By Christopher Gannatti, CFA

Global Head of Research

When you think about cloud computing companies this year, the most likely starting point will be performance1:

However, from June 16 to August 22 this year2:

- The BVP Nasdaq Emerging Cloud Index returned 17.56%.

- The S&P 500 and Nasdaq 100 Indexes returned 13.16% and 16.03%, respectively, over the same period.

The bottom line: The dominant force behind the performance of cloud computing companies has been macroeconomic, meaning that as the U.S. Federal Reserve and other central banks pursue more restrictive monetary policies to fight inflation, the valuations of cloud companies have fallen. Similarly, if investors “feel” that inflation is easing in any way—and subsequently, central banks may slow the pace of tightening—there has tended to be a strong positive share price response.

The BVP Nasdaq Emerging Cloud Index: August 2022 Rebalance

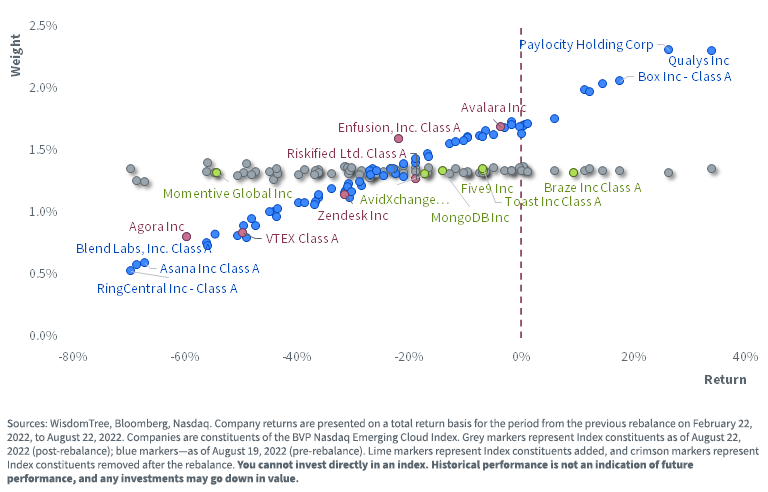

We mention the BVP Nasdaq Emerging Cloud Index as a measure of the performance of cloud companies because it is designed to offer a precise exposure to cloud companies growing revenues by serving enterprise customers. What we see in figure 13:

- The blue line, sloping upward from left to right, represents the weight (vertical axis) and the six-month performance (horizontal axis) of initial constituent companies before the August 2022 rebalance. Companies like RingCentral, Asana and Blend Labs faced performance challenges over this period, whereas companies like Paylocity Holding Corp, Box and Qualys tended to see stronger performance.

- The grey line shows that the rebalance resets the Index to equal weight. Companies that outperformed see their weights decrease, and companies that underperformed see their weights increase. This leads to a valuation sensibility and risk mitigation every six months.

- Red dots and company labels indicate companies that will no longer be constituents after the August 2022 rebalance. Historically, the primary reason companies are deleted is that there is an announced deal, such as an acquisition by a private equity firm.

- Green dots and company labels indicate companies that are new constituents and will be added to the Index after the August 2022 rebalance. The primary reason companies are added is that they have become accessible in public equity markets.

Figure 1: Bringing the BVP Nasdaq Emerging Cloud Index Back to Equal Weight

The Fundamentals Will Matter Again

Up to this writing in August, it would be difficult for us to note that the main catalyst for the share price performance of cloud companies has to do with fundamentals like revenue growth. As we noted earlier, the main catalyst has been the macroeconomic backdrop.

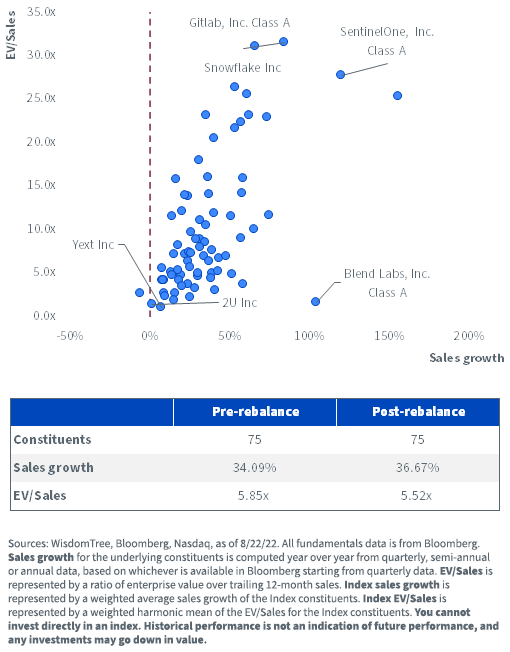

However, company fundamentals are always an important force and will always come back to prominence once macro pressures fade. What we see in figure 24:

