By David Trainer

- The Small Cap Growth style ranks last in Q4’19.

- Based on an aggregation of ratings of 20 ETFs and 554 mutual funds in the Small Cap Growth style.

- MDYG is our top-rated Small Cap Growth ETF.

The Small Cap Growth style ranks last out of the twelve fund styles as detailed in our Q4’19 Style Ratings for ETFs and Mutual Funds report. Last quarter, the Small Cap Growth style ranked eleventh. It gets our Very Unattractive rating, which is based on an aggregation of ratings of 20 ETFs and 554 mutual funds in the Small Cap Growth style. See a recap of our Q3’19 Style Ratings here.

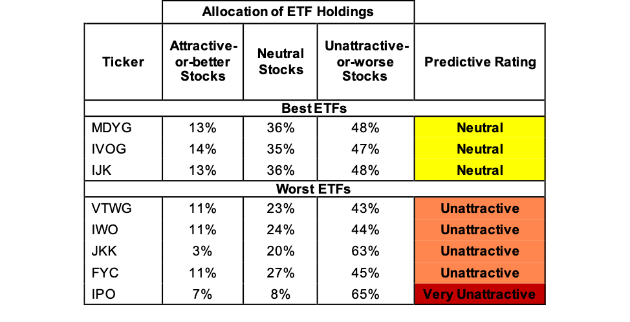

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Small Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 27 to 3257). This variation creates drastically different investment implications and, therefore, ratings.

Investors should not buy any Small Cap Growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off. Our Robo-Analyst technology[1] empowers our unique ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings.[2] We think advisors and investors focused on prudent investment decisions should include analysis of fund holdings in their research process for ETFs and mutual funds.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings

VictoryShares U.S. Small Cap High Dividend Volatility Weighted Index ETF (CSB), Janus Henderson Small Cap Growth Alpha ETF (JSML), and Janus Henderson Small/Mid Cap Growth Alpha ETF (JSMD) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

Read the full article on Seeking Alpha.