[ad_1]

A whirlwind month for crude oil prices has left investors’ heads spinning. A mere six weeks after hitting a four-year high of nearly $77, West Texas Intermediate (WTI) oil prices plunged to a one-year low of $55 this week, breaking downside records as it plummeted.

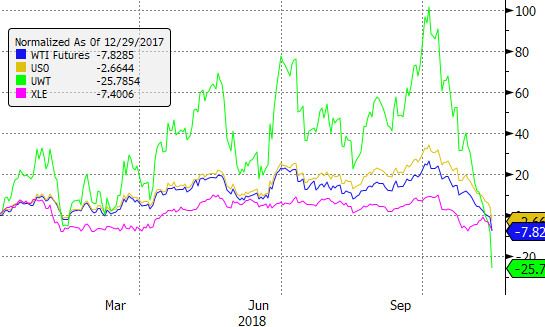

As of Nov. 13, WTI crude futures had fallen for 12-consecutive sessions, the longest such streak on record. In the blink of an eye, oil ETFs that were among the best-performing ETFs of the year as recently as last month became some of the worst performers of 2018.

The $1.6 billion United States Oil Fund LP (USO), which tracks near-month crude oil futures contracts, was up as much as 33.9% on Oct. 3; now it’s down 2.7% for the year. Meanwhile, the $309 million VelocityShares 3x Long Crude Oil ETN (UWT), which adds leverage to the mix, went from a gain of 101.3% to a loss of 25.8% year-to-date—an eye-popping reversal in just six weeks.

ETFs tied to energy equities also buckled, but not as much as the futures-tracking products. The $16 billion Energy Select Sector SPDR Fund (XLE), for example, went from gains of 9.5% to a loss of 7.4% in the same period.

A steep sell-off in the broader U.S. stock market around the same time certainly didn’t help XLE, but investors taking a longer-term view of oil prices limited losses in the energy equity ETF.

YTD Returns

From Shortage To Glut

The dramatic turnaround in oil prices and oil ETFs coincided with an equally dramatic turnaround in oil market fundamentals.

In early October, the market was fearful that U.S. sanctions on Iran’s oil industry would cripple exports out of that country, leading to a global supply shortage. But days before the sanctions went into effect on Nov. 5, the U.S. issued waivers to eight nations, allowing them to continue importing Iranian crude. By then, Iranian exports had already fallen 800,000 barrels per day from their peak, but the waivers halted an even larger decline.

With Iranian exports stable, the market was left to focus on growing supplies from elsewhere, including other OPEC producers who had pledged to increase output to make up for lost Iranian barrels.

The growth was staggering. Even with combined output from Iran and Venezuela down 1 million barrels per day, total global output was up a whopping 2.6 million barrels per day in October, according to the latest data from the International Energy Agency. That’s well ahead of demand growth of 1.3 million barrels per day.

Record production from Saudi Arabia, Russia and the U.S. means global crude oil inventories are on track to increase by 0.7 million barrels per day during the fourth quarter, predicts the IEA. If current trends continue, the buildup could jump to 2 million barrels per day during the first half of 2019, the agency notes.

Potential Cuts Coming

Seeking to head off a potential glut, Saudi Arabia said this week it would cut its oil production by 0.5 million barrels per day in December, and would urge its fellow OPEC members to cut production by a similar amount starting next year.

Russia, which has coordinated production cuts with OPEC in recent years, pushed back on that idea. The country’s energy minister said that producers shouldn’t react to “one-off fluctuations” and that they should wait and see how supply and demand develop going forward.

The IEA, which works in the interest of consumer nations, agreed that producers shouldn’t rush to cut output.

“[Rising inventories] should be welcomed as a form of insurance, rather than a threat. The United States remains committed to reducing Iranian oil exports to zero from the 1.8 mb/d seen today; there are concerns as to the stability of production in Libya, Nigeria and Venezuela; and the tanker collision last week in Norwegian waters, although modest in impact, is another reminder of the vulnerability of the system to accidents,” the agency said.

Painful Memories

That said, if oil prices continue plummeting, Russia could join Saudi Arabia in sounding the alarm. Both countries are highly dependent on revenues from oil sales, and are eager to prevent a complete collapse in oil prices like the one in 2014-2016 that sent WTI crude prices as low as $26.

Back then, a similar production surge, led by the U.S., created one of the biggest oil gluts in modern history. In 2014, U.S. oil production was up 1 million barrels per day; this year, it’s on track to rise a whopping 2 million barrels per day.

That’s enough to send shivers down the spine of any oil bull.

Email Sumit Roy at [email protected] or follow him on Twitter sumitroy2

[ad_2]

Source link