[ad_1]

A strange “heartbeat” pattern has emerged in the flows data for the second-largest technology ETF on the market, the $22 billion Vanguard Information Technology ETF (VGT), but investors shouldn’t be alarmed.

Rather than evidence of panic selling and buying in the tech sector, this unusual pattern actually represents Vanguard’s positioning in advance of industrywide sector classification changes scheduled to go into effect on Sept. 28 (read: “Changes Ahead For 24 Sector ETFs”).

Heartbeat Emerges

Since May 8, roughly equal amounts of money have flowed in and out of VGT each week, with the flows often separated by a single day. The quantity of money changing hands is sizable, ranging from $250 million to $400 million at a time:

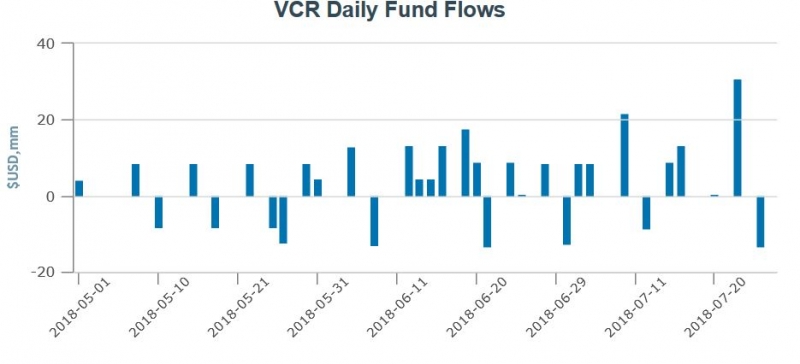

A similar pattern has emerged in the $3 billion Vanguard Consumer Discretionary ETF (VCR), though the quantity of money moving in and out of the fund is an order of magnitude smaller, between $5 million and $20 million:

Chart Sources: ETF.com, Factset; data as of July 31, 2018

No other Vanguard ETFs appear to demonstrate this weekly heartbeat pattern over the same time period.

At first glance, it might seem Vanguard is up to some clever portfolio management, deftly balancing large investors who wish to enter and exit two funds whose sectors have seen higher volatility as of late.

But given the timing of the flows—they first began at the beginning of May—and the fact that the pattern only appears in these two funds, another explanation is more likely.

Sector Changes Coming

As we’ve covered recently, VGT and VCR are two of three Vanguard ETFs impacted by this year’s change in the Global Industry Classification Standard (GICS), which will change the classifications for thousands of global stocks.

As a result of this change, several FANG-style internet companies and media stocks will move to the former telecommunications services sector, which will be renamed communications services. Meanwhile, many e-commerce stocks will be moving from information technology and into the consumer discretionary sector.

Curiously, the Vanguard Communications Services ETF (VOX)—formerly the Vanguard Telecommunications Services ETF—is also impacted by the GICS change, but does not show the same heartbeat pattern in its flows as VGT and VCR. But there’s a good reason for that, too.

Why Heartbeat Appears

Elisabeth Kashner, director of research and analytics for FactSet, first uncovered the appearance of the “heartbeat” pattern in ETF flows data, noting that these large, equal-but-opposite flows in and out of an ETF typically showed up around the fund’s rebalance dates (read: “The Heartbeat Of Tax Efficiency”).

The heartbeat, she theorized, was tell-tale evidence of a trade that allows ETF managers to reduce the significant capital gains that would otherwise result from large rebalance and reconstitution trades.

[ad_2]

Source link