[ad_1]

Volatility in the markets certainly hasn’t gone away this year, but a popular exchange-traded product tied to volatility will be gone this week.

The iPath S&P 500 VIX Short-Term Futures ETN (VXX), a product that tracks the Cboe Volatility Index (VIX) and is often one of the most actively traded ETPs on the market, will cease trading on Wednesday, Jan. 30.

A short-term tactical tool for speculation and hedging, VXX routinely trades $1 billion worth of shares per day or more. If it disappeared, it surely would be missed.

Fortunately, VXX’s end is only a blip, and a replacement—the iPath Series B S&P 500 VIX Short Term Futures ETN (VXXB)—is already online, with steadily rising volume and assets.

VXX Maturing This Week

VXX is an exchange-traded note (ETN) that is technically debt issued by Barclays. ETNs look and act much like traditional ETFs, but with some key differences. One of those key differences is that ETNs like VXX have a maturity date. That is when investors receive a lump sum payment and the security ceases to exist.

In the case of VXX, that date is this coming Wednesday, 10 years after the product launched.

For anyone who trades or owns VXX, the approaching maturity isn’t a big deal, but you should know what to expect. Market participants can continue trading or holding VXX through Tuesday. If they are still holding the product after that, market participants will receive a cash payment equal to VXX’s net asset value on Tuesday, Jan. 29, which could result in a capital gains tax or loss.

Replacement Product

Alternatively, investors and traders can sell VXX early and swap into VXXB, a replacement product by the same issuer.

VXX and VXXB are nearly identical—both are issued by Barclays, both have 0.89% expense ratios, and most importantly, both track the same S&P 500 VIX Short-Term Futures Index.

For all intents and purposes, VXXB should look and act just like its predecessor, but with the added benefit of continuous trading for the foreseeable future. VXXB, which was issued on Jan. 17 of last year, won’t mature until Jan. 23, 2048—29 years from now.

Of key importance to know is that holding VXX until maturity or selling it ahead of that date are both likely to have tax consequences. Consult a tax professional for guidance.

VXXB Volume & Assets Picking Up

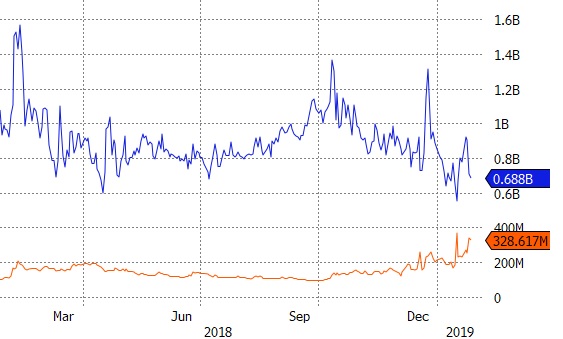

By the look of the volume and asset figures, many traders and investors are already making the switch from VXX to VXXB. Assets under management (AUM) for the new product surged to $348 million this week, closing the gap with the $730 million VXX.

AUM For VXX (Blue) & VXXB (Orange)

Source: Bloomberg

Trading activity has also picked up in VXXB. A total of 8.1 million shares traded hands on Friday, a record high, though still less than the 25.1 million shares of VXX that exchanged hands on the same day.

Trading Volume For VXX (Blue) & VXXB (Orange)

In the coming days, expect the gap in assets and volume between the two products to close further.

Email Sumit Roy at [email protected] or follow him on Twitter sumitroy2

[ad_2]

Source link