Detractors of bitcoin-related exchange traded funds (ETFs) like the ProShares Bitcoin ETF (BITO ) are quick to label the cost of getting exposure to the leading cryptocurrency as expensive, but an expense ratio doesn’t tell the full story. The fund’s lower premium in bitcoin futures exposure highlights the maturation process of the market.

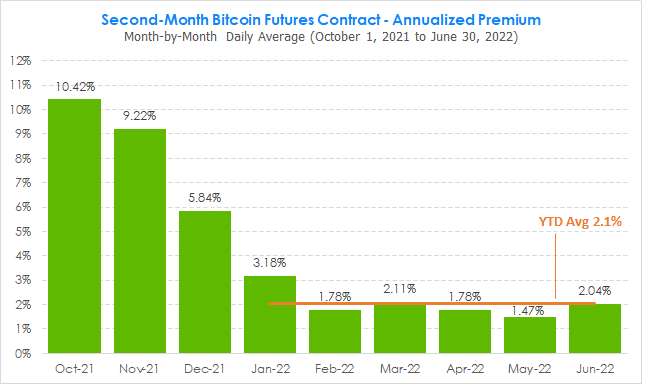

The annualized premium for second-month bitcoin futures contracts has fallen since BITO’s inception back in October 2021. At the fund’s introduction to the secondary market, the premium was above 10%, but it has since fallen to a year-to-date average of about 2.1%.

“The premium in bitcoin futures prices has been notably lower this year, compared to premiums around BITO’s inception – a possible sign that the market for bitcoin futures is maturing,” ProShares pointed out in an email.

Lower volatility relative to bitcoin’s history also highlights a maturing market with respect to the cryptocurrency itself. In the early years, 30-day volatility was remarkably higher, but that trend is reversing. As bitcoin’s price has increased over the years, that volatility measure has fallen from about 16% at its apex to the current 4%.

With that lesser volatility comes scarcity. With a finite supply of 21 million, 19 million tokens of the leading cryptocurrency have been mined, giving it that element of scarcity. So with that maturation process comes exclusivity in terms of exposure as the price of bitcoin continues to climb — something that bitcoin futures can alleviate by getting indirect exposure to bitcoin, but direct correlation to its price action.

“Bitcoin’s production scarcity is what defines its finiteness, and when reward goes down, supply is constrained,” said Chris Kline, chief operating officer of Bitcoin IRA. “Increasing demand at a time when supply is constrained has a positive impact on price, which can make bitcoin alluring to investors.”

Content continues below advertisement

Accurate Bitcoin Metric Senses Bullishness

Algorithmic models and metric forecasters can provide a sense of where bitcoin prices may be headed. One such metric, the Puell Multiple, looks at the number of bitcoin tokens mined within a 365-day time frame.

The metric can help determine whether bitcoin falls within overbought or oversold levels based on mining activity. Currently, the multiple is trending towards the upside, which could portend to future bullishness after much the year’s heavy sell-offs.

“Based on historical data, the breakout from this zone was accompanied by gaining bullish momentum in the price chart,” said Grizzly, who is a contributor for on-chain analytics platform CryptoQuant.

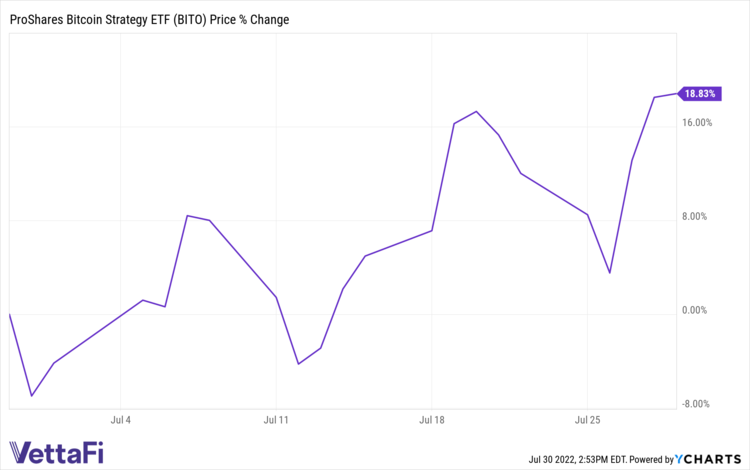

BITO itself is already heading towards an upward trajectory. The fund is up close to 20% within the past month.

For more news, information, and strategy, visit the Crypto Channel.