Central bankers are hoping that their policies will temper economic growth without pushing unemployment up or plunging America into a recession — engineering what they often call a “soft landing.”

“I really want us to have that be the outcome, but I recognize that it’s not going to be easy to do,” Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, said in an interview on Monday.

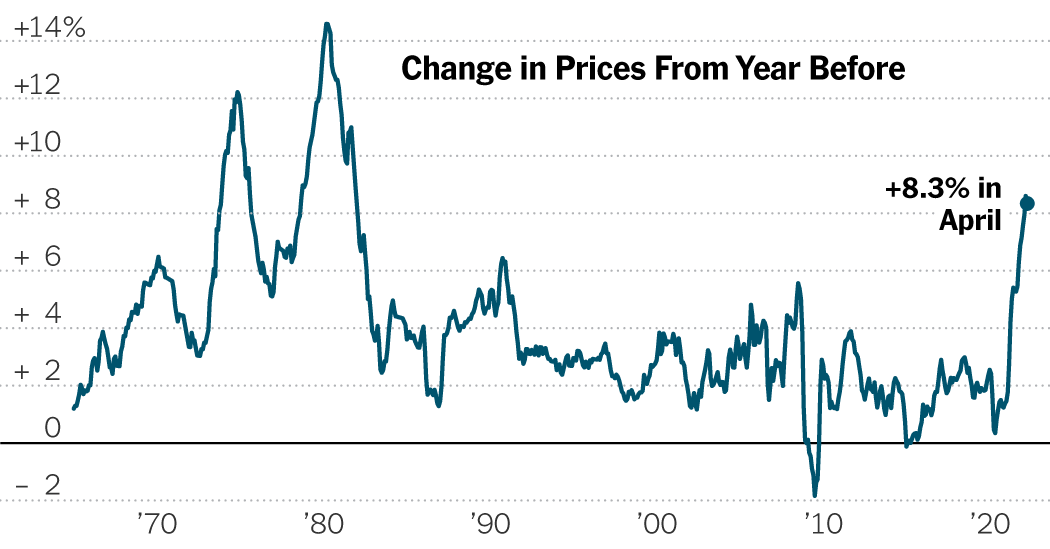

Officials have roundly acknowledged that letting the economy down gently will be difficult, and some have suggested that they would be willing to inflict economic pain if that was what it took to tackle high inflation.

If the economy gets to a point where unemployment begins climbing but inflation remains “unacceptably high,” Mr. Bostic said, price increases will be “the threat that we have to take on board.”

One challenge for policymakers — and even more for families — is that price increases are surfacing in essentials. Food costs rose 0.9 percent in April from the previous month, the 17th consecutive monthly increase, Wednesday’s report showed.

The increase was driven by dairy, nonalcoholic beverages and a 10.3 percent monthly increase in the cost of eggs, as avian flu decimated poultry flocks. Such inflation tends to especially hit the poor, who spend a bigger chunk of their budgets on needs like groceries and gas.

But as Americans see strong job gains and strong wage growth — albeit not strong enough to fully counteract inflation — many are managing to shoulder the rising costs for now, keeping overall demand strong.

“Consumers appear willing to accept the higher menu prices, particularly as inflation is broad,” George Holm, chief executive officer at the food distributor and restaurant supplier Performance Food Group, said on an earnings call Wednesday. “Still, this is something to closely monitor across the next few months and quarters.”

Ana Swanson contributed reporting.