Dogged by scandal, grocers need to get it right on inflation — but some in the industry don’t think that’s happening

Article content

One weeknight this spring, Michael Medline was speaking at an event at a Toronto business school. It was a starchy corporate function, promoting a book that Medline and some other CEOs helped write on management in the pandemic.

Advertisement 2

Article content

Medline, the head of Empire Co. Ltd., Canada’s second-biggest grocery chain, started off the way you’d expect. He talked about plexiglass. He talked about the obsession with safety, the profits-be-damned attitude that coursed through the food industry during those first few waves of COVID-19. It was the “best behaviour from capitalism” that he’d seen, he said.

“Not once in any conversation did someone talk to me about maximizing profit.”

But then — maybe off the cuff, maybe not — he switched to talking about the present. He said he’d noticed how some are quick to demonize corporations, and “how much money they make.”

Medline had an opinion about that. “I don’t think it’s fair,” he said, before backtracking a bit. “It’s fair in some cases. I’m not sticking up for every company in the world, OK?”

Advertisement 3

Article content

But he argued that companies like his — a network of 1,500 stores that includes Sobeys, Safeway, IGA, FreshCo and Farm Boy — are more valuable to the country when they’re doing well. “When we weren’t successful, we’re weren’t employing as many people, we weren’t giving back to the community as much,” he said. “So to me, you want to be successful.”

In that brief aside, Medline traced what has become the most dangerous fault line in the entire food business.

Being successful — more specifically, boosting profits, hiking dividends, and increasing share buybacks — has become a public relations liability, in the middle of the worst inflation crisis in decades. And it is exactly what Canada’s big grocers have done, quarter after quarter, to the point that some economists and customers have started asking a simple question: Are you getting rich off inflation?

Advertisement 4

Article content

That isn’t really one question. Try to answer it and you get more questions. The first one comes from David Macdonald, an economist at the Canadian Centre for Policy Alternatives, a left-leaning think-tank, who has written on the subject. He realizes that drought, supply-chain backlogs, the war in Ukraine, and fuel prices have all driven up the cost of food. But his question is whether Canada’s handful of dominant grocery chains are jacking up prices more than necessary.

“Is the expectation of higher prices allowing stores to take advantage of that?” he asked recently.

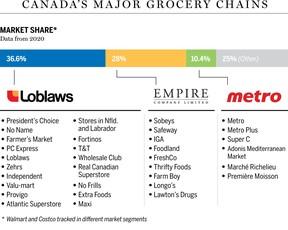

The country’s top three grocers — Loblaw Companies Ltd., Empire and Metro Inc. — say they’re not. Earlier this month, the Toronto Star, the biggest newspaper in the country’s biggest city, published an investigation that concluded the grocers are, in fact, profiting from inflation. The Star said it ran its analysis by five economists, Macdonald among them.

Advertisement 5

Article content

We are doing well in spite of inflation

Empire spokesperson Karen White-Boswell

But the grocers say there are other, non-inflation-related reasons for their profit gains — they’ve acquired new businesses, or become more efficient in running the ones they have, or started selling more of the higher-margin pharmacy and beauty products that mostly disappeared during the height of the pandemic.

As one grocery spokesperson put it recently: “We are doing well in spite of inflation.”

If that’s true, if the situation is much more complicated than consumers and economists think it is, here’s another question: What’s the best way to go about explaining to the Canadian grocery-shopping public that you’re not ripping them off?

Because at this point, trust is probably running thin in the shadow of scandals dogging the industry. There’s the ongoing federal investigation into allegations of bread-price fixing, and the Hero Pay debacle of June 2020, and the drawn-out government campaign to stop the grocery chains from bullying their suppliers. All of it means it’s very important for the grocers to get it right on inflation. Some in the industry don’t think that’s happening.

Advertisement 6

Article content

‘It doesn’t give a clear picture’

Steven Salterio, who holds the Stephen J.R. Smith chair in accounting and auditing at Queen’s University, co-wrote a bestselling case study in the 1990s on Loblaw that focused on an innovation the company was using in auditing.

