Kevin Carmichael: 100 basis point increase shows public it’s serious about getting price pressures under control

Article content

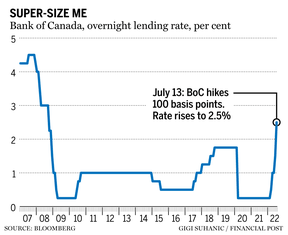

The Bank of Canada delivered a jolt to Bay Street, raising its benchmark interest rate a full percentage point, the biggest one-time increase since August 1998, when the central bank was fighting to protect the value of the currency during the Asian financial crisis.

Advertisement 2

Article content

Canada’s benchmark borrowing rate is now 2.5 per cent, compared with 1.75 per cent ahead of the COVID-19 recession. The aggressive move is all about inflation, which the Bank of Canada predicts will accelerate to around eight per cent this summer, way too fast for policymakers whose job it is to keep the consumer price index advancing at an annual rate of about two per cent.

“Surveys indicate more consumers and businesses are expecting inflation to be higher for longer, raising the risk that elevated inflation becomes entrenched in price- and wage-setting,” the Bank of Canada said in a statement. “If that occurs, the economic cost of restoring price stability will be higher.”

Here’s what you need to know:

Panic move

Advertisement 3

Article content

Governor Tiff Macklem’s crew of policymakers barely tried to conceal their alarm over recent data that suggests companies and households are starting to see inflation as permanent.

“With the economy clearly in excess demand, inflation high and broadening, and more consumers expecting high inflation to persist for longer, the Governing Council decided to front-load the path to higher interest rates by raising the policy rate by 100 basis points today,” the Bank of Canada said in a statement.

Central bankers have nightmares about the public losing faith in their ability to keep inflation low and stable. Most think one of the lessons of the 1970s and early 1980s is that suppliers and workers won’t overreact to temporary surges in commodity prices if they think the central bank will keep a lid on inflation.

Advertisement 4

Article content

It’s been four decades, however, since Canadians have seen inflation like they’ve seen in 2022. Macklem came of age as an economist while former United States Federal Reserve chair Paul Volcker was winning his war on inflation by jacking up interest rates to double digits. The Canadian decided a demonstration of his own resolve was necessary to avoid a repeat of the painful recession Volker’s strategy caused.

“It’s a little bit of a `wow’ moment,” said Tom O’Gorman, director of fixed income at Franklin Templeton Canada, the Canadian unit of Franklin Templeton Investments Corp. “They’re nervous.”

More coming

The Bank of Canada estimates the “neutral” rate — a theoretical setting at which the central bank’s benchmark rate neither helps nor hinders economic growth — is between two per cent and three per cent. The policy rate is now in that zone, but policymakers made it clear they aren’t finished.

Advertisement 5

Article content

“The Governing Council continues to judge that interest rates will need to rise further, and the pace of increases will be guided by the bank’s ongoing assessment of the economy and inflation,” the statement said. “The Governing Council is resolute in its commitment to price stability and will continue to take action as required to achieve the two-per-cent target.”

The Governing Council continues to judge that interest rates will need to rise further

Macklem previously said he might have to push the benchmark rate above three per cent to get inflation under control. With prices accelerating into the second half of the year, rather than slowing, it’s become more likely that policymakers will have to push interest rates to a level that hinders economic growth.

The new outlook

The decision to “front-load” the shift to higher interest rates was based on an updated quarterly forecast that would have startled Macklem and his deputies when staff economists presented it. Here are the highlights:

Advertisement 6

Article content

Inflation

The central bank sees year-over-year increases in the consumer price index averaging eight per cent in the third quarter, and ending the year 7.5 per cent higher than at the end of 2021, compared with a previous estimate of 4.5 per cent. The Bank of Canada now assumes the consumer price index will still be above three per cent at the end of 2023 (compared with a previous estimate of 2.4 per cent). The central bank’s projection has inflation returning to target in 2024.

Growth

Higher interest rates and costs are starting to bite. The Bank of Canada predicts gross domestic product will expand 3.5 per cent in 2022, compared with an April estimate of 4.2 per cent, and then slowing to 1.8 per cent in 2023, compared to 3.2 per cent forecasted previously. That would be what economists call a “soft landing” from the shock of higher interest rates, and Macklem will have orchestrated an impressive manoeuvre if he can pull it off. In the past, sharp increases in borrowing costs have tended to cause recessions.

Advertisement 7

Article content

Lighting up the loonie

Few, if anyone, on Bay Street saw a full one-point increase coming. Most reckoned the Bank of Canada would follow the Fed and lift the benchmark rate by three-quarters of a point.

Macklem and his deputies had an incentive to outdo the Fed. Typically, higher oil prices cause the value of the Canadian dollar to rise. But for whatever reason, the exchange rate has been roughly stable even as international oil prices surged above US$100 per barrel. That has contributed to inflation because a weaker currency makes imports more expensive.

