Click here to read Astoria’s Q4 Investment Outlook

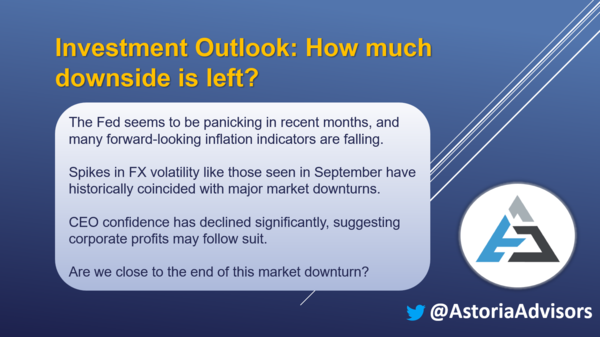

- The following quote refers to an old Wall Street saying: “The stock market stops panicking when central banks start to panic.” The Fed seems to be panicking in recent months, and we believe at their September meeting they made a mistake. Most of the forward-looking inflation indicators Astoria monitors are falling, and some quite rapidly. Hiking aggressively while the economy is slowing is rare. Typically, monetary policy becomes tighter when the economy is expanding.

- Astoria feels that we may be close to the end of this tightening cycle. Will inflation stay structurally higher and for longer? Sure, but we believe we are 75% through this market downturn. When the Fed panics, usually that implies we’re close to the end of the market downturn.

- Just remember, as markets correct, valuations improve, and forward expected returns become more attractive. It’s logical to be more bullish as the market goes lower, but many market pundits are preaching the opposite.

- In conclusion, Astoria prefers dividend payers, value over growth, defensive quality stocks, and we are finally warming up to bonds after years of shunning the asset class. We are beginning to buy laddered US treasuries, IG credit, and munis—all short-dated paper. As always, we continue advocate including alternatives and to be diversified across factors.

Best,

Astoria Portfolio Advisors