“We got over 40,000 downloads on it,” said Salterio, who still pops into foreign grocery stores on vacation, just to poke around. “In the accounting case world, that’s a big number.”

The way he sees it, if a grocery company was using inflation to pad its profits, there’d be tells. First, the margins would get fatter. Second, there wouldn’t be a plausible explanation for that growth in the public financial statements.

“That’s my accountant’s logic in a nutshell,” he said in June, during one of several long talks this summer.

Advertisement 7

Article content

Salterio looked at balance sheets from Loblaw, Empire and Metro, and compared margins and efficiency metrics over the last year to their five-year averages. (The other two main food retailers, Walmart Inc. and Costco Wholesale Corp., don’t provide detailed reporting on their Canadian operations.)

The first test was easy. Each of the three grocers’ operating margins and gross margins increased in the last year, compared with their five-year averages. The second part was more complicated.

Salterio went through reports on inventory turnover, asset turnover, and receivables turnover, as well as the quick ratio and the current ratio — both measures of the company’s liquidity — and the debt-to-equity ratio, based on data from Investing.com. He was looking for signs that the company was getting better at managing the business.

Advertisement 8

Article content

At Metro, he found the “least compelling evidence” that the chain was exploiting inflation to increase profits. Despite the company’s profit margin growth, the past year’s return on assets were lower than the five-year average. “So that indicates that they have a long way to go just to meet past expectations of overall performance,” he said.

For its part, Metro spokesperson Stephanie Bonk said the improvement in gross margins is due to “a strong bounce-back performance” in the company’s pharmacy division after eight weeks of “labour conflict” in the first quarter of 2021, and a six-week government ban on the sale of non-essential products in Quebec the following quarter.

“Metro is not taking advantage of inflation to increase its profits,” Bonk said in an email.

Advertisement 9

Article content

At Empire, Salterio found improvements in the inventory turnover rate, which measures how quickly a store cycles through inventory. If the turnover rate is 12, “you sold that inventory and you bought new inventory 12 times in a year,” he said. “The faster you can sell your inventory, the more profit you make because you don’t have to mark it down due to obsolescence, you don’t have to throw it out because it’s spoiled and you don’t have to pay interest on the holding cost of the inventory.”

At Empire, inventory turned over 14.6 times in the latest 12 months, compared to an average of 14.1 times in the last five years, according to Investing.com. That would help explain Empire’s gross margin improvement to 25.7 per cent in the most recent 12 months of financial reporting, from an average of 25.1 per cent in the last five years, according to Investing.com. But at the same time, Empire’s asset turnover dropped to 1.9 times in the last 12 months, from a five-year average of 2.3 times.

Advertisement 10

Article content

“It’s not unambiguous evidence,” Salterio said.

Empire said the margin improvements came from the launch of two major overhauls of the business. Project Sunrise, starting in 2017, cut $550 million of cost from the business, and “greatly simplified our operating structure,” spokesperson Karen White-Boswell said in an email. Project Horizon, launching in 2020, aims to cut $500 million in annualized EBITDA by driving an improvement in EBITDA margin of 100 basis points, or one percentage point.

We are doing well in spite of inflation,” White-Boswell said in an email. “We do think inflation has helped some other businesses, but for us, it impacts sales and doesn’t help margins. Our success has come from improved execution and the implementation of the transformation initiatives we have been focused on since 2017.”

Advertisement 11

Article content

White-Boswell didn’t respond when asked what other business might be getting help from inflation.

Salterio found a similar situation at Loblaw, where one efficiency indicator showed progress while another didn’t. At Loblaw, the inventory turnover dropped by 10 basis points in the last year, compared to the five-year average. At the same time, its asset turnover rate improved by 10 basis points, according to Investing.com data.

“It doesn’t give a clear picture,” he said. “In order for me to unambiguously say ‘Yes,’ I would like to see consistent movement in one direction or the other. But that’s not what the numbers show.”

