China’s latest activity indicators were stronger than expected, but most are still in contraction zone, requiring additional policy support.

Signs Of Growth Rebound In China

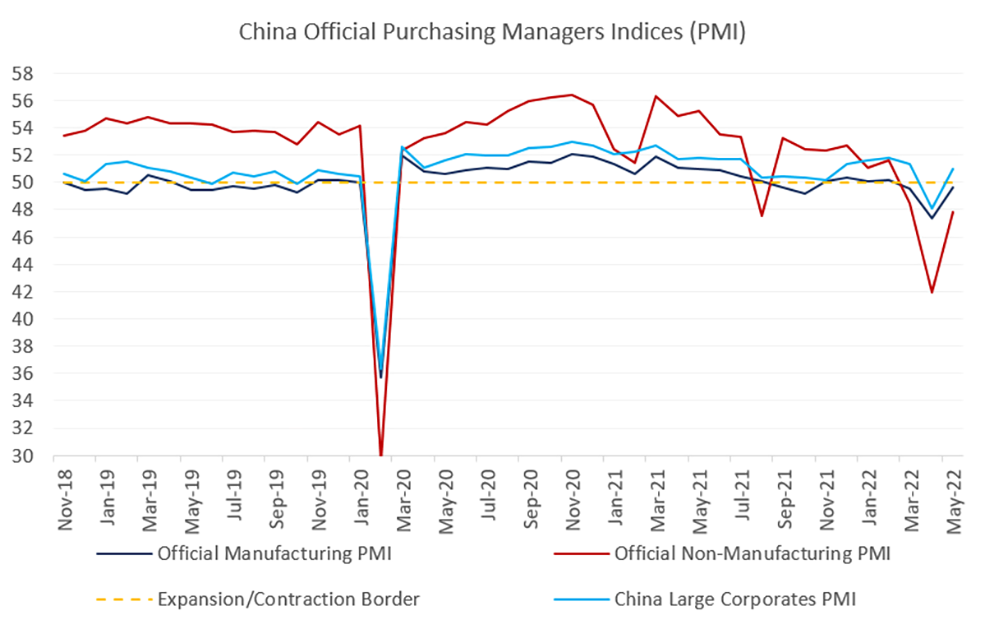

It’s been a while since we had an upside activity surprise in China – but the latest batch of the official Purchasing Managers Indices1 (PMI) signaled that the worst might be behind. Granted, pretty much all gauges – manufacturing, services, new orders, exports, and imports – remained in contraction zone, but they all beat consensus by a sizable margin – giving a nice boost to Chinese equities (and also commodities) in today’s trade. The newswires are talking about lifting some mobility restrictions in major cities, and China’s confirmed COVID cases graph is plateauing. The business expectations PMIs – both in manufacturing and services – looked pretty good. So, where next?

China PMIs – Details Show Many Weaknesses

PMI details show that closing the gap between the 2022 growth forecast (currently 4.7%) and the official growth target (about 5.5%) will not be easy – in part due to supply chain disruptions/backlogs and labor market issues (weak employment PMIs). The latter will continue to weigh on consumption – fueling concerns about the unbalanced recovery. The persisting gap between the small and large companies PMIs shows that while China’s supply-side stimulus allows to “mobilize” the official sector fairly quickly (the large companies PMI flipped to expansion zone in May – see chart below), it does not do much for small privately-owned companies. And this can limit the scope of any future recovery, despite the weakening COVID drag.

China Policy Support – Focus on Supply Side

The recent policy announcements – including “33 Measures” – show more urgency, but in practical terms the emphasis is still on fiscal support and industry/infrastructure. We do get occasional reports about initiatives to boost consumption – including digital cash (e-CNY) transfers in Shenzhen and few other places, lower taxes on some passenger cars – but these are quite limited in size. Other so-called “demand side” measures – for example railway construction bonds – look like supply side measures in disguise. In the meantime, Ministry of Finance is calling for more special bond issuance on the provincial level, asking local governments to utilize proceeds by the end of the summer. The forthcoming credit and money aggregates will therefore be closely watched after a major downside surprise last month. Stay tuned!

Chart at a Glance: China Growth Rebound – Still Driven by SOEs

1We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

Originally published by VanEck on 31 May 2022.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.