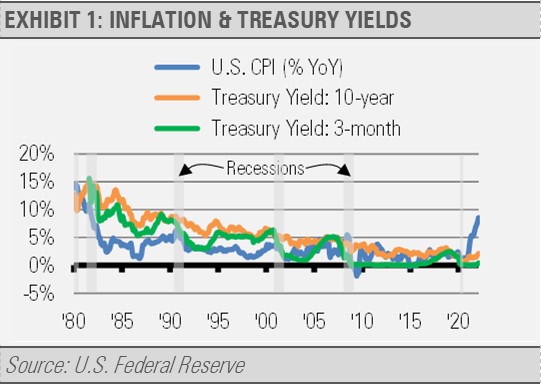

We made a call last year for a 3% 10-year Treasury yield, which was twice where the yield was at that time. One key limiting factor to the upside on the 10-Year Treasury yield at the time we made this projection was the trend in falling rates of inflation as well as short-term and long-term interest rates since the early 1980s.

As the following graph suggests, since the 1980s when Federal Reserve Chairman Paul Volker ended the inflationary spiral, each successive business cycle exhibited a peak in inflation as well as both short-term and long-term interest rates at levels that were lower than the previous business cycle.

Content continues below advertisement

However, inflation recently broke out of its long-term downtrend in a big way. We think that persistent economic growth combined with the recent inflationary breakout creates an environment where interest rates will move past their declining, down-trending pattern as well. It is now likely that short-term interest rates can climb to nearly 3% with long-term interest rates heading towards 4%.

With U.S. Federal Reserve policy still loose, and trillions in excess money and liquidity sloshing around the financial system, it will take time for inflation to settle down. In the meantime, short-term and long-term interest rates may reach levels higher than the peak during the previous business cycle and break the 40-year trend of lower interest rates.

We think these higher interest rates in the years to come will eventually benefit savers and bond investors who count on current income from high-quality fixed-income investments.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.