However, Salterio did note that Loblaw led its rivals in margin improvement, with its gross margin in the last year up 130 basis points to 31.8 per cent, compared to a five-year average of 30.5 per cent.

Advertisement 12

Article content

Loblaw executives have said repeatedly that recent margin growth is coming from the drug retail side of the business, which includes the Shoppers Drug Mart chain. People started going back to offices and parties as the public health restrictions waned in the last few quarters, boosting demand for “high margin” products such as beauty products and cosmetics.

“There’s tremendous strength in fragrances and we’re wondering what people are doing with all of those perfumes,” Loblaw president Galen Weston said in a call with financial analysts on July 27.

That explanation makes sense to Salterio. “That’s a plausible argument,” he said. But it’s not possible to check using the data available in the public financial statements.

Advertisement 13

Article content

‘Flawed premise’

Loblaw said the critique of its methods is based on a “flawed premise.” Spokesperson Catherine Thomas said it’s unfair to use the inventory turnover rate as a gauge of Loblaw’s internal efficiency and its impact on profit margins.

Thomas said inventory turnover is only “a representation of our sales efficiency, not our cost efficiency.”

Loblaw also said comparing its margins over the last year to the five-year average doesn’t work, because the business has changed substantially over that time — most notably because Loblaw spun out its interest in the real-estate investment trust Choice Properties in 2018. In the past five years, Loblaw said it has made a number of changes to its business, including selling off gas bars, introducing new digital advertising and freight businesses, and finding operational efficiencies that totalled $1.2 billion over the past four fiscal years.

Advertisement 14

Article content

“It is impossible to look at our business over the past five years and not take into account the way the business has changed, or the full portfolio,” Thomas said.

Loblaw also said its margins reflect the performance of its entire slate of businesses, which includes its personal banking wing, PC Financial — not just groceries.

“As we’ve said a number of times, our business includes apparel, banking, mobile shops, pharmacy, beauty and, yes, food,” Thomas said. “Over the past five years, and in the past quarter in particular, we’ve seen faster growth in retail pharmacy than in grocery, and our increased profits can be attributed to higher margin items, like cosmetics.”

Partha Mohanram, an accounting professor at the University of Toronto’s Rotman School of Management, said pointing to a boost in sales on high-margin category as proof that you’re not price-gouging in food makes for a “weird argument,” adding that “it’s like they’re saying, ‘Hey, you know what? We are not profiteering here, but we’re profiteering elsewhere.’”

Advertisement 15

Article content

Thomas, Loblaw’s spokesperson, said that’s an “unfounded assumption.”

“It implies that we are being opportunistic about margin in ANY category,” she said. “What we’re saying (and have said consistently) is that there are higher margin categories in our business, such as cosmetics. That has not changed. What HAS changed is that customers are buying more of those.”

Thomas gave an example about bananas and lipstick.

“If last quarter someone bought two bananas with a profit margin of five per cent and one lipstick with a profit margin of 10 per cent and this quarter they bought two bananas and two lipsticks, nothing has to change at our end for our profit margin to increase,” she said.

Loblaw declined to provide additional financial information to show how profits are coming from a boom in pharmacy and not grocery. Bloomberg data show that 94.3 per cent of Loblaw’s gross profits in 2021 came from the retail segment, with the rest coming from banking.

Advertisement 16

Article content

“Gross margin performance in food retail was stable,” Loblaw chief financial officer Richard Dufresne told analysts on July 27, adding that COVID-19 vaccinations and testing at Shoppers helped drive margin improvement in the drug retail division.

‘People are getting colds again’

The Retail Council of Canada, a lobby group that represents grocers, said Loblaw’s financial reporting does in fact support its explanation that its recent gains were driven by a surge in drug retail sales. The company’s latest quarterly release on July 27 shows that in drugstores, same-store sales — a common metric used in retail, which ignores results from recently opened or closed stores to give a clearer picture on year-over-year performance — increased by 5.6 per cent compared with the previous year. In food, Loblaw’s same-store sales increased by only 0.9 per cent.

