quite a reversal of fortunes given that the fund has fallen 18% year-to-date. The gains are likely attributable to two factors.

First, TAN consistently ranks among the most widely shorted ETFs. In fact, at times the fund has earned so much extra revenue from lending out its shares that it has managed to offset its 0.70% expense ratio several times over, helping to juice its overall returns.

Over the past month, short interest in solar stocks has grown—likely a result of several factors, including reduced Chinese subsidies for solar power, tariffs on Chinese-made solar power components and strong performance from natural gas. On Oct. 31, short interest in TAN peaked at 298,000 shares, up from a bottom of 52,604 shares on Aug. 31.

As of Nov. 29, short interest in TAN was still elevated, at 204,333 shares.

Xinyi Up On Subsidiary Plans

But TAN’s supercharged performance lately isn’t just because of short selling. Its underlying portfolio has also had a surprisingly robust month of performance.

At 9%, TAN’s largest holding is Xinyi Solar Holdings, a Chinese solar glass manufacturer that has risen 27% since Oct. 30.

The rise is likely due to news that the company plans to spin out its solar farm business into a subsidiary as a way to raise cash to build out production capacity for its solar glass facilities. Though China—Xinyi’s main market—has scaled back its expansive solar power subsidy program this year, reducing demand, Xinyi clearly is betting that falling prices for solar power will open up new markets overseas.

First Solar Rebounds

TAN’s second-largest holding, at 7%, is First Solar (FSLR), which has had a rocky 2018. But it too has rebounded over a one-month period, rising 23% since Oct. 30.

Part of this increase can be attributed to a rebound from a short-term earnings season plunge; though First Solar beat its Q3 earnings estimates on Oct. 25, it missed revenues and earnings-per-share targets.

Increased optimism on an end to the China-U.S. trade dispute is likely pushing prices higher as well. First Solar, like many U.S.-based solar companies, has been hit hard by the tariffs on Chinese components and arrays, which are used widely in U.S. solar operations.

Continued Support For US Solar

Whether the rebound lasts is anybody’s guess, but new initiatives announced in the U.S.—First Solar’s main market—are likely to continue benefiting the U.S. solar industry for some time to come.

In late October, Illinois inked an ambitious state law to source at least 25% of its electricity from clean energy sources by 2025. Earlier this year, California mandated solar panels on all new home construction, starting in 2020 (read: “ETF Of The Week: Guggenheim Solar ETF”).

More recently, on Nov. 5, Facebook (FB) announced plans to install a solar farm to power its Alabama data center, while on Nov. 28, Exxon-Mobil (XOM) announced it would use wind and solar to power its Permian Basin projects in the largest renewable power contract ever inked by an oil company.

Contact Lara Crigger at [email protected]

[ad_2]

Source link