[ad_1]

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) was one of the week’s most popular funds, raking in $980 million in net creations—the equivalent of a 23% jump in total assets under management. That’s the second-largest AUM increase any ETF with more than $200 million in assets saw this past week—second only to a semiconductor fund.

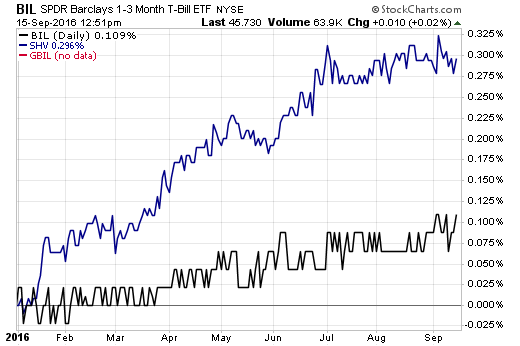

BIL tracks a market-weighted index of zero-coupon U.S. Treasury bills with maturity between one and three months. The fund, which costs 0.14% in expense ratio—$14 per $10,000 invested—today has $5.3 billion in total assets.

BIL’s asset-gathering pace in recent days reflects a broader trend in the ETF space this year, one that has many investors flocking to cashlike ETFs offering access to ultra-short-term bonds for safety as well as returns.

3-Month Treasury Bill At 2.18%

That’s because yields are rising, but they are rising faster in the short end of the curve, and in some cases, are at their highest levels in a decade. That’s fueling concerns that an inverted yield curve—and possibly economic recession—may be looming ahead.

“The wonderful thing about rising rates is that the three-month T-bill is now paying 2.18%, the highest in 10 years,” said Josh Jenkins, senior portfolio manager and co-director of research for CLS Investments, in a recent interview. “That’s a real return; it’s more than what the S&P 500 dividend yield is. If investors out there are really scared, they can shorten duration as a way to protect themselves.”

Going forward, according to Jenkins, the short end of the curve, which is driven by the Federal Reserve, should continue to move up. What’s more, at current levels, many still see short-term bond ETFs as good value now that rates have gone up from rock-bottom levels.

Some of BIL’s direct competitors, such as the PIMCO Enhanced Short Maturity Active ETF (MINT) and the iShares Short Treasury Bond ETF (SHV)—funds that own bonds with up to one-year remaining maturity—have seen similar success year-to-date with net creations in the billions of dollars.

So far in 2018, BIL has delivered gains of 1.4%, outperforming the Bloomberg Barclays U.S. Aggregate Bond Index, as measured by the iShares Core U.S. Aggregate Bond ETF (AGG). The fund has also, at times this year, done better than the S&P 500:

Chart courtesy of StockCharts.com

Contact Cinthia Murphy at [email protected]

[ad_2]

Source link Google News