China announced another supply-side stimulus package, as the consensus continues to cut the 2022 growth forecast.

China Growth Slowdown, Policy Response

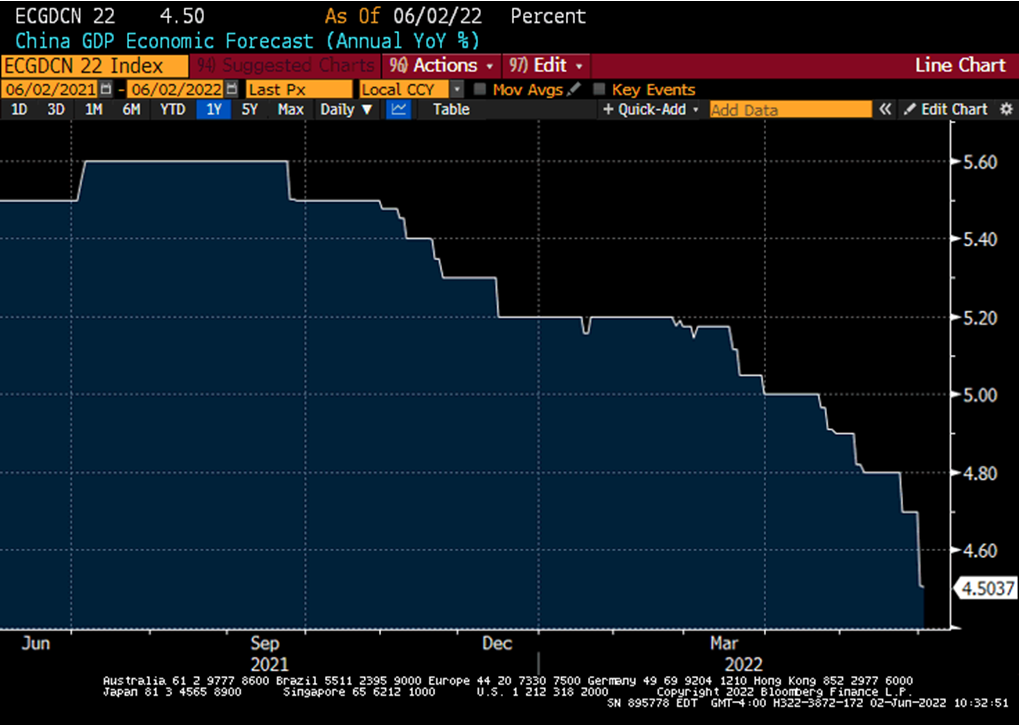

China’s policy stimulus is a newswire fixture these days – and the chart below shows why. China’s 2022 GDP forecast keeps moving farther and farther away from the official growth target, and the speed of downward growth revisions is accelerating despite some encouraging developments on the COVID front. So, is China’s USD120B increase in the credit quota for policy banks – announced yesterday – a game-changer or not? First of all, the package aims to support infrastructure investment – so it sounds like more of the same (= the demand side is still an “orphan”). Second, it is not huge size-wise – well below, for example, the loss of local government’s revenue from land sales estimated by sell-side analysts. So, what we have here is another supply-side “drip stimulus” measure. It will definitely help at the margin, but it remains to be seen whether its impact on GDP growth will not be offset by weak consumption.

New Eurozone Members

China is not the only independent global growth driver, which keeps investors on their toes. The Eurozone is often referred to as the world’s “weak link” due to the worsening growth outlook and a lack of political (and policy) cohesion. But, apparently, some “aspirants” still want to join the club. Croatia is now expected to enter the monetary union in January 2023, and the focus now shifts to the Croatian kuna/EUR conversion rate and potential rating upgrades. The accession also means that Croatia will be leaving the J.P. Morgan’s EM sovereign bond index (EMBIG), albeit its small weight (0.52%) means that the relative weights of other constituents will not change much.

Ukraine War And Policy Challenges

The final big policy move of the day is Ukraine’s humongous rate hike, which brought the policy rate from 10% to 25%. The size was definitely surprising, with the central bank pointing to rising inflation and larger FX interventions (the currency is currently fixed against the U.S. Dollar) as the main reasons for reactivating the policy tool in such a dramatic fashion. This is a strong signal for sure – but the problem is that international aid covers only a portion of Ukraine’s budget deficit, and the country continues to rely on monetary financing as Plan B (which boosts inflation). Stay tuned!

Chart at a Glance: China 2022 Growth Forecast Keeps Moving Away from the Target

Source: Bloomberg LP