- Along the horizontal axis, almost every blue dot is to the right of the 0% boundary, indicating positive year-over-year revenue growth, as per the most recent announced quarterly results. It may be a tough economic environment, but by and large, these companies continue to grow revenues.

- Along the vertical axis, higher on the chart means higher valuation. Some companies, like Gitlab, Snowflake and SentinelOne, are still trading in the range of 25.0x–30.0x enterprise value to sales ratio (EV/Sales). While this may not be “inexpensive,” these companies have been growing revenues in the range of 50%–100%, year over year. If that can be kept up, maybe that premium multiple is warranted. We would note that the majority of the 75 blue dots are below the 10.0x line, however.

- The weighted average sales growth for the BVP Nasdaq Emerging Cloud Index is still in the range of 35%¬–40%, where it has been with some consistency for some time. Is this sustainable? Microsoft Azure, Amazon Web Services and Google Cloud tend to see their, admittedly very large, revenue bases growing year over year in this range. The fact that the biggest players seem to be sustaining these rates of growth, for the moment, tells us that the smaller companies—like those in this Index—may be able to sustain growth rates higher than one could see in other sectors.

Figure 2: Gauging the Fundamentals

Conclusion: Cloud Companies Will Continue to Deliver Exciting Results

In cloud computing, it’s important to look at all the available signals to gain the most appropriate sense of market conditions.

Bessemer Venture Partners has just put out its annual Cloud 100 Benchmarks report for 2022.5 This report specifically looked at the largest and most dynamic private cloud companies, which provide important signals for the overall health of the business model.

In 2022, Bessemer specifically notes that the valuation of private companies may not be the best metric to look at if the goal is to get a sense of the “health” of a given market. For instance, if companies have not raised money recently, they may not have their valuations marked all the way to present market conditions. Bessemer instead focuses on what they call “Centaurs.” While a “Unicorn” has $1 billion in private market valuation, a Centaur has $100 million in annual recurring revenue.

For the 2022 Cloud 100, 70% are already achieving Centaur status and a further 10% more are quite close and could reasonably do it before the year is out. In an environment where the market is focusing much more on results than exciting stories and private funding is harder to come by, proving business success at the Centaur level is indeed important.

At WisdomTree, we work directly with Bessemer Venture Partners and Nasdaq to provide an investment strategy that seeks to track the returns of the BVP Nasdaq Emerging Cloud Index, the WisdomTree Cloud Computing Fund. If you are thinking it is an interesting time to learn more about the investment strategy, please visit our cloud computing research.

1 Source: Bloomberg, with data from 11/9/21–6/16/22.

2 Source: Bloomberg, with data from 6/16/22–8/22/22.

3 Source: The six-month period between rebalances is 2/22/22–8/22/22. The performance source is Bloomberg.

4 Sources: WisdomTree, Nasdaq and Bloomberg, with data measured as of 8/22/22. Further details in sourcing are below figure 2.

5 Source: D’Onofrio, Teng, Schmitt, “The 2022 Cloud 100 Benchmarks,” Bessemer Venture Partners, 8/9/22.

Originally published by WisdomTree on August 30, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

Important Risks Related to this Article

As of August 26, 2022, WCLD held 1.33%, 1.21%, 1.35%, 1.29%, 1.26%, 1.40%, 1.41%, 1.70% and 1.45% of its weight in RingCentral, Asana, Blend Labs, Paylocity Holding Corp, Box, Qualys, Gitlab, Snowflake and SentinelOne, respectively.

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s parent company, WisdomTree Investments, Inc.

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.