[ad_1]

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article is by John Davi, chief executive officer and chief investment officer of Astoria Portfolio Advisors in New York City.

Bonds are having a really bad year. The Bloomberg Barclays U.S. Aggregate Bond Index is having its worst yearly return since 1994:

Sources: Bloomberg, Astoria Portfolio Advisors. Year-to-date returns for 2018 are as of 10/18/2018.

To put 2018’s disappointing return into perspective, the Agg has registered only three negative total return years in the past 40.

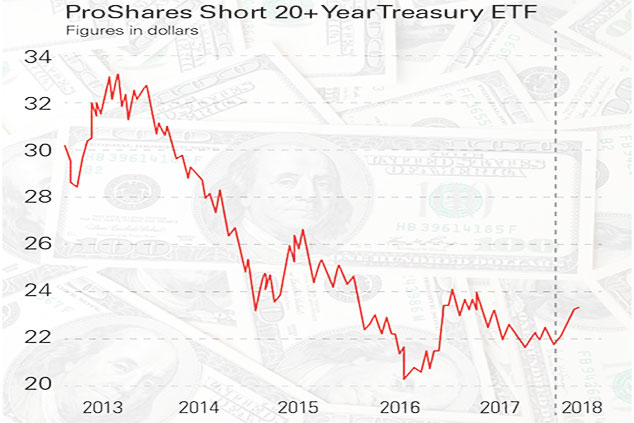

We are not surprised by this year’s disappointing U.S. bond returns. We have long warned about the challenges that bonds face in an environment where valuations are expensive; there’s no margin of safety; U.S. rates are rising; and U.S. inflation is trending higher.

10-Year Real Yields Up Nearly 0.40% Since Late August 2018

Sources: Bloomberg, Astoria Portfolio Advisors

We’ve been particularly vocal about avoiding most traditional U.S. credit and interest rate spread products. Bonds no longer provide the downside protection toward equities as they did in the past.

Don’t Rely On Bonds To Hedge Your Equity Risk

The equity risk premium is well-understood. Equities have outperformed all major asset classes over extended periods of time. Investors should earn their equity risk premium, but in doing so, construct a diversified portfolio, hedge equity risk appropriately, diversify across factor exposures, largely avoid bonds, include inflationary linked assets, and use cash to produce attractive risk-adjusted returns across varying market cycles.

We’ve said it before: 2018 would be quite different. Investors needed to hedge their risk assets this year. That was our motto for this year, and we continue to believe that is the right strategy.

As bonds have been in a powerful bull market for the past 40 years and have been mostly uncorrelated to stocks, most investors use bonds to hedge their equity risk.

But if 2018 ended today, most multi-asset investors would be disappointed if they relied solely on bonds to hedge risk. When you factor in a traditional model portfolio (60% stocks/40% bonds) and adjust for the volatility of bonds, 2018 is likely to be tough for investors that weren’t properly diversified.

Bonds Will Struggle If Inflation Rises

Sources: Bloomberg, Astoria Portfolio Advisors

Why Do People Use Bonds?

It’s simple to understand why investors have gravitated toward bonds the past half century. As mentioned above, U.S. bonds have consistently produced positive returns. Buying a broad-based U.S. bond portfolio would historically have given you high income, diversification and carry.

Illustration only. Source: Astoria Portfolio Advisors

Since 2009, investors have poured more than $2 trillion into bond funds and ETFs. Unfortunately, most of the historical attributes for bonds have declined significantly in our view. On a per-unit-of-risk basis, cash and ultra-short bond funds were significantly more attractive than high-yield bonds or intermediate corporate bonds.

Multi-asset portfolios should look at other asset classes such as commodities (a play on inflation and one that provides positive carry), alternatives (systematic HF replication, convertible bonds, gold) and cash to help soften the volatility of one’s portfolio.

Going Forward

Nobody truly knows the direction of U.S. rates. Astoria’s vantage point is that U.S. rates are starting from a low base, and investors aren’t providing themselves with any margin of safety should rates rise. Moreover, there are other ways to generate income or to diversify one’s portfolio.

There is a saying on Wall Street that everything works until it doesn’t. Well, bonds worked great over the past 40 years, but the probability of material positive returns for traditional credit and spread products will be challenged in the years to come.

Are we bearish? No. We are attracted to assets where there is intrinsic value, and especially where we can purchase those assets below intrinsic value. But we continue to advocate for alternatives, for diversification across factor exposure, and to largely avoid bonds where there is no margin of safety. Remember, markets trade on the margin, and the rate of change ultimately drives financial assets.

How We Are Investing

In Astoria’s Multi-Asset Risk Strategy (MARS) ETF portfolio, we own 64% in stocks, of which we are diversified globally and across factors. We are hedging our risk via alternatives, gold, nontraditional fixed-income products and cash.

We believe products such as the SPDR Blackstone / GSO Senior Loan ETF (SRLN), the SPDR Bloomberg Barclays Convertible Securities ETF (CWB), the Vanguard Tax-Exempt Bond ETF (VTEB), Vanguard Mortgage-Backed Securities ETF (VMBS), the iShares Short-Term Corporate Bond ETF (IGSB), the IQ Hedge Multi-Strategy Tracker ETF (QAI) and the iShares Gold Trust (IAU) offer a more compelling opportunity than traditional bonds.

You can reach John Davi at [email protected] or @AstoriaAdvisors. Any ETF holdings shown are for illustrative purposes only and are subject to change at any time. For full disclosure, please refer to our website: www.astoriaadvisors.com/disclaimer.

[ad_2]

Source link