Advertisement 17

Article content

“Much of the growth is being driven by health and beauty sales as people return to work,” said RCC spokesperson Michelle Wasylyshen. “And, people are getting colds again and pollen allergies — basically the whole front of store in a pharmacy.”

Loblaw’s financial statements do not provide breakdowns for the profit performance of food versus pharmacy, and Thomas said it won’t break out numbers beyond what’s published. “The grocery industry is one of the lowest-margin sectors in the entire country,” she said in early July, adding that Loblaw made less than four cents for every $1 it sold at its grocery stores.

Thomas was referring to the first quarter, in which Loblaw made $12.3 billion in sales. Less than four cents on the dollar works out to almost $460 million in profit. Loblaw’s profits in 2021 totalled more than $1.85 billion, up from $1.18 billion in 2020 and $1.14 billion in 2019, according to Bloomberg data. In the latest 12 months that Loblaw has reported on — between June 2021 and June 2022 — the company has made $1.98 billion in profit, Bloomberg data show.

Advertisement 18

Article content

In 2021, the entire food and beverage industry made about $7.3 billion in pre-tax profit, according to Statistics Canada. That’s $1.8-billion more than 2020, and about $4-billion more than the industry’s pre-pandemic profits of $3.2 billion in 2019. Food and beverage manufacturers in Canada made $9.9 billion in 2021, $1-billion more than 2020 and roughly $3-billion more than 2019.

In the first quarter of 2022 — the latest period for which Statistics Canada has data — pre-tax profits were $1.52 billion, below the $2.29 billion in profits at the same time in 2021. However, that was still ahead of more than the $1.16 billion the industry earned in profits over the first three months of 2020.

The Retail Council said that in 2021, the amount of total cents the grocers made on each dollar was in the normal range. Loblaw’s total profit margin last year was 3.6 per cent, Empire’s was 2.5 per cent and Metro’s 4.7 per cent, RCC said.

Advertisement 19

Article content

“These are all within, or very close to, the historical norms for the grocery industry of profits in the 2.5 per cent to 4.5 per cent range (which is one of the lowest in any industry and is dwarfed by the level of profitability of most food vendors),” Wasylyshen said in an email.

As profits increased this year, Canada’s top grocers rewarded their shareholders with large dividend increases and share repurchases. In May, on the same day it reported a 41-per-cent increase in first-quarter profit, Loblaw announced it was increasing its dividend by four cents per share, or 11 per cent. Loblaw said it has raised its dividend 11 consecutive times since 2012. In that time, it’s never raised the dividend by as much as 11 per cent. Last year, the increase was nine per cent. Between 2012 and 2022, annual dividend increases at Loblaw averaged 6.2 per cent.

Advertisement 20

Article content

In its latest earnings update, on July 28, Loblaw said it is now forecasting earnings per share in the “mid-to-high teens” — higher than its previous forecast for EPS growth “in the low double digits.” Loblaw said it plans to “return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.” The company spent $603 million on repurchases for cancellation in the second quarter alone.

At Empire, the company in June announced a 10-per-cent dividend hike and said it also intends to repurchase $350 million in shares in the coming fiscal year. And Metro announced a 10–per-cent dividend increase in January.

“On the margin side, I can tell you that our gross margins in food are not necessarily up,” Metro CEO Eric La Flèche said at the time. “Actually, we’re not passing on all the cost increases that we’re getting from our suppliers.”

Advertisement 21

Article content

‘Charging high prices is not illegal’

But some feel the grocers still haven’t adequately explained the jump in profits.

“Frankly, there is a limit to what you can see in the public statements,” said Macdonald, the economist at the Canadian Centre for Policy Alternatives.

“Now it’s a question of, OK, profits are up. Is inflation playing a role?” Macdonald continued. “In big operations like this, there’s going to be a variety of factors. It’s not just going to be inflation. Or it’s not just going to be changing preference. Or it’s not just going to be efficiencies.”

