Article content

The federal government is aiming to strike a balance with targeted new supports and fiscal discipline over the next few years in the face of soaring inflation and a looming economic downturn.

Article content

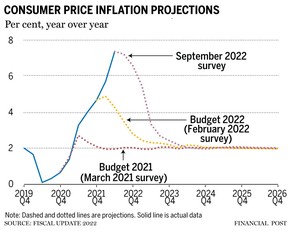

Ottawa said in its fall economic statement on Thursday that inflation has risen much higher than projected in the spring budget, with the latest consumer price index (CPI) reading sitting at 6.9 per cent in September. Interest rates around the world have sharply risen this year to combat pricing pressures, prompting a global economic slowdown and expectations that Canada’s growth would stall next year.

Article content

The fiscal update slashes growth forecasts for this year and next from its spring projections. Real gross domestic product (GDP) is expected to slow to 0.7 per cent in 2023 from the originally forecast 3.1 per cent. GDP this year is expected to grow 3.2 per cent, down from an earlier forecast of 3.9 per cent.

Against this gloomier economic backdrop, the update said fiscal prudence would be important to mitigate the impact of inflation and ensure the government has the capacity to provide targeted support to Canadians.

Article content

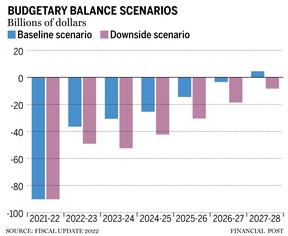

The government is now expecting the deficit to shrink to $36.4 billion in fiscal 2022-2023 and become a $4.5-billion surplus by fiscal 2027-2028.

However, Thursday’s statement also warned of a downside scenario where the budgetary balance deteriorated by an average of around $16 billion per year, adding 3.3 percentage points to the federal debt-to-GDP ratio by 2027-2028, if tax revenues fell, program costs were higher than expected and public-debt charges dramatically rose.

“I am confident that we have the right approach … in this fall economic statement,” Deputy Prime Minister Chrystia Freeland said during a press conference. “And what we’re announcing today — what we’ve been doing throughout — is to strike a balance between necessary, compassionate support for Canadians and fiscal responsibility.”

Article content

A key part of the update was “new support for Canadians who need it most,” or targeted aid for lower-income Canadians to help them cope with the coming downturn and possible recession.

- The government said it would automatically advance Canada Workers Benefit payments for Canadians who qualified for the measure last year, a move expected to cost $4 billion over six years beginning in 2022/2023. This measure could provide $714 for single workers and $1,231 for a family split between three advance payments to help cope with rapidly rising costs of living.

- It also plans to double the goods and services tax credit payment for an estimated 11 million low- and moderate-income Canadians over the next six months, which is expected to provide $2.5 billion in additional support. Single Canadians without children are expected to receive an extra $234, families can get up to an extra $467 and seniors may receive an extra $225 on average.

- The government also plans to move ahead on the Canada Dental Benefit it established in partnership with the New Democratic Party to provide payments of up to $1,300 per child under the age of 12 for families without dental coverage making less than $90,000 a year. The legislation was first introduced in September and the government anticipates it will provide support for 500,000 Canadian children as the government develops a national dental care program by 2025.

- An investment of $250 million over five years into employment training starting in fiscal 2023-2024 to prepare Canadian workers for a shifting global economy under its Employment and Social Development Canada program.

Article content

- The government also plans to lower credit-card transaction fees for small businesses by negotiating with payment card networks and other financial institutions to lower fees. The government is publishing a draft legislative amendment to the Payment Card Networks Act to make this happen. If the industry fails to come up with an agreement over the next few months, the government will push this legislation forward in the new year to regulate credit-card transaction fees.

- The government earmarked about $1.16 billion for fiscal 2022-2023 to top up the Canada Housing Benefit previously announced on Sept. 13 this year. The government expects this tax-free $500 payment will aid 1.8 million low-income renters, families with an adjusted net income of less than $35,000 and single Canadians making under $20,000.

- Following the economic statement, the government plans to table legislation to create the new Tax-Free First Home Savings Account, granting would-be first-time homebuyers another tax-free tool to save up to $40,000, and double the First-Time Home Buyers’ Tax Credit that can provide $1,500 in direct support to homebuyers.

-

Ottawa reveals plan for new tax on stock buybacks

-

Ottawa willing to accept lower returns, more risk to put $15-billion growth fund to work

Once Canada comes out the other side of the anticipated global slowdown next year, Freeland remains optimistic of the country’s economic prospects.

“So far this year, our economic growth has been the strongest in the G7,” she said. “And when we get through the coming global slowdown with the COVID recession behind us, there is no country in the world better-placed than Canada to thrive.”

• Email: shughes@postmedia.com | Twitter: StephHughes95