An important factor in determining exchange rates is interest-rate differentials between various central banks. By going bigger than the Fed and other major central banks, the Bank of Canada will jolt traders into rethinking the values they assign to various currencies. The loonie should get a lift, which would lean against inflation — at least until the next Fed policy meeting, when chair Jerome Powell will have to confront his own inflation threat.

Advertisement 8

Article content

Ahead of the Bank of Canada’s announcement, markets learned the U.S. consumer price index increased 9.1 per cent in June from a year earlier. “The Fed will probably do 100 now,” O’Gorman said. “It’s the new arms race.”

The Canadian dollar traded as high as about 77.3 cents against the U.S. dollar, compared with about 77.8 cents ahead of the interest-rate increase. The exchange rate drifted back towards 77 cents as the day wore on.

Housing starting to hurt

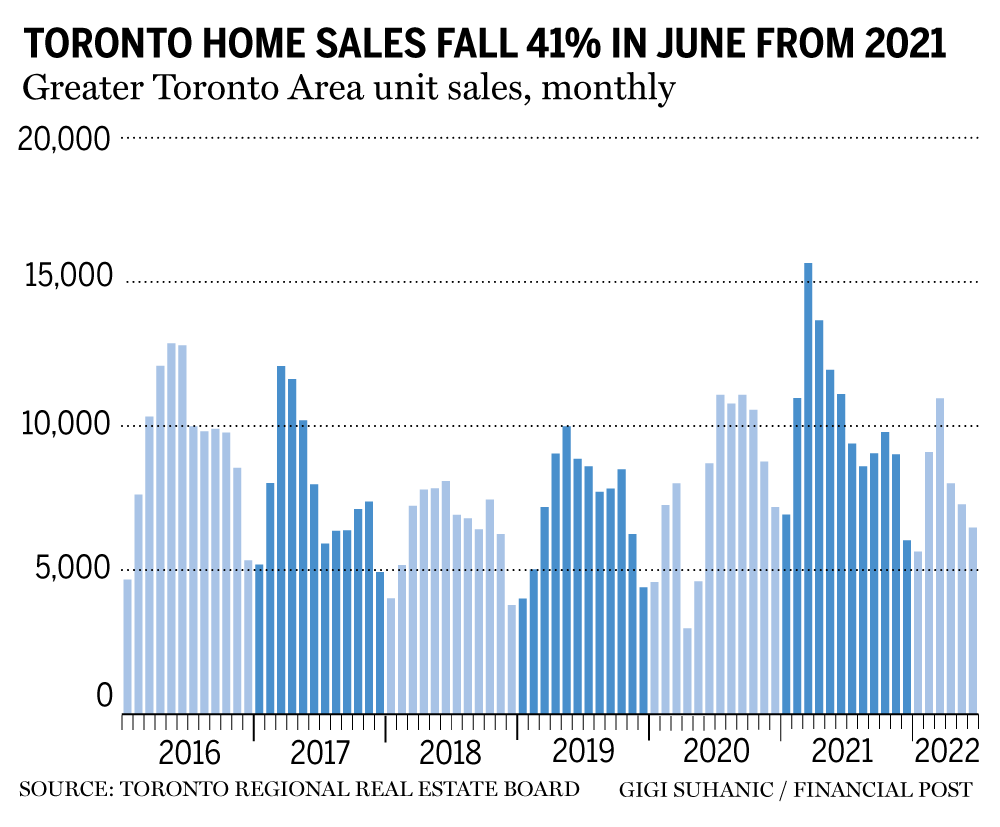

“A sharp slowdown in the housing market is underway,” the Bank of Canada said in its new quarterly economic outlook.

Real estate is perhaps the industry most sensitive to interest rates. Demand and prices skyrocketed when the Bank of Canada dropped the benchmark rate to almost zero, and now the froth in markets such as Toronto is quickly dispersing as borrowing costs rise.

Advertisement 9

Article content

-

Bank of Canada raises interest rate: Read the official statement

-

What the Bank of Canada’s full percentage point hike means for the housing market and your mortgage

The biggest change in the Bank of Canada’s forecast for economic growth is its outlook for the contribution from housing, which it now sees subtracting 0.7 percentage points from gross domestic product in 2022 and an additional 0.6 percentage points from its 2023 GDP calculation. (The April estimate had housing subtracting 0.2 percentage points from GDP in 2023.)

Five-year fixed mortgage rates are now at their highest in more than a decade.

Bottom line

Central banks have spent the past decade thinking about the extent to which they test old relationships between employment and inflation, because there was plenty of evidence that they could probably run their economies hotter than they thought. Still, price stability remained the primary mission, and since it is now clear that inflation isn’t slowing on its own, the Bank of Canada decided to go with a shock-and-awe increase to show the public it’s serious about getting price pressures under control.

Recent data showed that companies and households are starting to bake expectations of higher inflation into what they charge for goods and services and what they expect to be paid for their labour. That risks an inflation spiral that would require a recession to stop. By moving aggressively now, policymakers hope they are pre-empting a bad outcome.

• Email: kcarmichael@postmedia.com | Twitter: CarmichaelKevin