By Dan Suzuki, CFA

Deputy Chief Investment Officer

Bear markets always signal a change in leadership

Very few market rules, technical or otherwise, withstand the test of time, mostly owing to the efficiency of markets. But here are two that you can count on: (1) future cycle leadership is never the same as prior cycle leadership, and (2) bear markets always signal a change in leadership. Thus, this year’s sell-off has been the market’s way of trying to hit investors over the head with the idea that they should avoid clinging to yesterday’s winners, but few seem to be listening.

Bubbles don’t deflate overnight

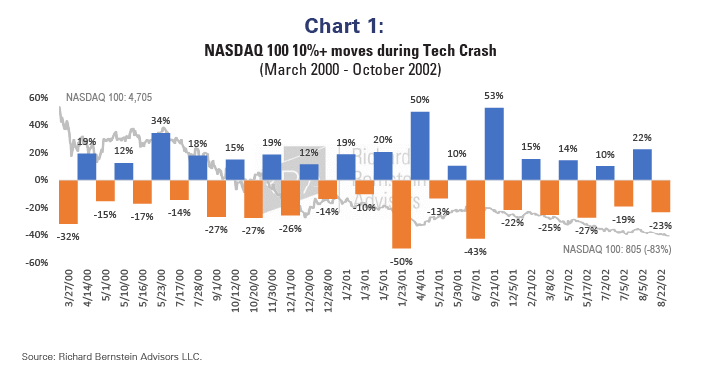

Rather than rotating portfolios away from bubble assets, investors tend to view the initial price declines as attractive opportunities to buy secular growth at huge discounts. Yet the history of bubbles suggests that they don’t return to being great investments after just six months of selling off. During the Tech crash in 2000-2002 — a bear market which lasted 2.5 years — the NASDAQ 100 Index had 16 distinct bear market rallies exceeding 10% during its 83% decline, with three of those rallies greater than 30% (Chart 1).

Chart 1: NASDAQ 100 10%+ moves during Tech Crash (March 2000 – October 2002)

Better to be late than early

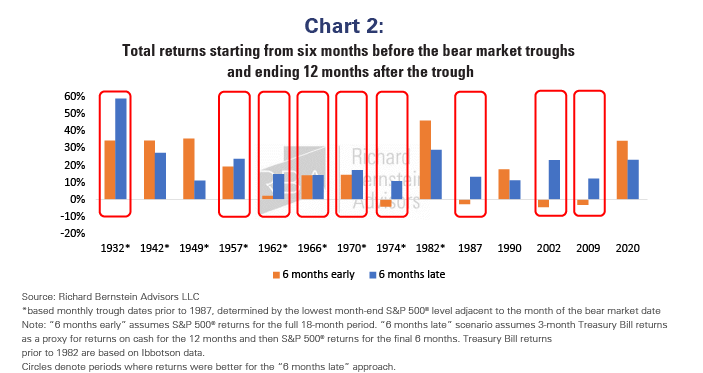

Many investors insist on buying early so that they “can be there at the bottom.” Yet history suggests that it’s better to be late than early. In a refresh of our previously published analysis, we analyzed the returns for the full 18-month period encompassing the six months before and the 12-months after each market bottom. We then compared the hypothetical returns of an investor who owned 100% stocks for the entire period (“6 months early”) with one who held 100% cash until six months after the market bottom, then shifted to 100% stocks (“6 months late”). In seven of the last ten bear markets, it has been better to be late than early (Chart 2). Not only does this tend to improve returns while drastically reducing downside potential, but this approach also gives one more time to assess incoming fundamental data. Because if it’s not based on fundamentals, it’s just guessing.

As an aside, the only instances in the past 70 years where it has been better to be early were in 1982, 1990 and 2020. But in each of those instances, the Fed had already been cutting interest rates. Given the high likelihood that the Fed will continue to tighten into already slowing earnings growth, it seems premature to be significantly increasing equity exposure today.

Chart 2: Total returns starting from six months before bear market troughs and ending 12 months after the trough

Content continues below advertisement

based monthly trough dates prior to 1987, determined by the lowest month-end S&P 500® level adjacent to the month of the bear market date

Note: “6 months early” assumes S&P 500® returns for the full 18-month period. “6 months late” scenario assumes 3-month Treasury Bill returns as a proxy for returns on cash for the 12 months and then S&P 500® returns for the final 6 months. Treasury Bill returns prior to 1982 are based on Ibbotson data.

Circles denote periods where returns were better for the “6 months late” approach.

For more news, information, and strategy, visit the ETF Strategist Channel.

Dan Suzuki is registered with Foreside Fund Services, LLC which is not affiliated with Richard Bernstein Advisors LLC or its affiliates.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. The investment strategy and broad themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.