[ad_1]

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article features Gary Stringer, president and chief investment officer of Memphis, Tennessee-based Stringer Asser Management.

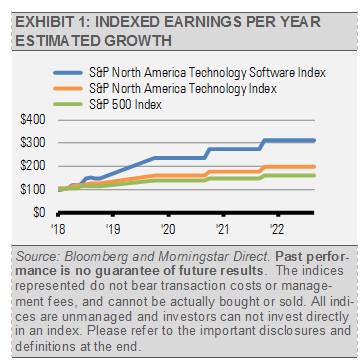

The growth rate of the U.S. economy should slow going forward, so it will be important to focus on industries that can achieve above-average earnings growth, such as the U.S. software industry.

The software industry has seen tremendous growth over the past several years, as enterprise software has begun to replace the traditional model of satisfying the needs of an individual user. The largest players in the space are now offering customized solutions that address business resource planning, customer relationship management and business intelligence, among other areas.

Global spending on enterprise software is expected to grow from $405 billion in 2018 to $439 billion in 2019, according to Gartner data. The financial services, communications, media, manufacturing and natural resources markets continue to spend the most on the enterprise software market.

As the chart below illustrates, the U.S. software industry is expected to achieve above-average earnings growth across a variety of areas, including cloud, cybersecurity, customer relationship management, internet applications and video games.

What’s more, this above-average earnings growth should continue even as this market matures. For example, though platform-as-a-service (PaaS) is the smallest segment of the cloud market, PaaS is expected to grow exponentially in the coming years, from $23.2 billion in 2018 to $62.1 billion in 2022, according to the International Data Corporation, as enterprises migrate to the cloud to develop and deploy their technology resources.

There are several options for investors looking to add a dedicated software ETF to their portfolio. A few of those options include the SPDR S&P Software & Services ETF (XSW), the iShares North American Tech-Software ETF (IGV) and the Invesco Dynamic Software ETF (PSJ).

- XSW tracks an equal-weighted index of software and services companies in a methodology that looks to address the top-heavy, concentrated nature of this segment. With 145 holdings, the portfolio includes names like Imperva, Red Hat and FireEye. XSW has $125 million in total assets and costs 0.35% in expense ratio.

- IGV tracks a market-cap-weighted index of U.S. and Canadian software companies, but it too addresses concentration by imposing an 8.5% cap on single security weighting to ensure more diversification. The fund, which has $2 billion in total assets, costs 0.47% in expense ratio. IGV owns only about 62 securities, led by companies such as Oracle, Microsoft and Adobe.

- PSJ uses a quantitative approach. The fund selects 30 companies based on its analysis of risk factors, style classification and stock valuation. Securities are then tiered-weighted, which ultimately shifts PSJ’s focus to smaller-growth companies. With $240 million in total assets, PSJ costs 0.63% in expense ratio. Some of its largest holdings—aside from the like of Microsoft and Adobe—are companies like Liberty Broadband and Intuit.

Performance Year-to-Date

Chart courtesy of Stockcharts.com

Index Definitions

The S&P 500 Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P North America Technology Index is a capitalization-weighted index of the sub-index of the S&P North American Sector Indices, the constituents of which are classified under the Global Industry Classification Standards (GICS) as information technology or internet retail.

The S&P North America Technology Software Index is a capitalization-weighted index that provides investors with a benchmark for the U.S. traded technology software related securities.

At the time of writing, Stringer Asset Management held IGV among its universe of ETFs included in its suite of ETF Portfolios. Stringer Asset Management is a Memphis, Tennessee third-party investment manager and ETF strategist. Contact Stringer Asset Management at 901-800-2956 or at [email protected]. For a complete list of relevant disclosures, please click here.

[ad_2]

Source link