If the financial statements don’t definitively show what’s happening, he said, the government should investigate to answer it for them.

“There’s a role for federal agencies to be playing in terms of making sure that those price increases aren’t excessive,” Macdonald said.

Advertisement 22

Article content

Federal Agriculture Minister Marie-Claude Bibeau’s office suggested checking in with the Competition Bureau — the agency responsible for enforcing competition law in Canada.

But the Bureau said it’s only able to enforce matters where competitors collude to raise prices, not when one company does so by itself. “Charging high prices is not illegal in itself, and the Competition Bureau does not have the authority to regulate prices,” spokesperson Marie-Christine Vézina said in an email.

The federal Agriculture Department said it is monitoring food prices closely.

“There are many factors that contribute to grocery retail profit,” the department said in a statement. “A key driver of retail profitability includes increasing sales volumes and making purchases more attractive to consumers by keeping prices low.”

Advertisement 23

Article content

‘Why should they benefit from the delta?’

What’s clear is that food inflation is up, and so are profits at the country’s biggest food retails. That sounds bad, for sure. But with such sprawling operations, and limited public information, there’s no unambiguous evidence that what the grocers are doing is actually bad — certainly not to the extent that Macdonald and other critics imply.

The grocers have plausible explanations for how they expanded margin and grew profits. Still, some wonder whether that growth is right, philosophically speaking. Partha Mohanram, the University of Toronto accounting professor who specializes in the analysis of financial statements, said it’s clear that inflation has increased the sales dollars funnelling into grocery stores. And even if food margins stayed the same, “the same percentage of a larger number is a larger number.”

Advertisement 24

Article content

In other words, four cents on the dollar is more when you’re making more dollars. If profit margins haven’t changed, it means members of the grocery oligopoly opted against using their heft to absorb any of the increases in food, fuel, and transportation costs. Gita Gopinath, deputy managing director of the International Monetary Fund, wondered in a note in February 2021 whether industry consolidation over recent decades would act as a firewall between surging commodity prices and retail costs. Not in the case of Canadian grocery, where Loblaw, Empire, and Metro account for 75 per cent of sales, according to the market research firm IBIS World.

“If the only reason sales have increased is because of inflation, you could argue that in an ideal world, their profit margins should go down — because why should they benefit from the delta because of inflation?” Mohanram said.

Advertisement 25

Article content

-

Loblaw suspects food inflation crisis may have finally peaked

-

How the COVID ‘hero pay’ scandal prompted Ottawa to make wage-fixing illegal

-

Sobeys’ parent Empire boosts dividend after growing profits in latest quarter

Through this latest bout of inflation, grocers have said they are facing a wave of requests from suppliers. Each one is looking for the same thing. Their costs for ingredients, packaging, transport and labour are rising and they want the retail chains to pay more at wholesale, to shoulder more of the burden. From there, grocers can just say no — as in the case of Loblaw versus PepsiCo Inc. earlier this year.

Diane Brisebois, CEO of the Retail Council, said just because profit margins are up, doesn’t mean grocers aren’t absorbing cost increases as well. “You’re assuming that one cannot go with the other,” she said. “They know how consumers are sensitive to price.”

Advertisement 26

Article content

But Gillian Kerr, a veteran grocery executive who held positions at all three of the grocery chains, said she believes the industry is too focused on shareholder value to absorb some of the cost increase in its margins. “They do not have the DNA to take a lower margin. It’s just not what they do,” she said.

Kerr said there’s a follow-the-leader spirit in the Canadian grocery sector, and she doesn’t expect anyone to do anything drastic on price unless they have to.

“It’s always a game of chicken,” Kerr said. “Until it’s a competitive issue, nobody is going to do a damn thing,” she continued. “They’re just waiting and seeing where public outrage is going to go.”

• Email: jedmiston@nationalpost.com | Twitter: jakeedmiston